This article is a video transcript, using text and images to record the key information from the original video. For detailed content, please refer to the original video: How The Economic Machine Works (30 minutes) Ray Dalio - YouTube

Introduction

The economy works like a simple machine, but many people don’t understand this, or they don’t agree on how it works, and this has led to a lot of unnecessary economic suffering. I feel a deep sense of responsibility to share my simple but practical economic template. Though unconditional, it has helped me to anticipate and sidestep the global financial crisis, and it has worked well for me for over 30 years. Let’s begin! Though the economy might seem complex, it works in a simple, mechanical way. It is made up of a few simple parts and a lot of simple transactions that are repeated over and over again a zillion times.

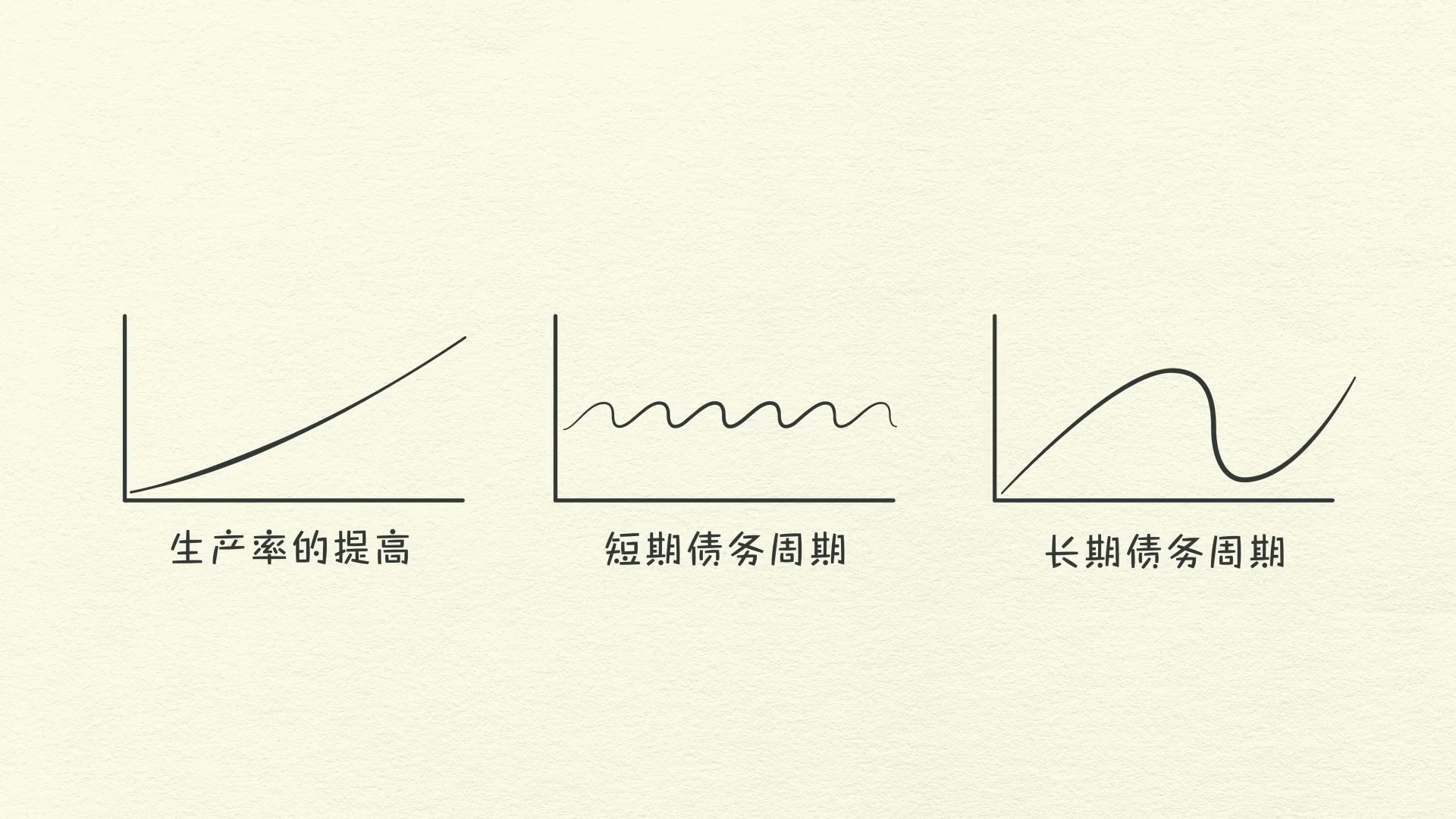

These transactions are above all else driven by human nature, and they create 3 main forces that drive the economy:

-

Productivity Growth

-

The Short Term Debt Cycle

-

The Long Term Debt Cycle

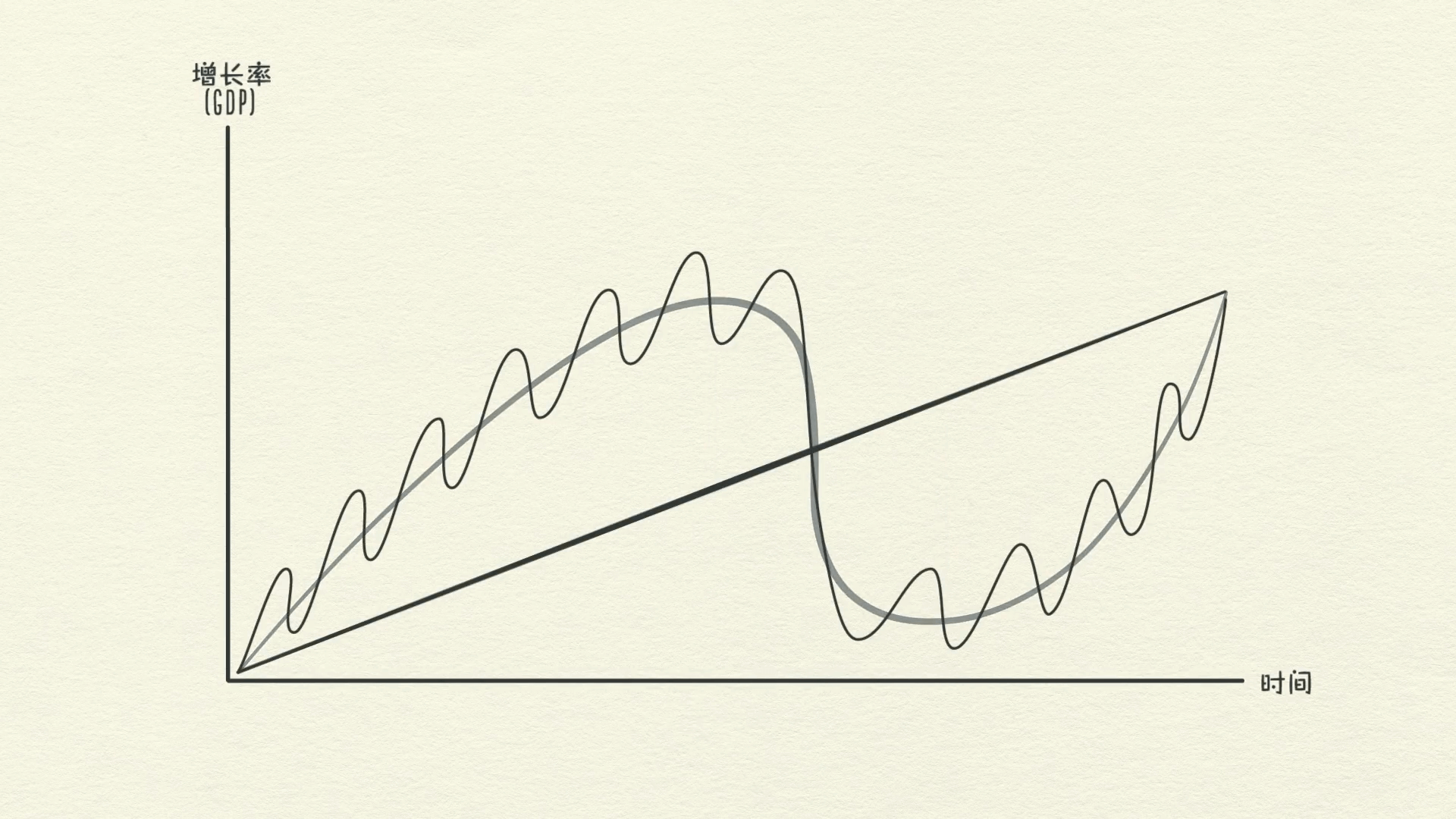

We’ll look at these three forces and how laying them on top of each other creates a good template for tracking economic movements and figuring out what’s happening now.

What is a Transaction

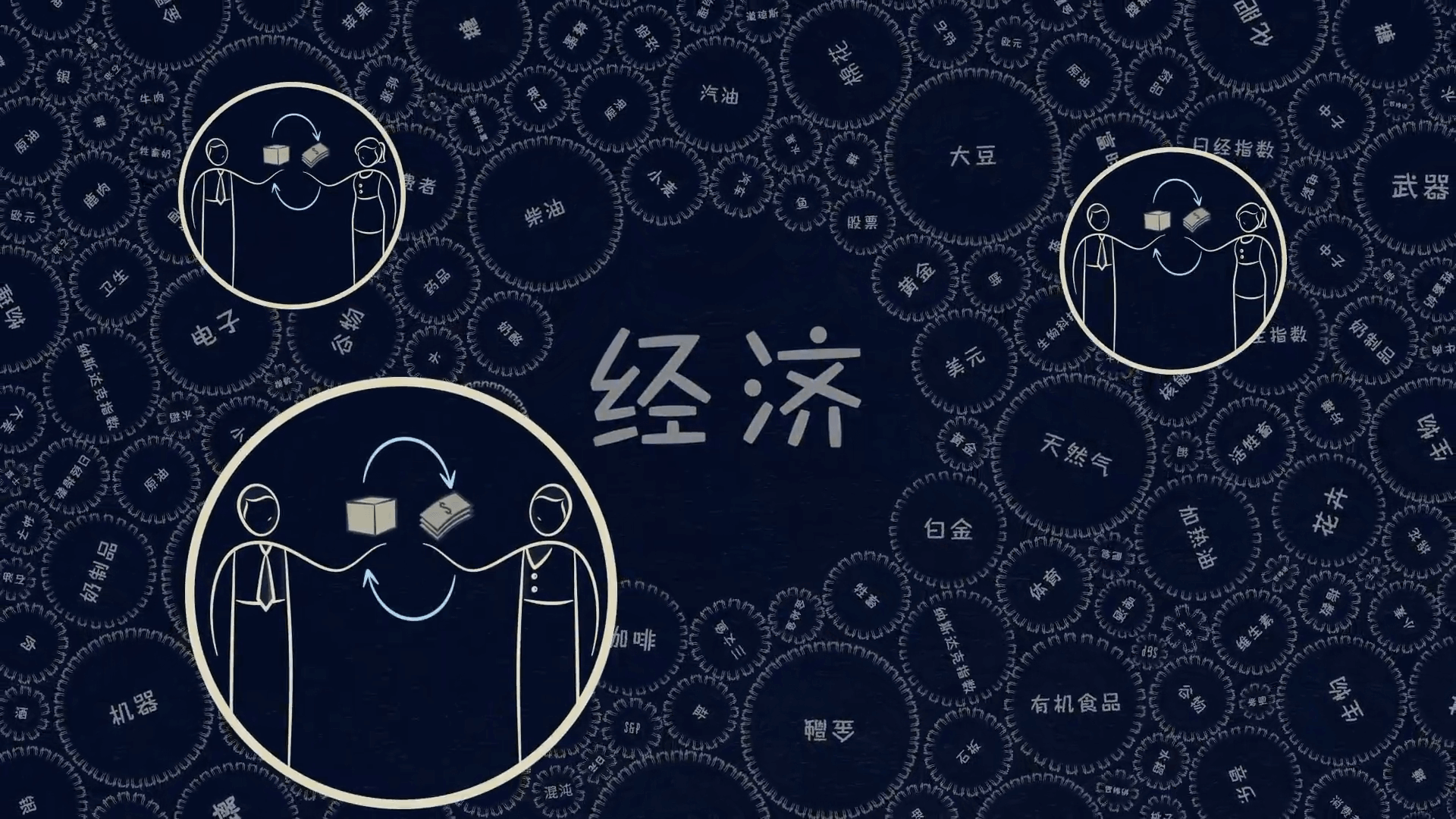

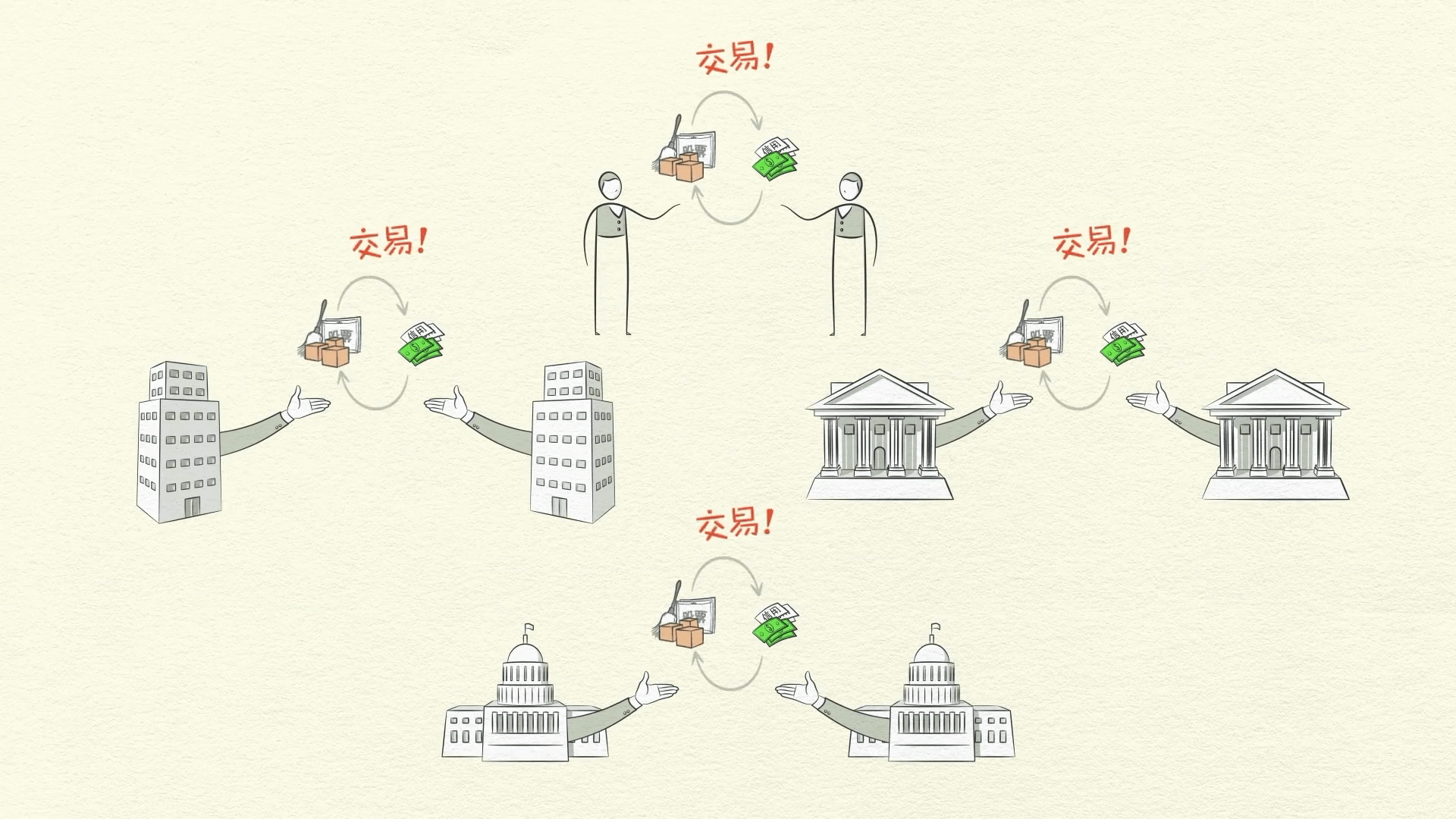

Let’s start with the simplest part of the economy: Transactions.

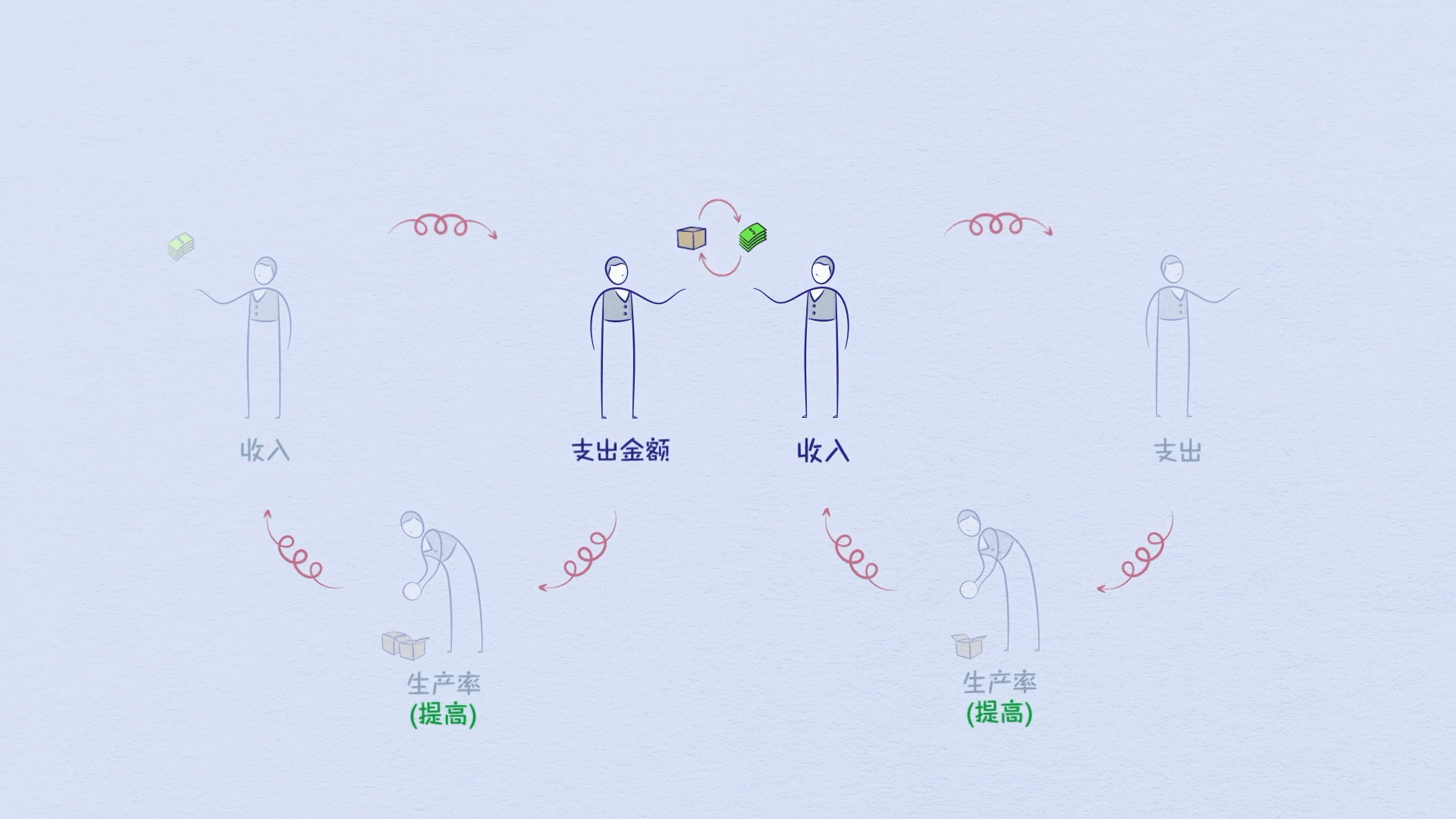

An economy is simply the sum of the transactions that make it up, and a transaction is a very simple thing. You make transactions all the time. Every time you buy something, you create a transaction. Each transaction consists of a buyer exchanging money or credit with a seller for goods, services, or financial assets.

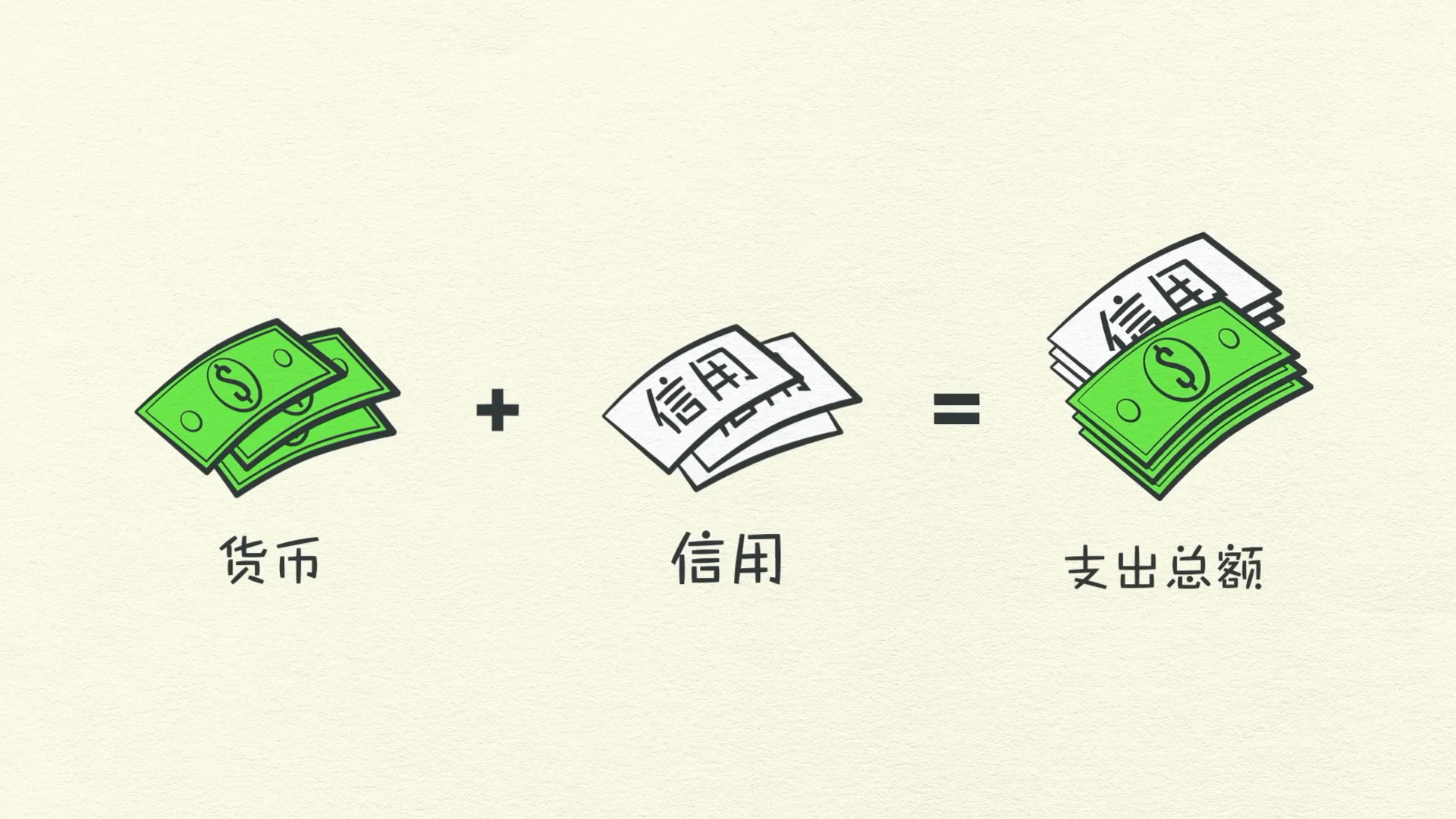

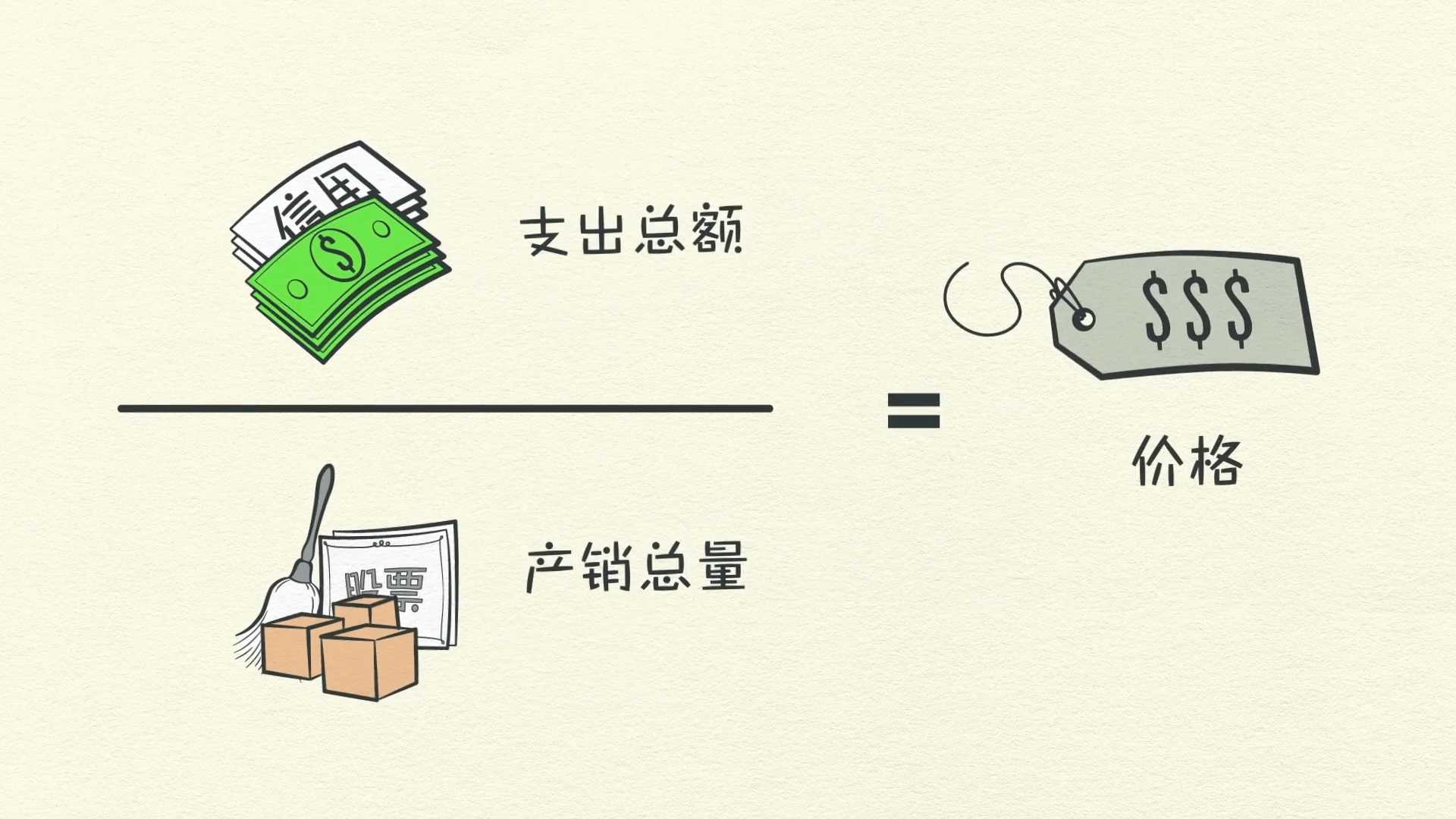

Credit spends just like money, so adding together the money spent and the amount of credit spent gives you the total spending.

The total amount of spending drives the economy. If you divide the amount spent by the quantity sold, you get the price.

And that’s it. That’s a transaction.

It is the building block of the economic machine. All cycles and all forces in an economy are driven by transactions.

So, if we understand transactions, we can understand the whole economy. A market consists of all the buyers and all the sellers making transactions for the same thing. For example, there is a wheat market, a car market, a stock market, and markets for millions of things. An economy consists of all of the transactions in all of its markets. If you add up the total spending and the total quantity sold in all of the markets, you have everything you need to know to understand the economy. It’s just that simple. People, businesses, banks, and governments all engage in transactions the way I just described: exchanging money and credit for goods, services, and financial assets.

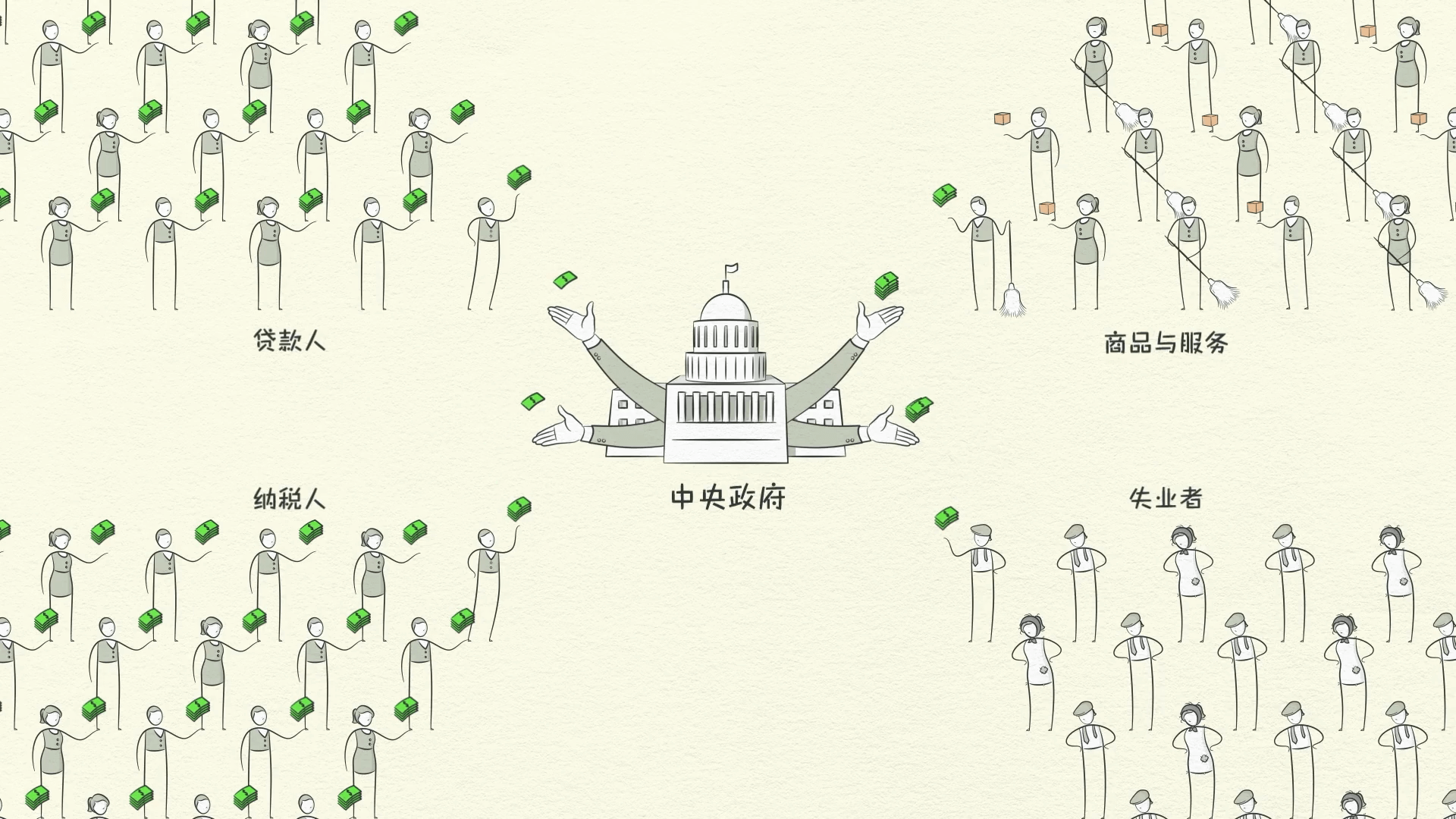

The biggest buyer and seller is the government, which consists of two important parts: a Central Government that collects taxes and spends money, and a Central Bank, which is different from other buyers and sellers because it controls the amount of money and credit in the economy.

It does this by influencing interest rates and printing new money. For these reasons, as we’ll see, the Central Bank is an important player in the flow of credit.

Credit, the Most Important Part of the Economy

I want you to pay attention to credit. Credit is the most important part of the economy, and probably the least understood.

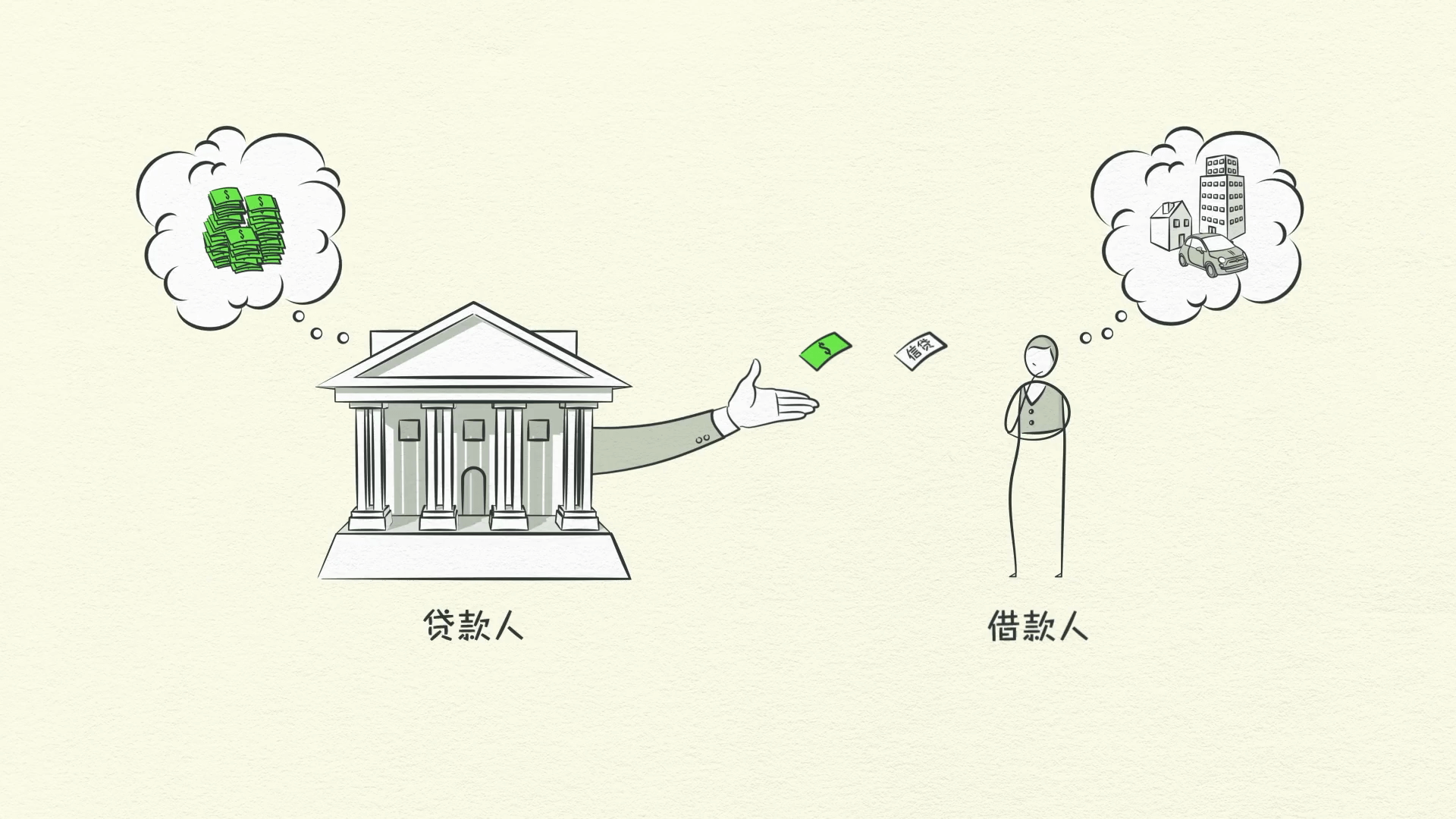

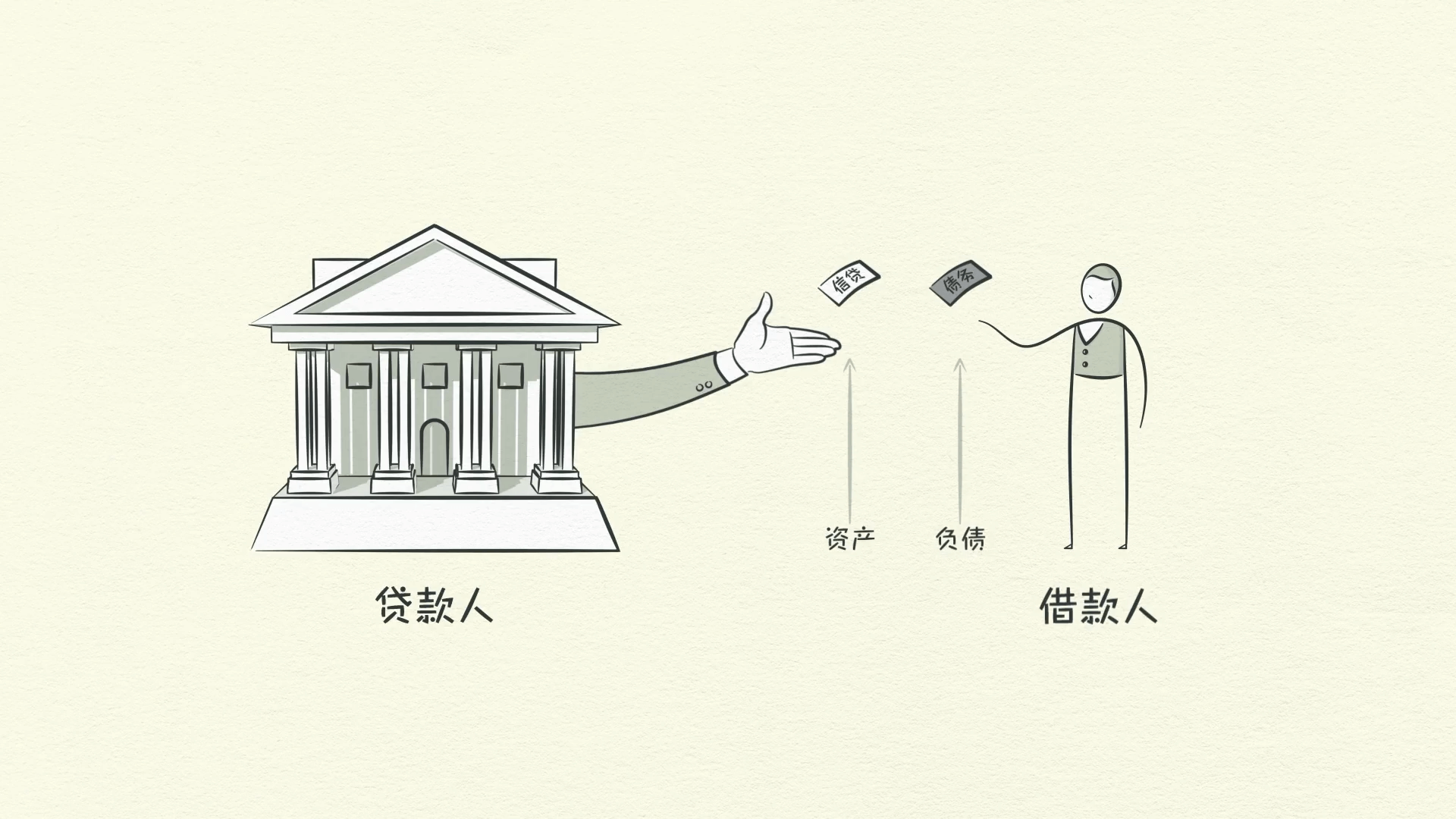

It’s the most important part because it’s the biggest and most volatile part. Just like buyers and sellers go to the market to make transactions, so do lenders and borrowers. Lenders usually want to make their money into more money, and borrowers usually want to buy something they can’t afford, like a house or a car, or they want to invest in something, like opening a business.

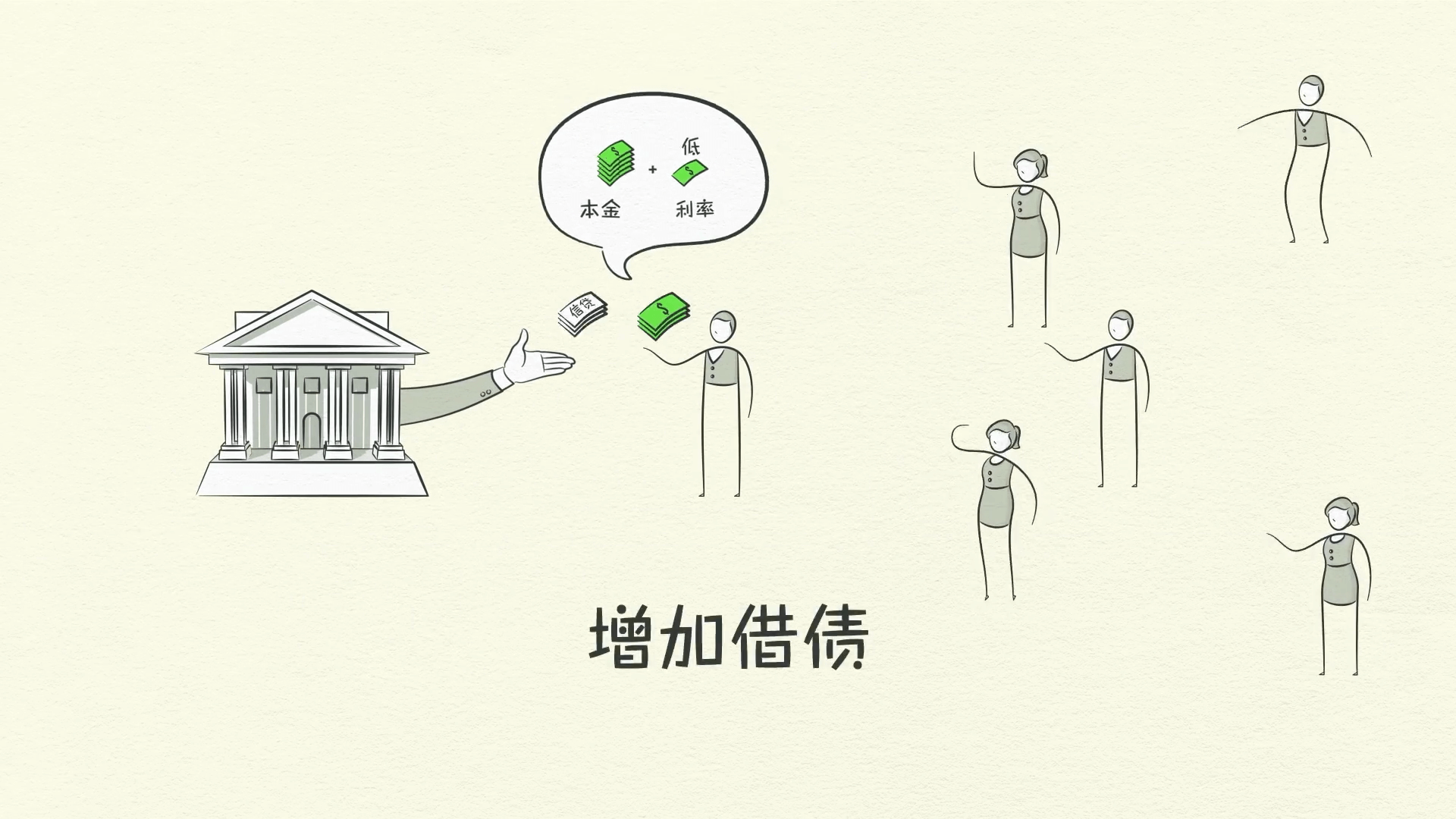

Credit can help both lenders and borrowers get what they want. Borrowers promise to repay the amount they borrowed, called principal, plus an additional amount, called interest. When interest rates are high, there is less borrowing because it’s expensive. When interest rates are low, borrowing increases because it’s cheaper. When borrowers promise to repay and lenders believe them, credit is created.

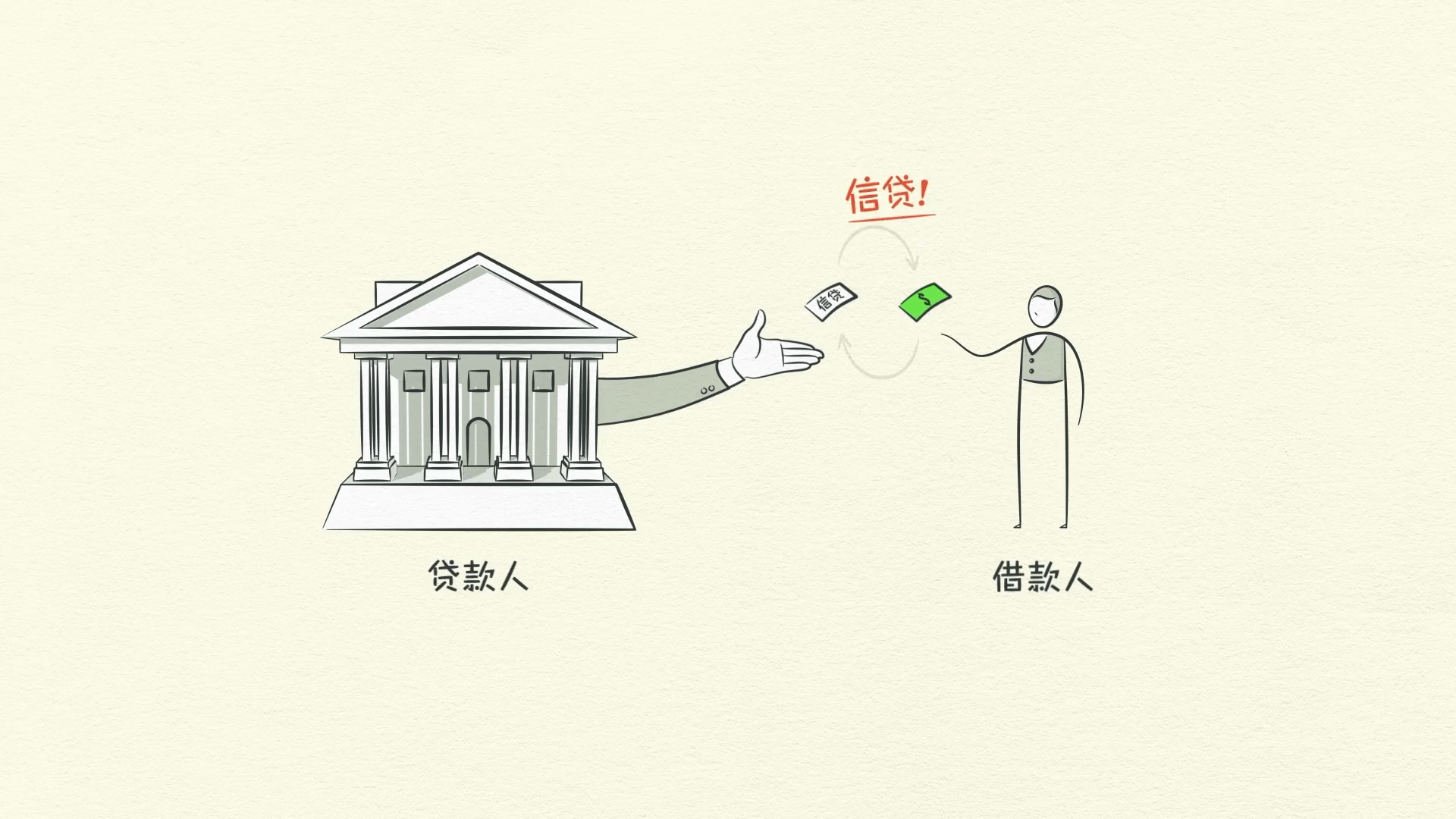

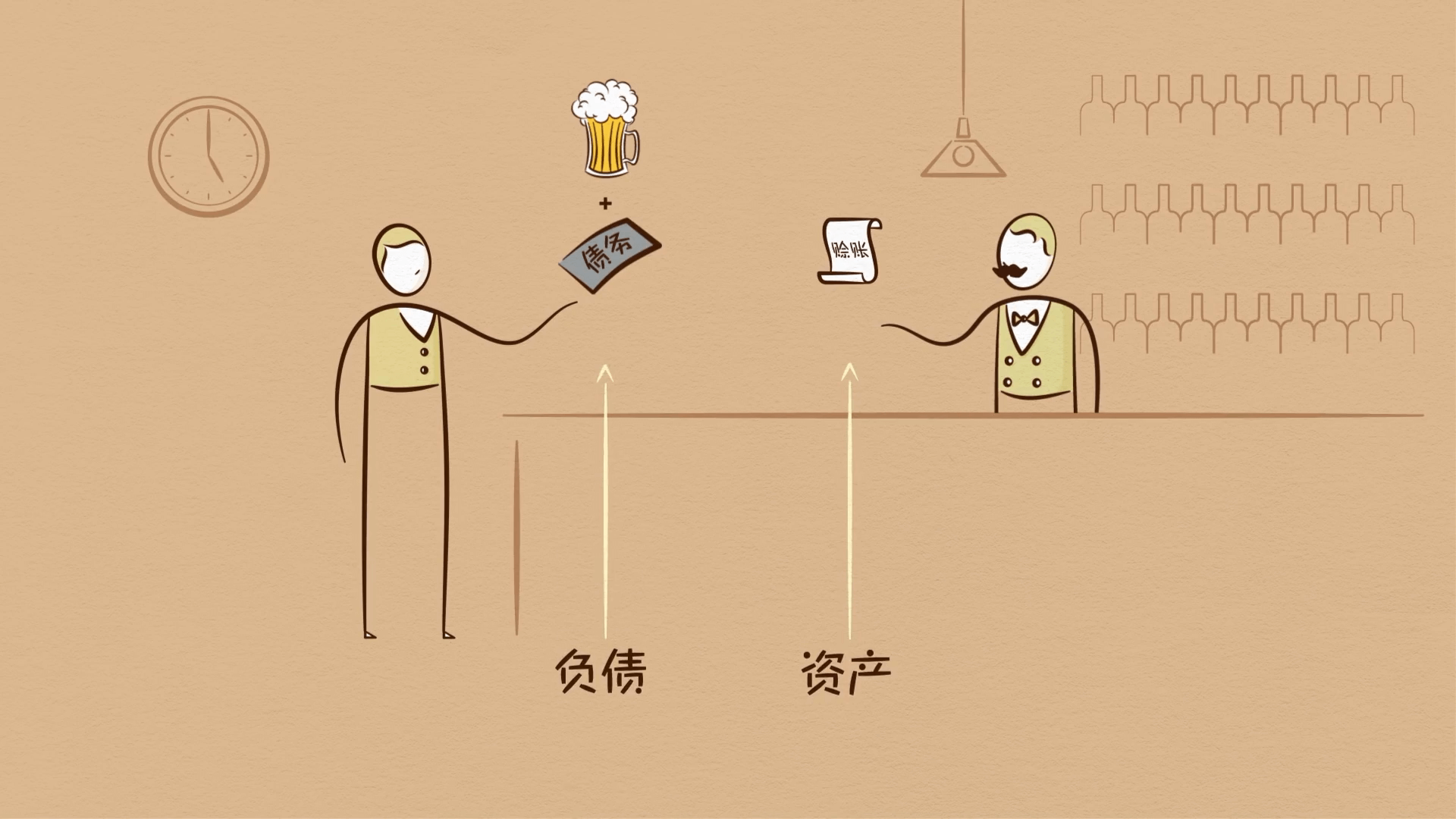

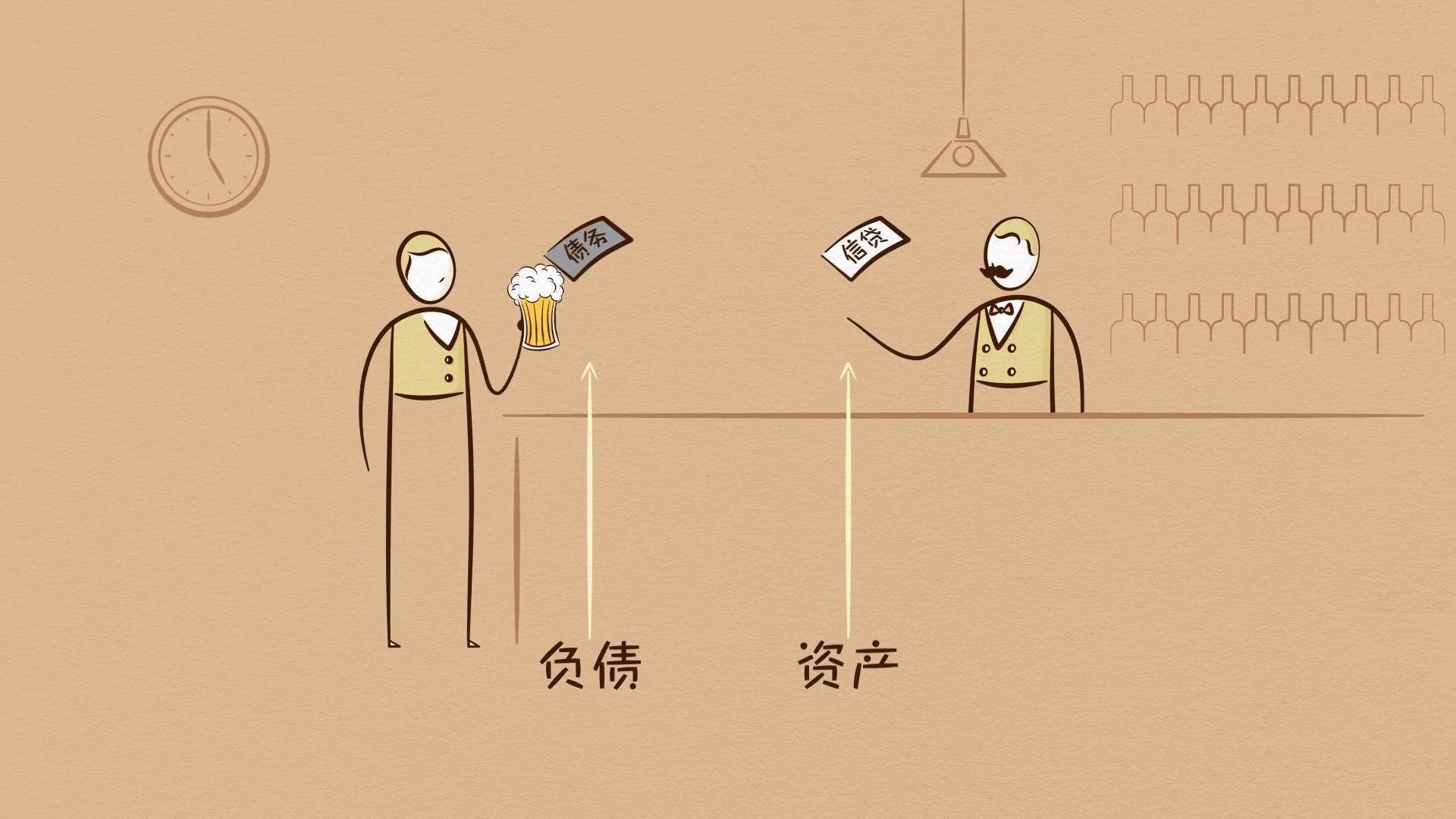

Any two people can agree to create credit out of thin air! That seems simple enough, but credit is tricky because it has different names. As soon as credit is created, it immediately turns into debt.

Debt is both an asset to the lender and a liability to the borrower. In the future, when the borrower repays the loan plus interest, the asset and liability disappear, and the transaction is settled.

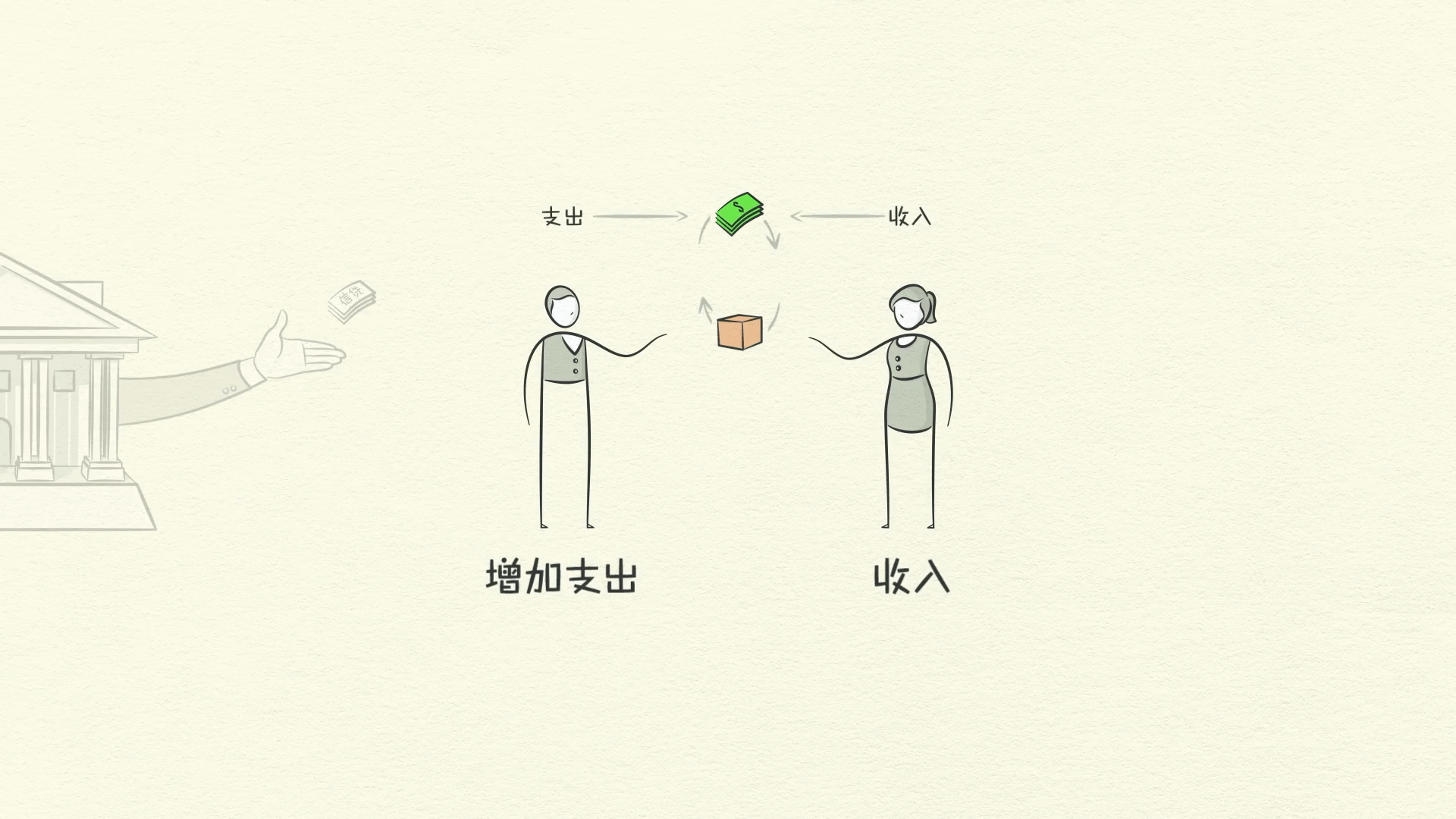

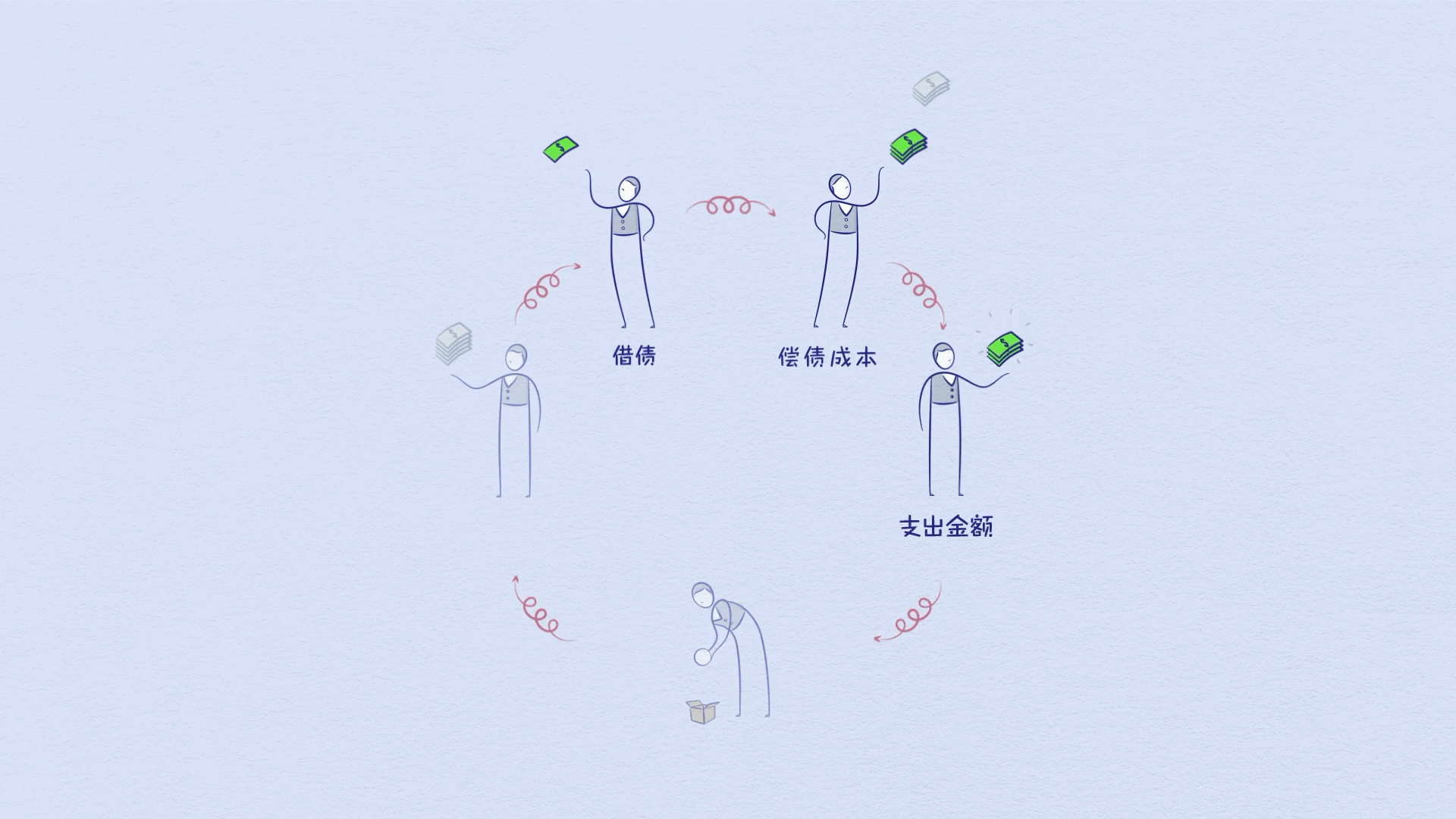

So why is credit so important? Because when a borrower receives credit, he is able to increase his spending. And remember, spending drives the economy. This is because one person’s spending is another person’s income.

Think about it, every dollar you spend, someone else earns. And every dollar you earn, someone else has spent. So when you spend more, someone else earns more. When someone’s income rises, it makes lenders more willing to lend to him because now he’s more worthy of credit.

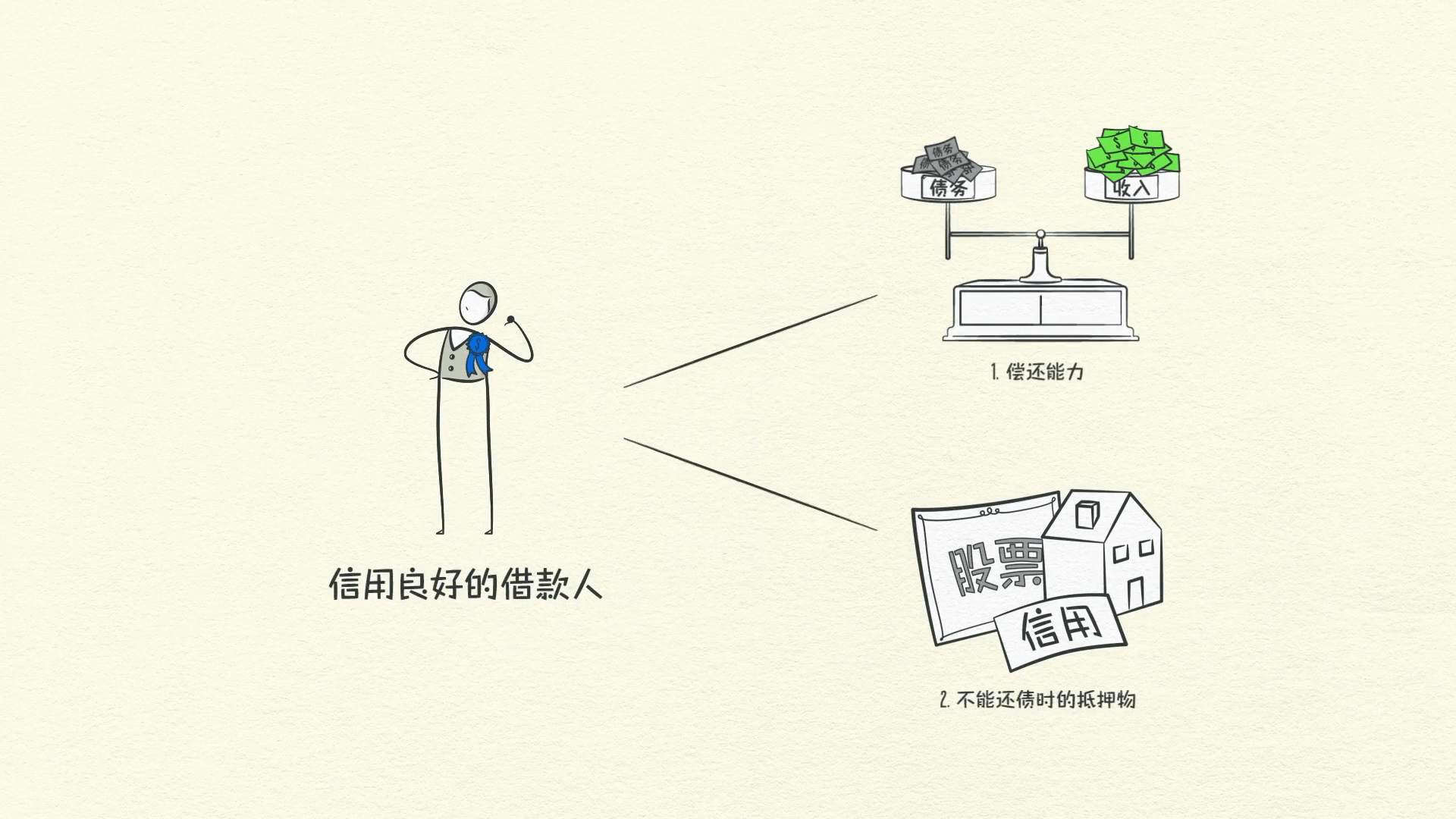

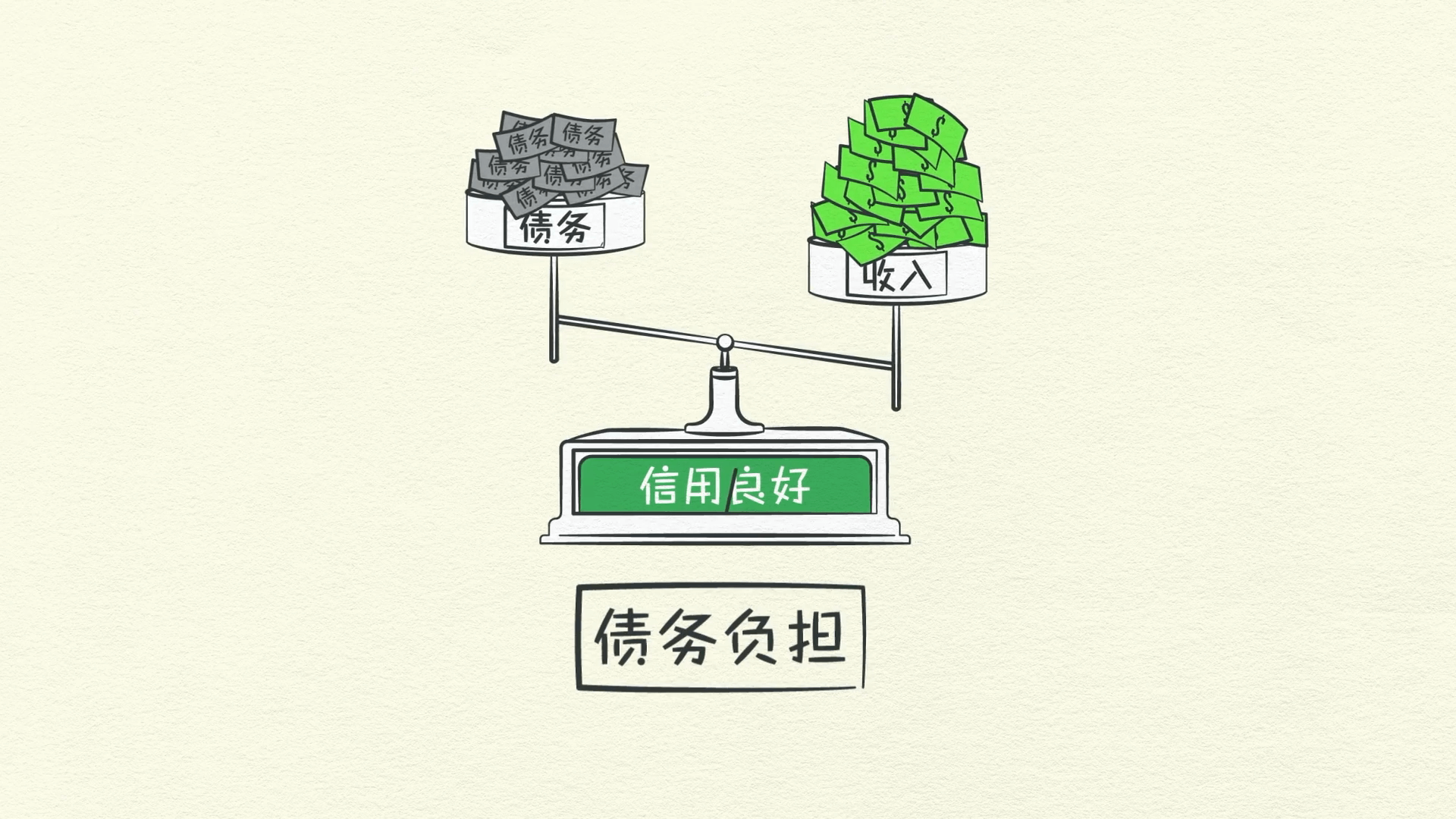

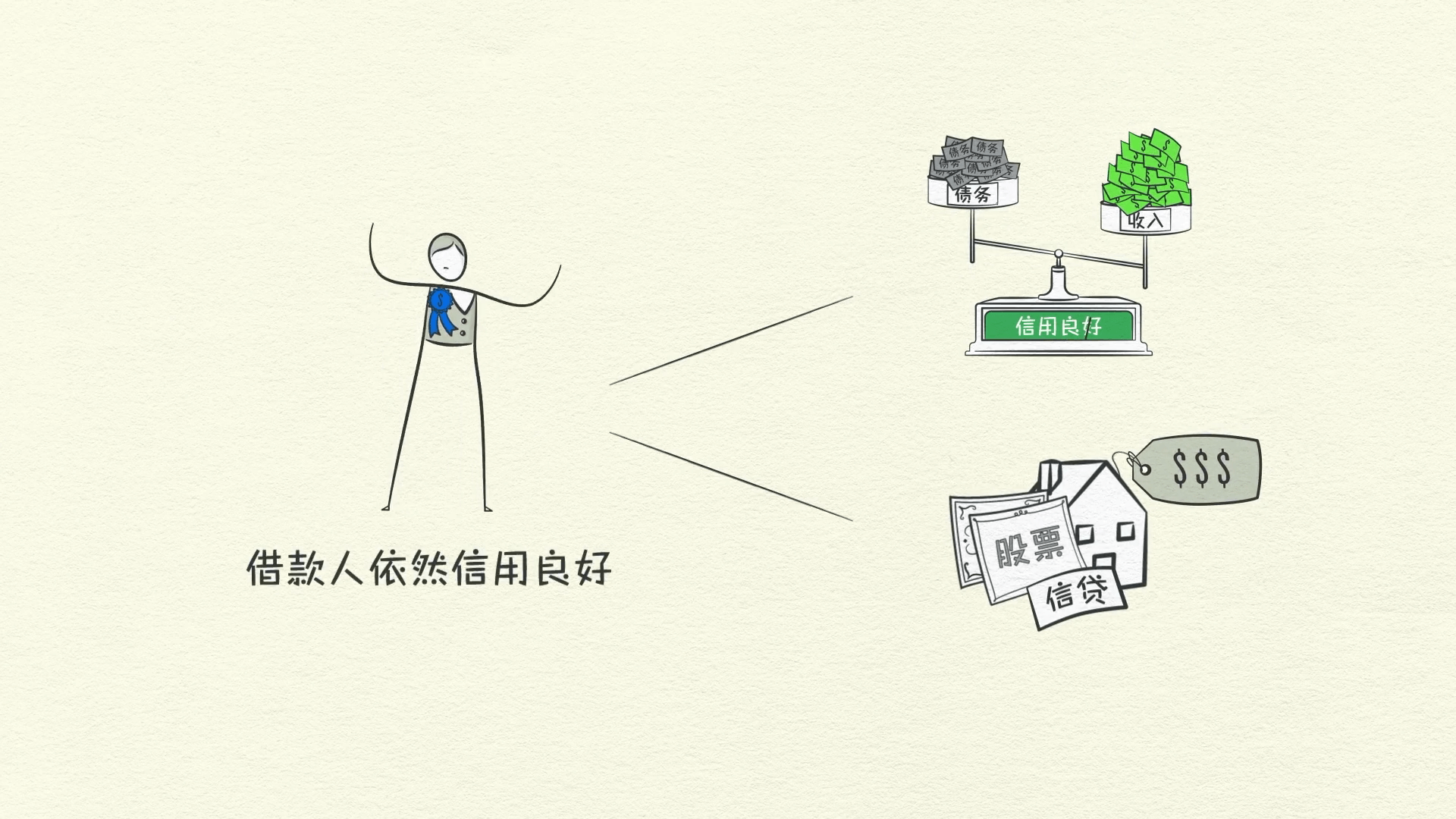

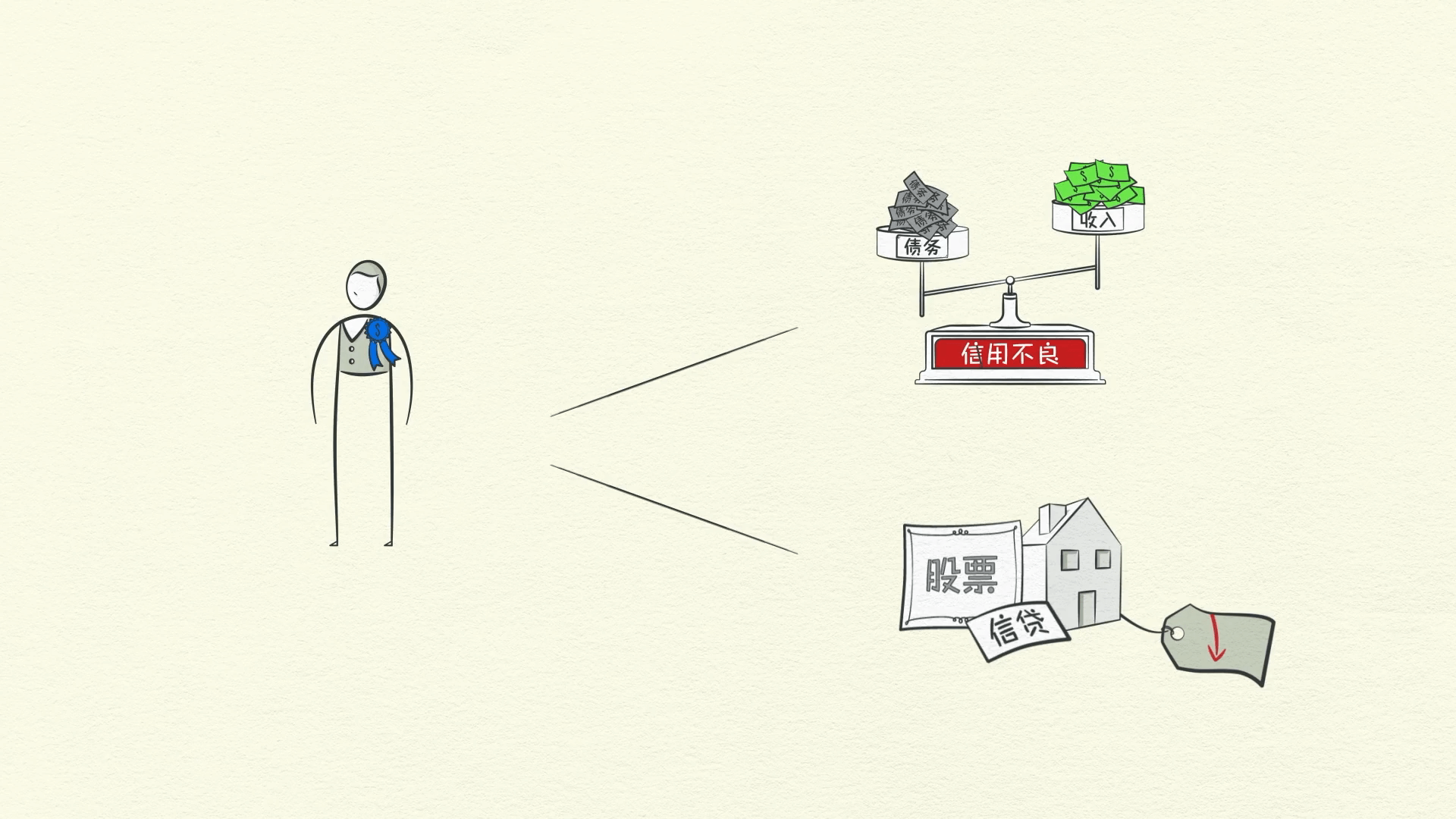

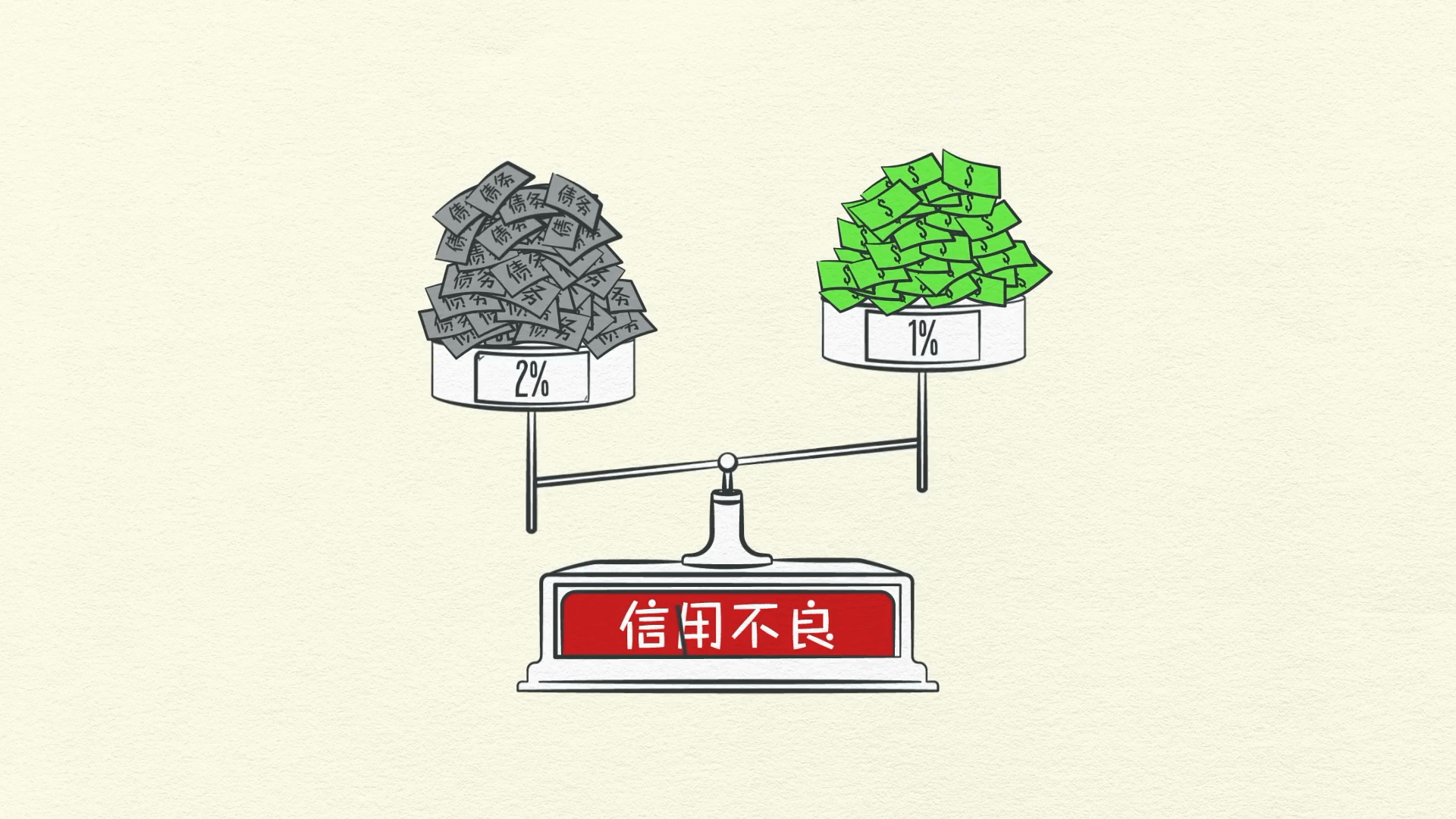

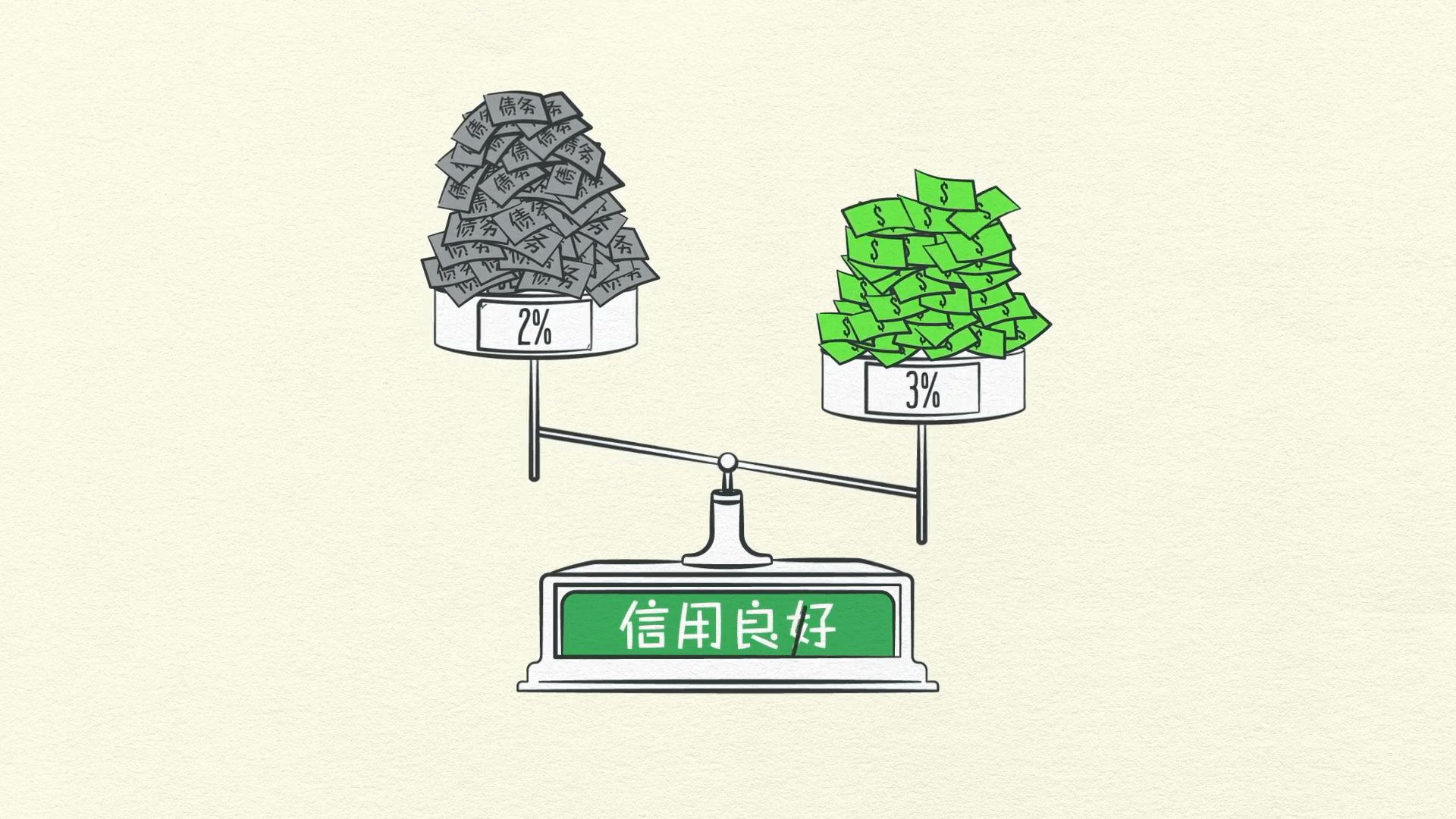

A Creditworthy Borrower Has Two Things: The Ability to Repay and Collateral

Having a lot of income in relation to his debt gives him the ability to repay. In the event that he can’t repay, he has valuable assets to use as collateral that can be sold. This makes lenders feel comfortable lending him money. So increased income allows increased borrowing, which allows increased spending. And since one person’s spending is another person’s income, this leads to more increased borrowing and so on. This self-reinforcing pattern leads to economic growth and is why we have cycles.

In a transaction, you have to give something to get something, and how much you get depends on how much you produce.

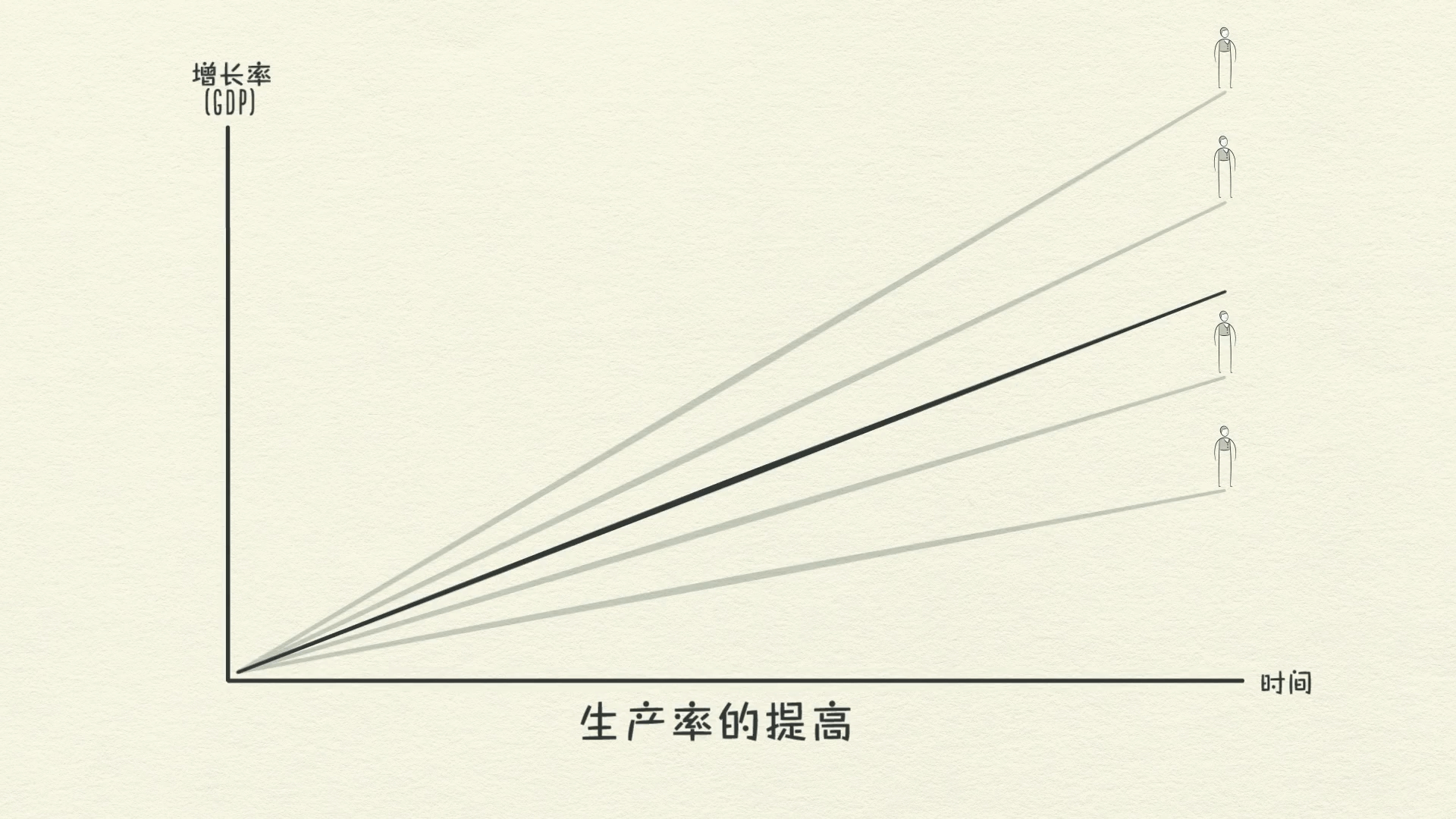

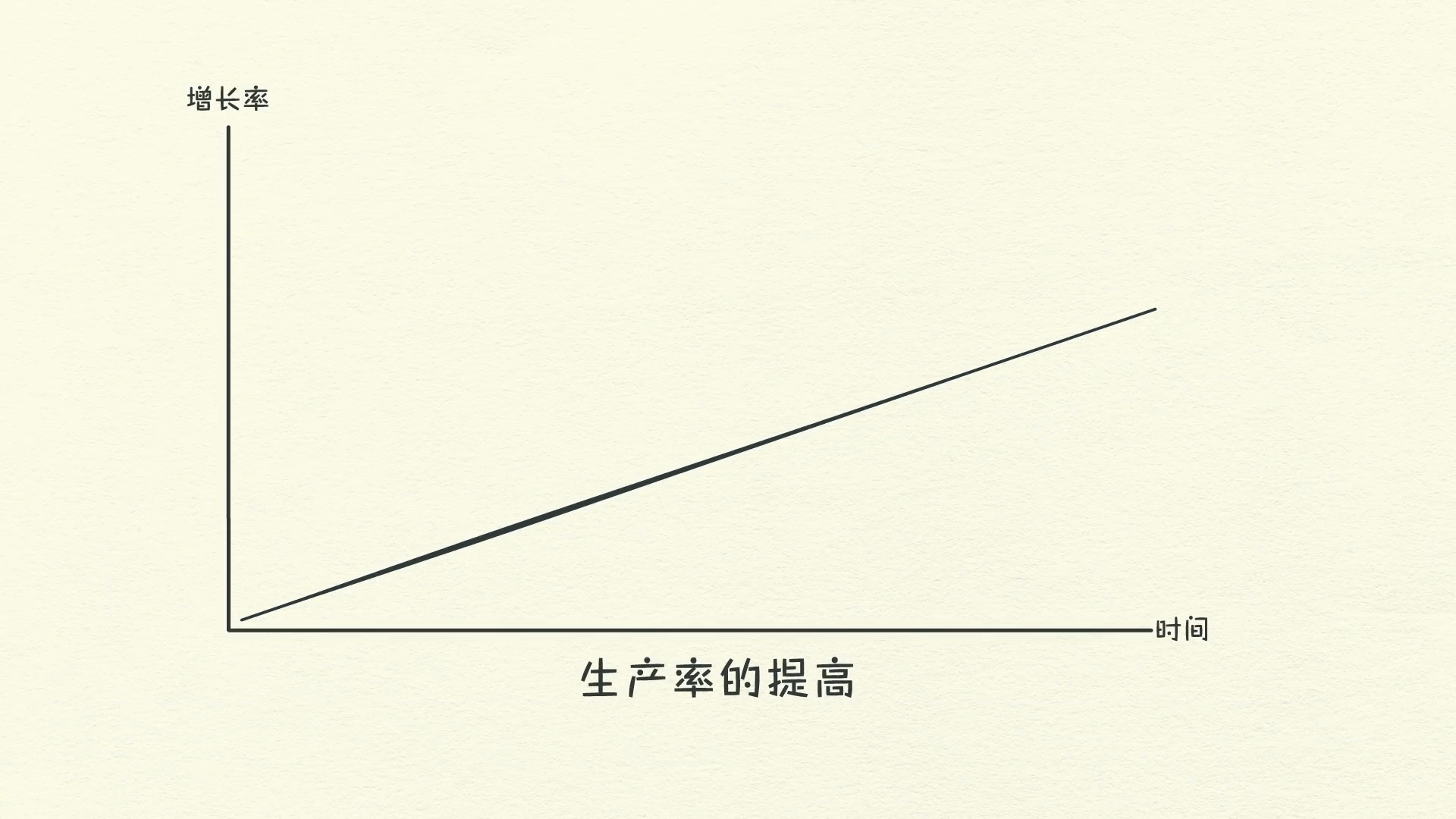

Over time we learn, and that accumulated knowledge raises our living standards. We call this productivity growth. Those who are inventive and hard-working raise their productivity and their living standards faster than those who are complacent and lazy. But that isn’t necessarily true over the short run.

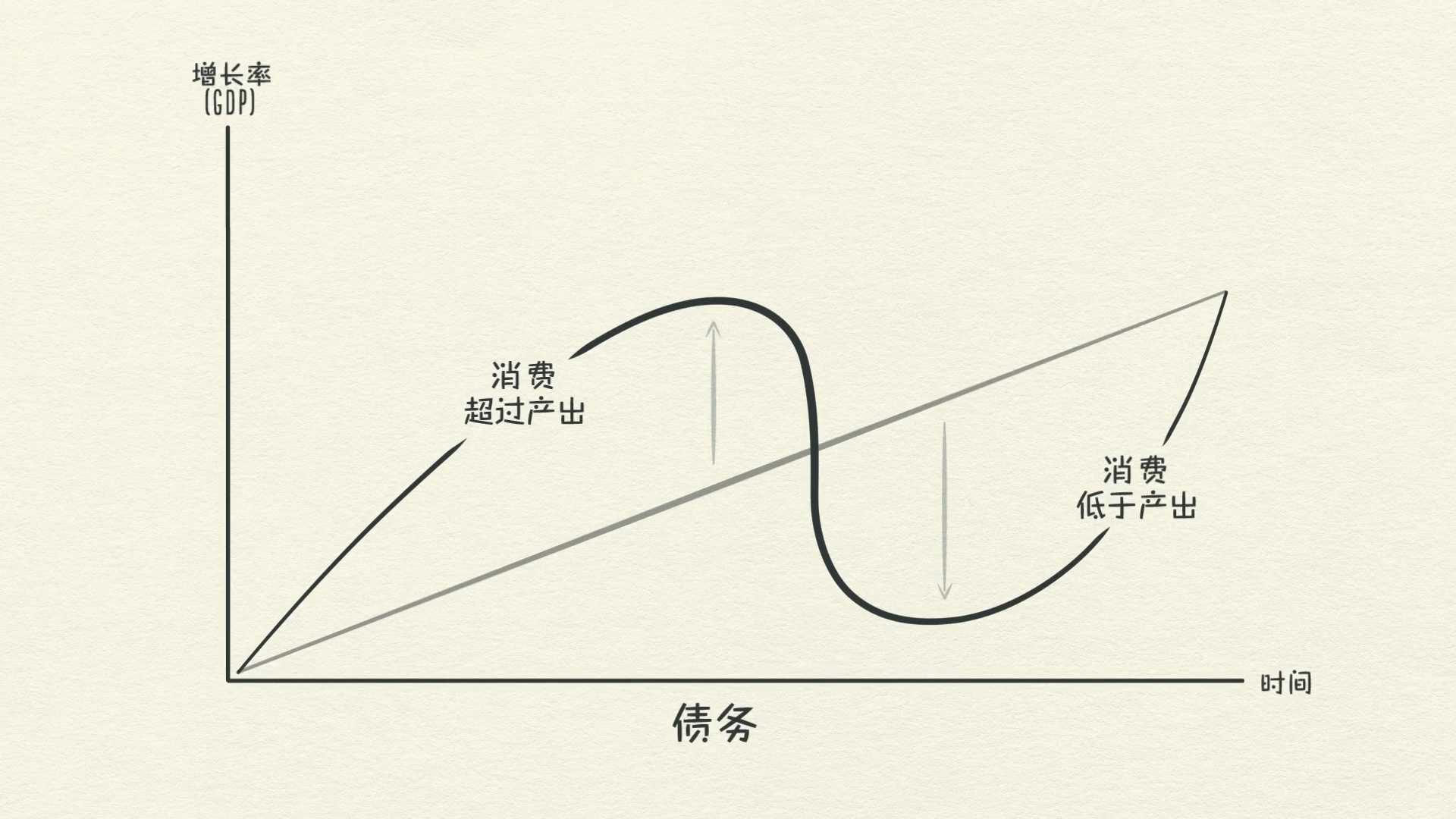

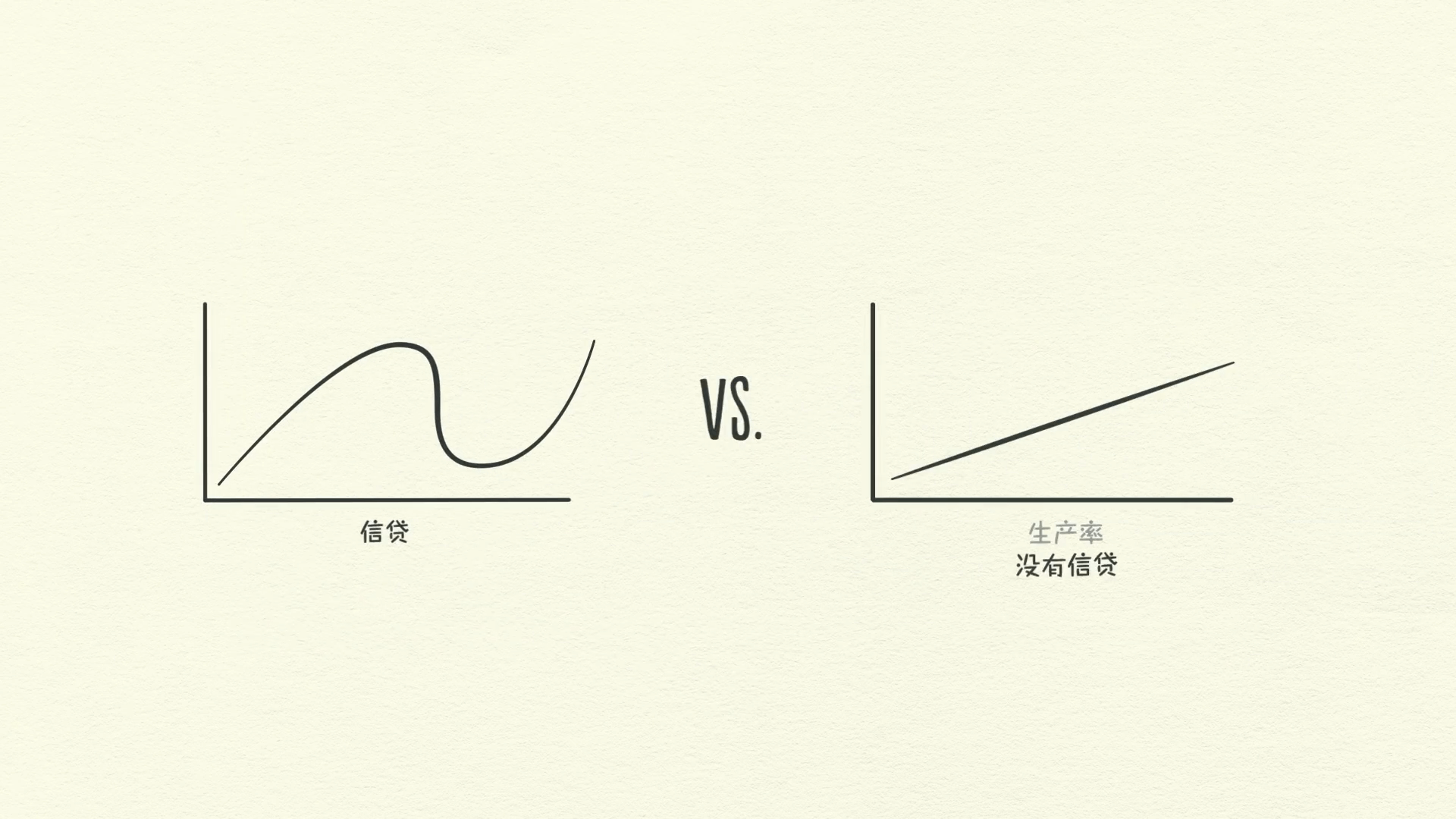

Productivity matters most in the long run, but credit matters most in the short run.

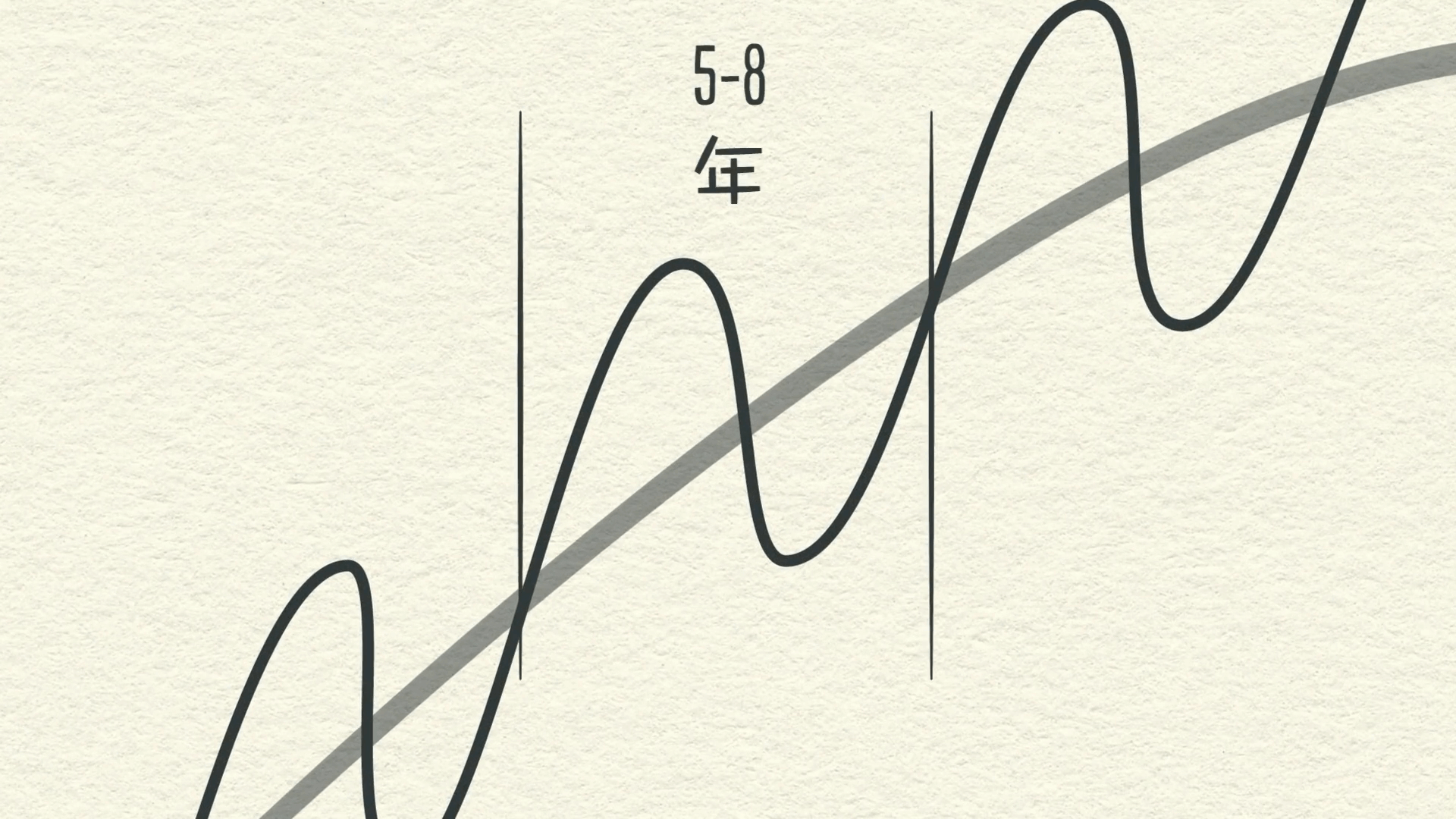

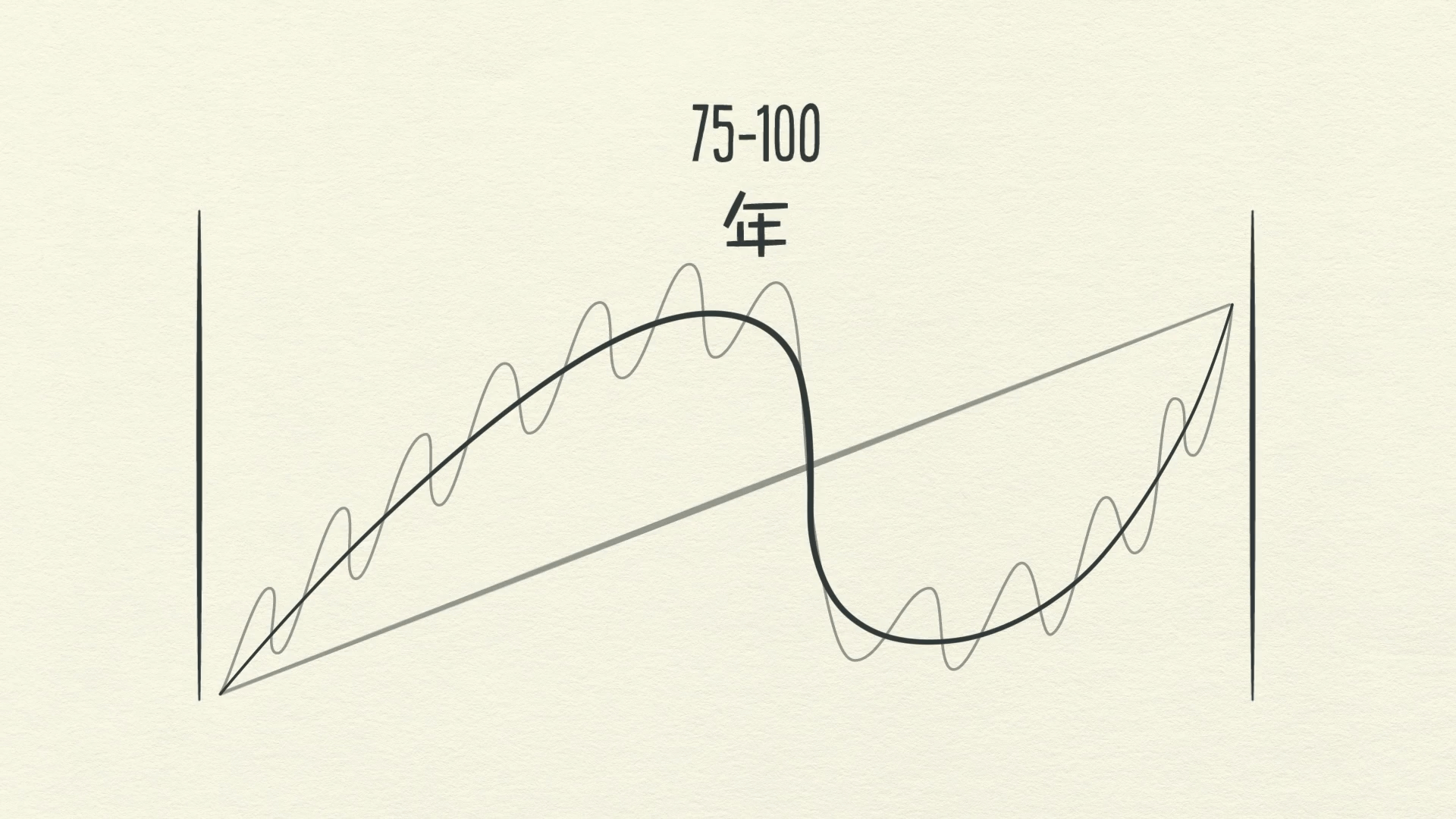

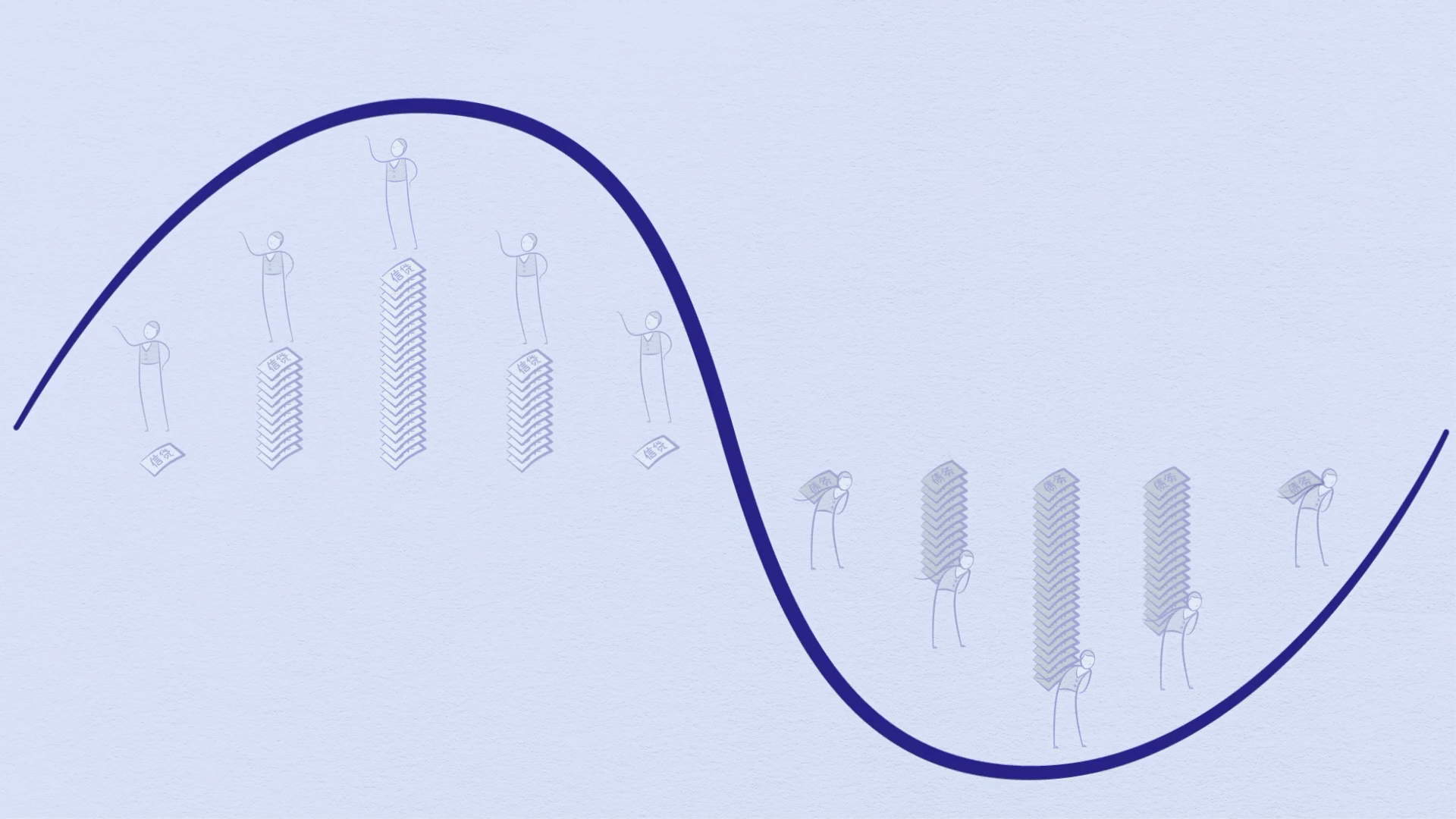

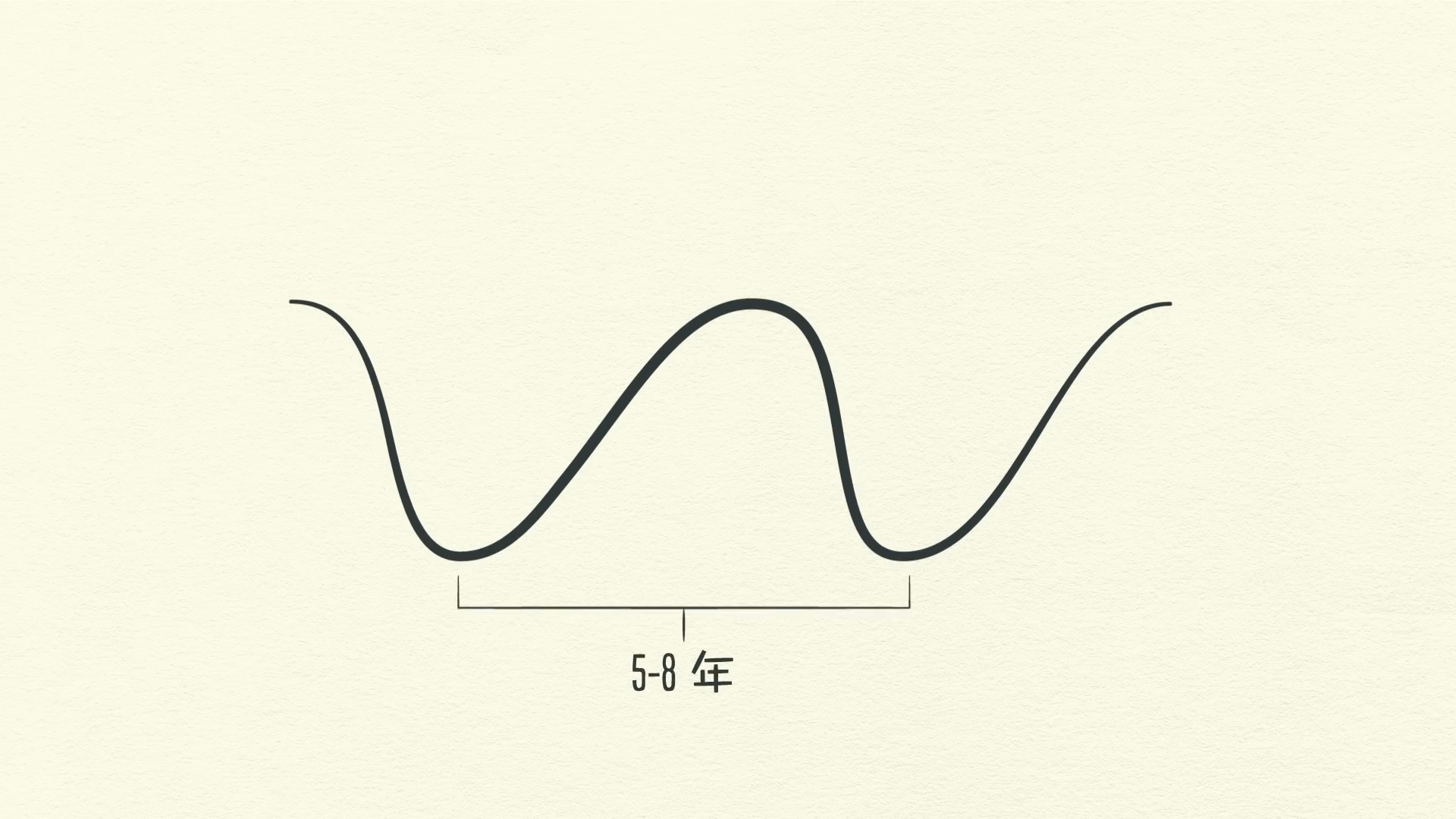

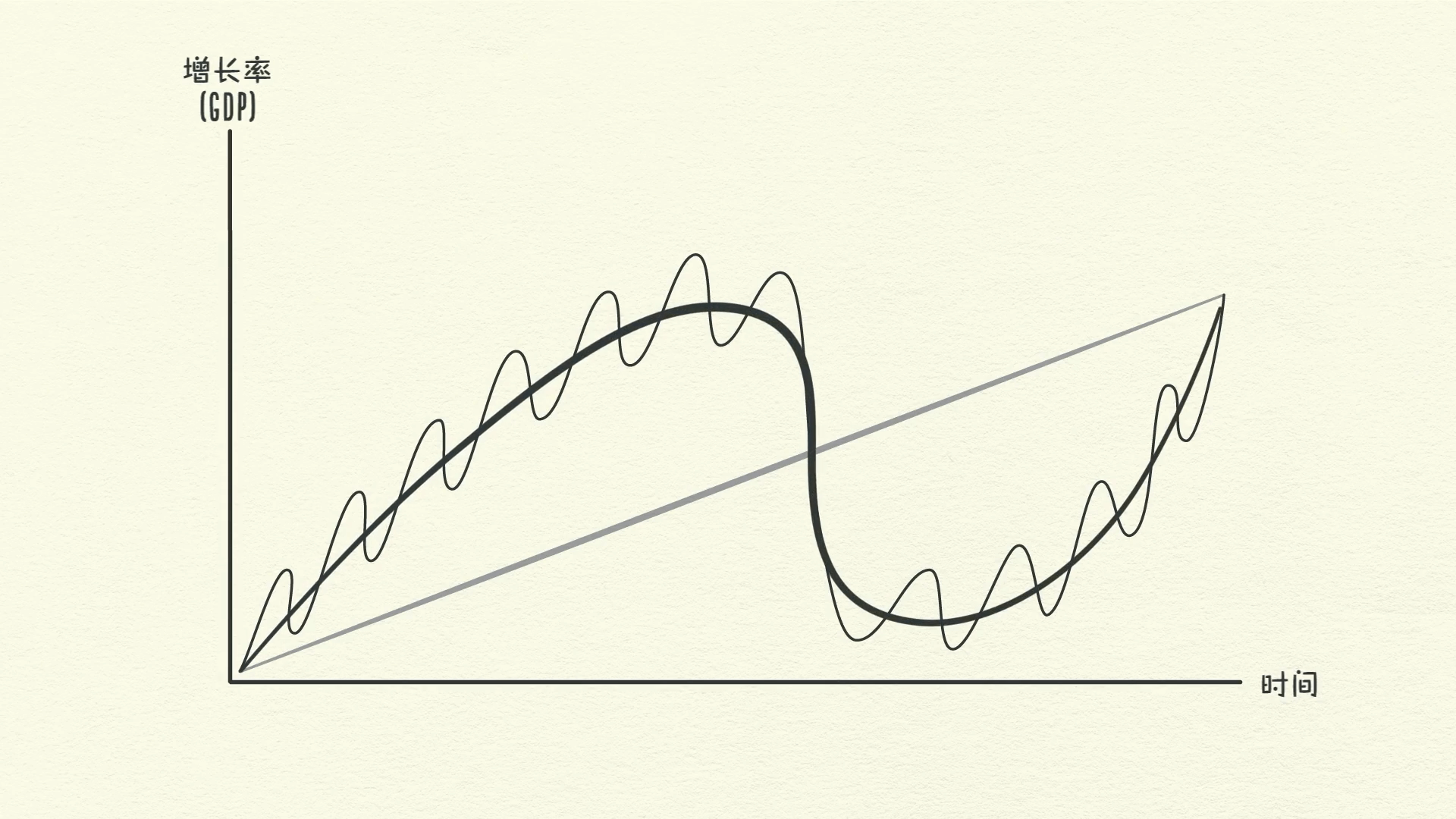

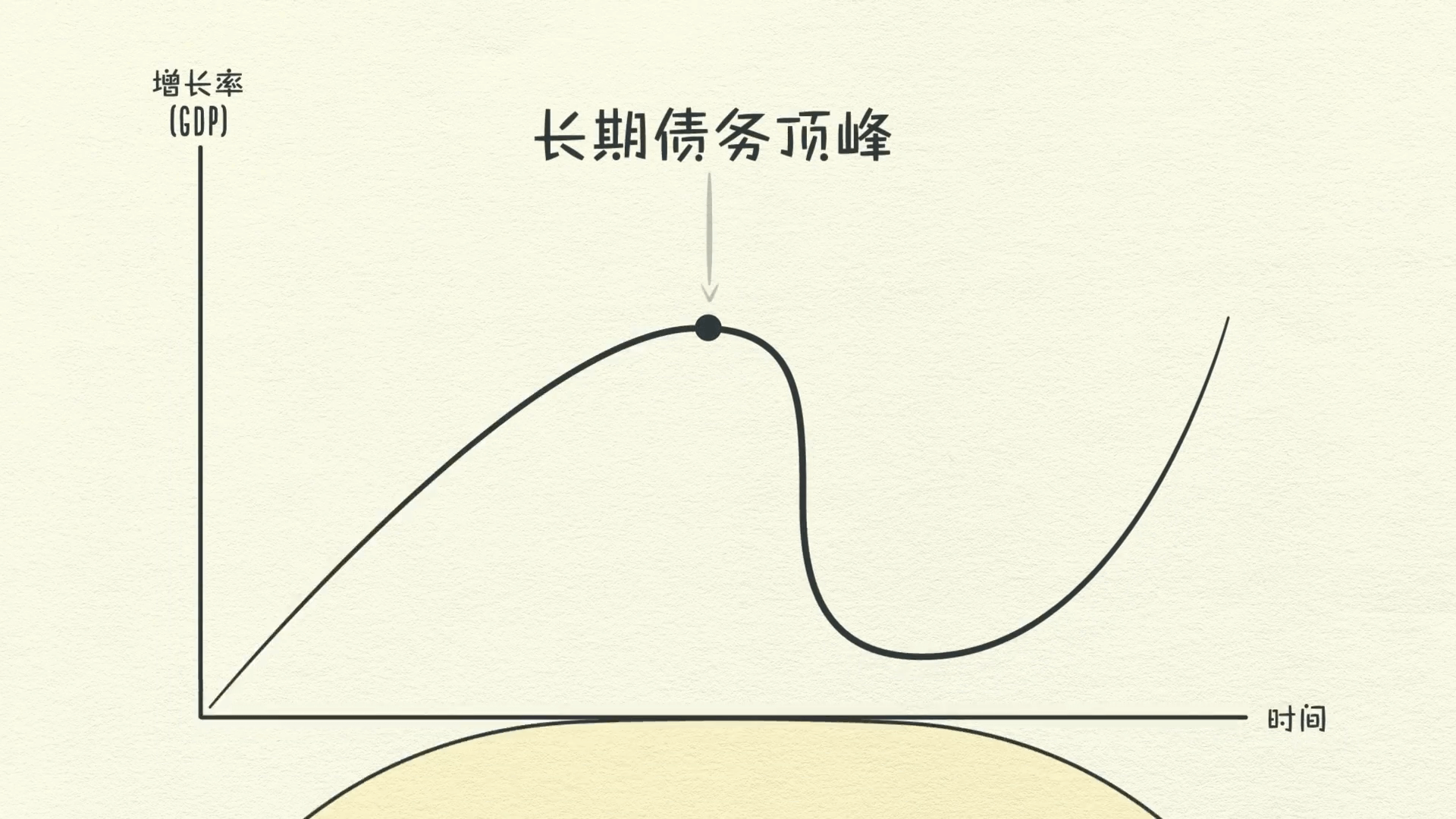

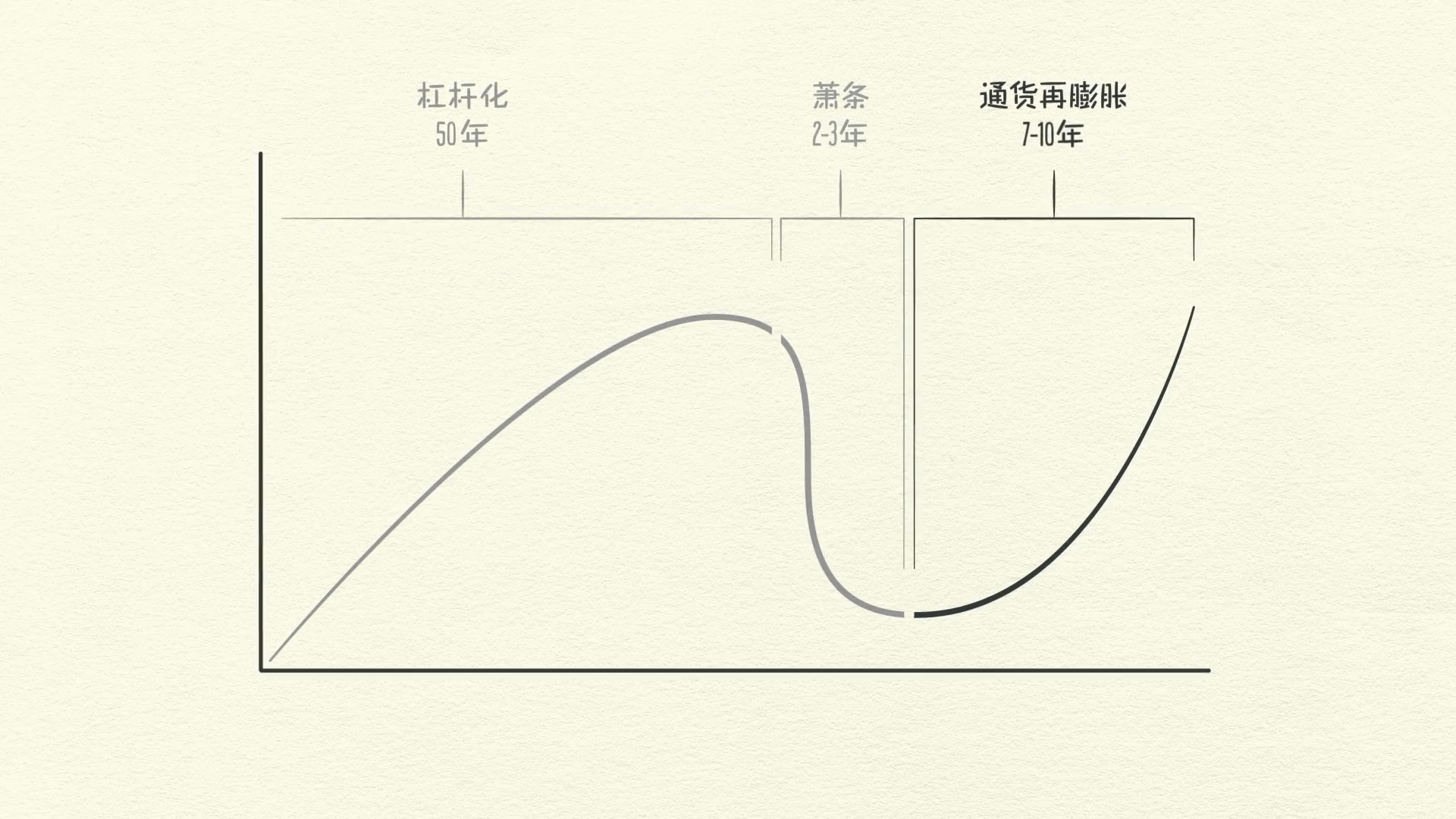

This is because productivity growth doesn’t fluctuate much, so it’s not a big driver of economic swings. Debt is, because it allows us to consume more than we produce when we acquire it, and it forces us to consume less than we produce when we have to pay it back. Debt swings occur in two big cycles. One takes about 5 to 8 years and the other takes about 75 to 100 years. While most people feel the swings, they typically don’t see them as cycles because they see them too up close—day by day, week by week.

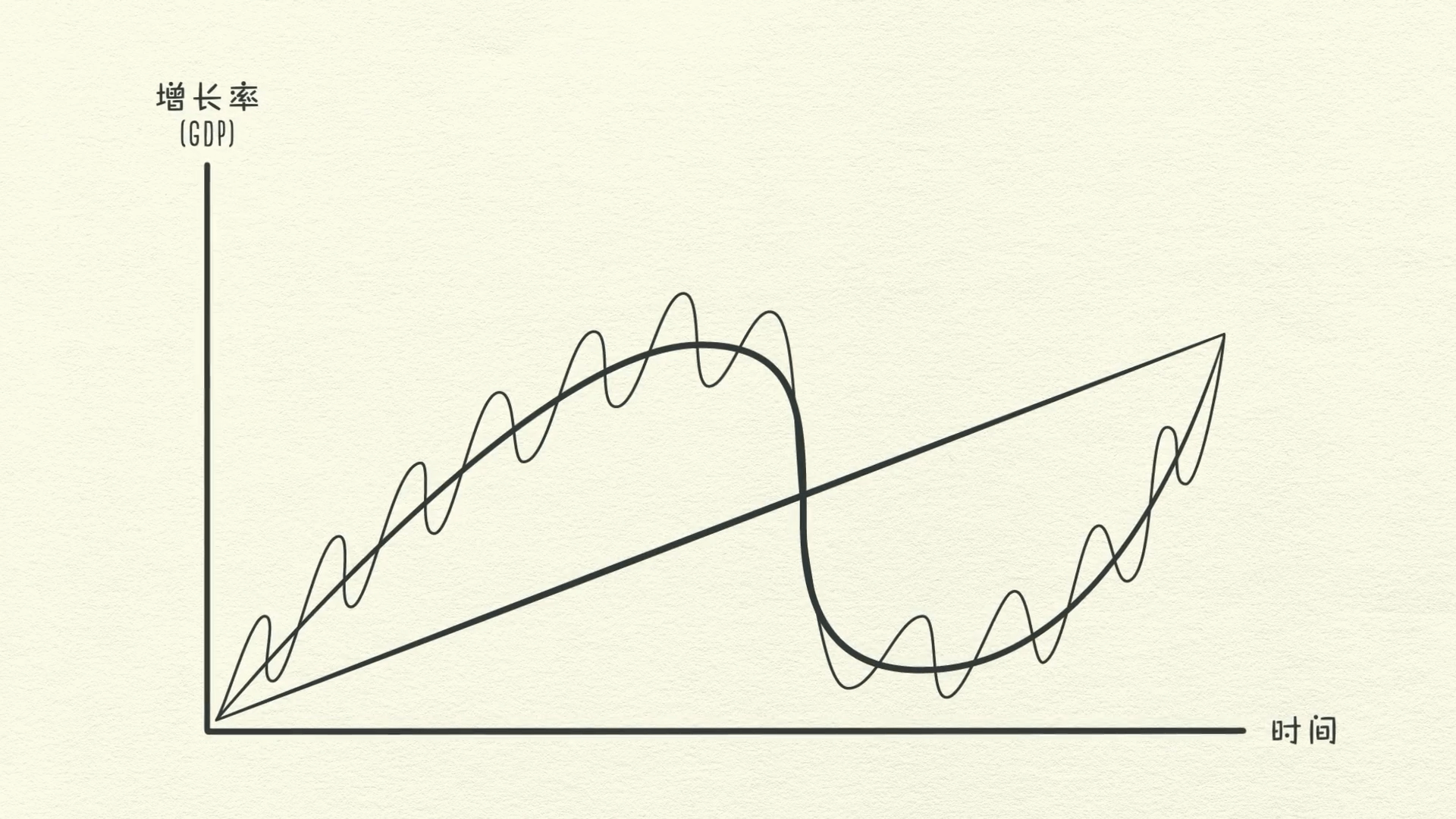

In this chapter, we’re going to step back and look at these three big forces and how they interact to make up our experiences.

As I mentioned, swings aren’t driven by how much innovation or hard work there is, they’re primarily driven by how much credit there is.

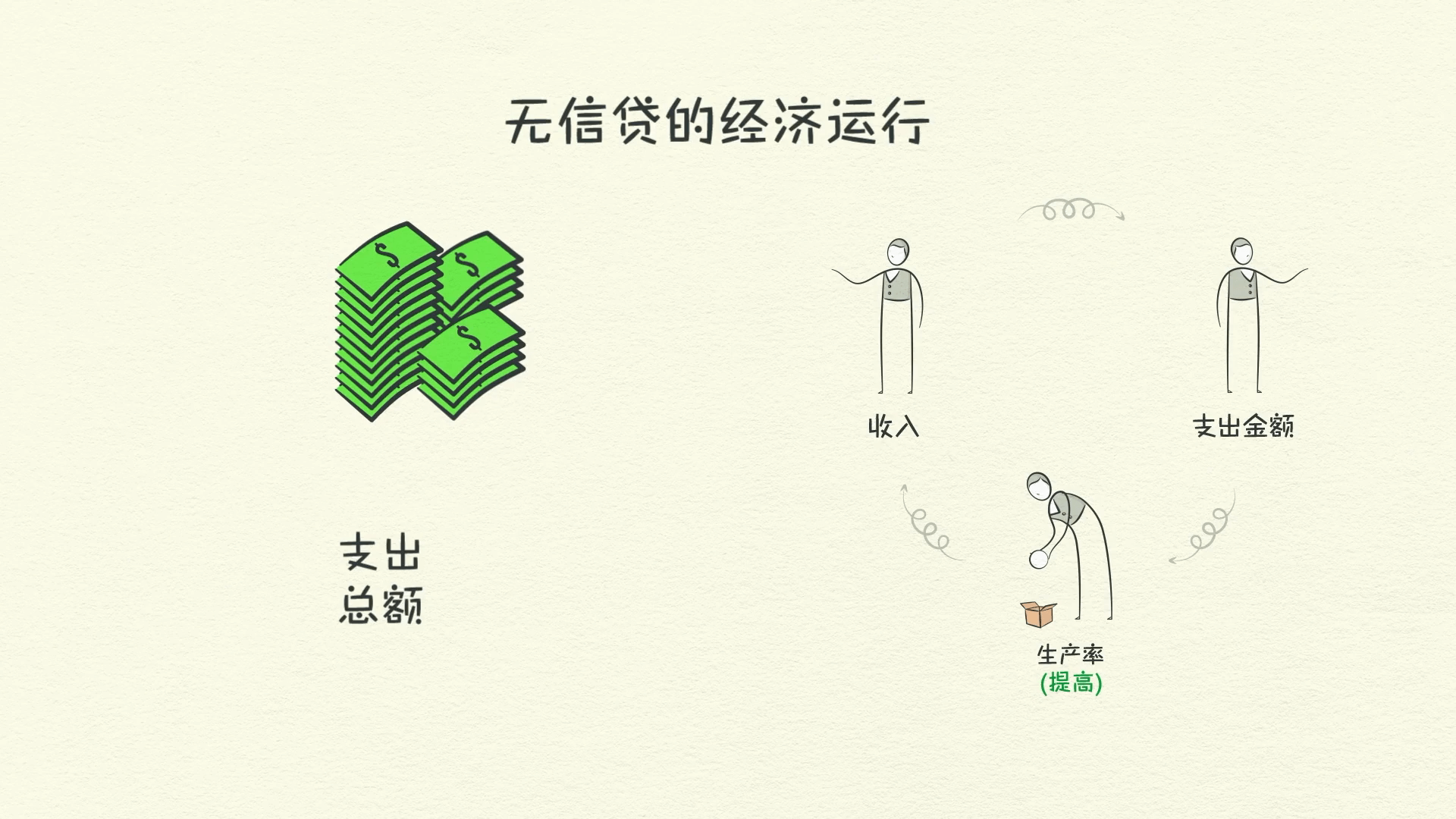

An Economy Without Credit

Let’s imagine for a second an economy without credit.

In this economy, the only way I can increase my spending is to increase my income, which requires me to be more productive and do more work. Increased productivity is the only way for growth. Since my spending is another person’s income, the economy grows every time I or anyone else becomes more productive.

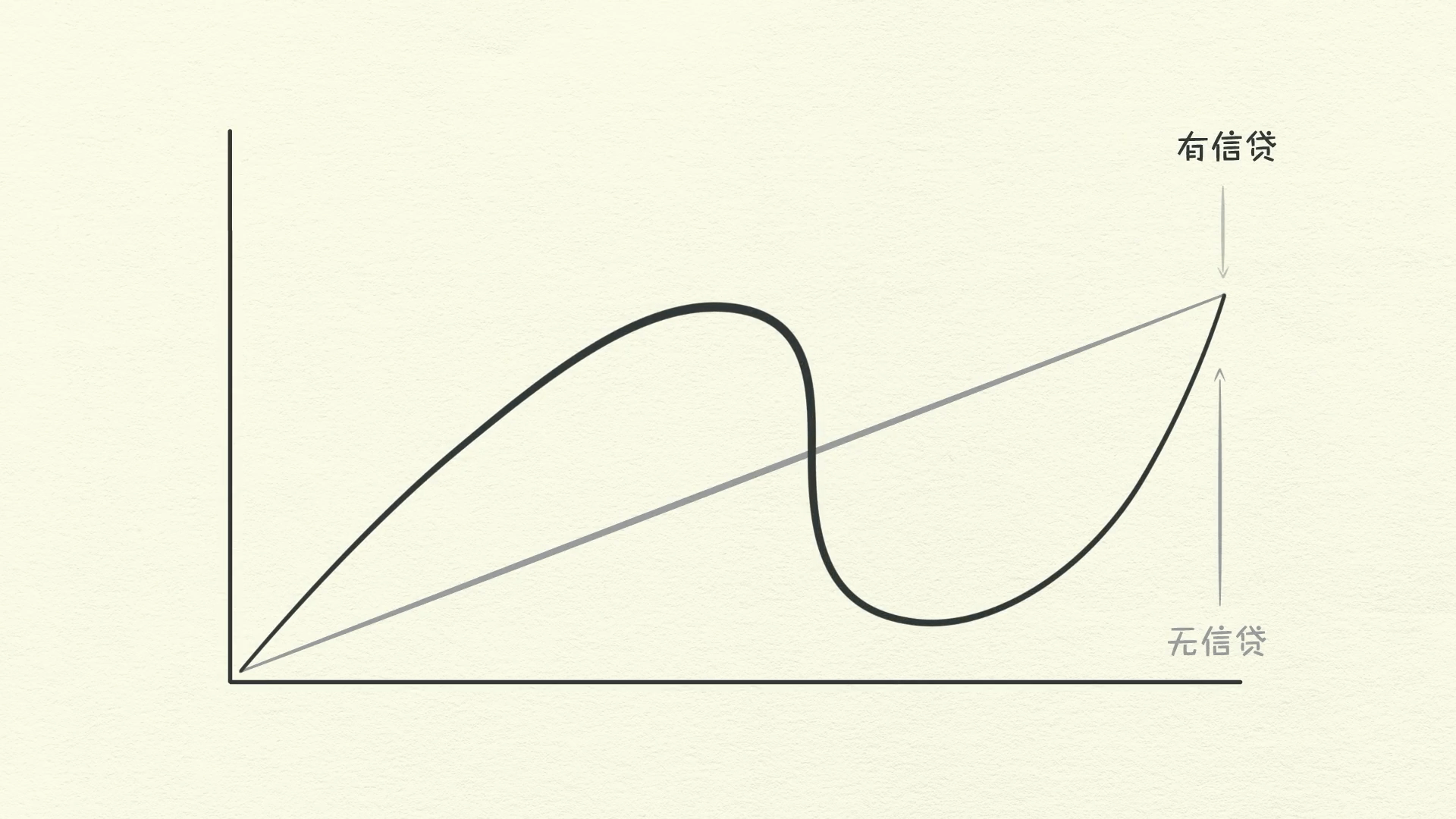

If we follow the transactions and play this out, we see a progression like the productivity growth line.

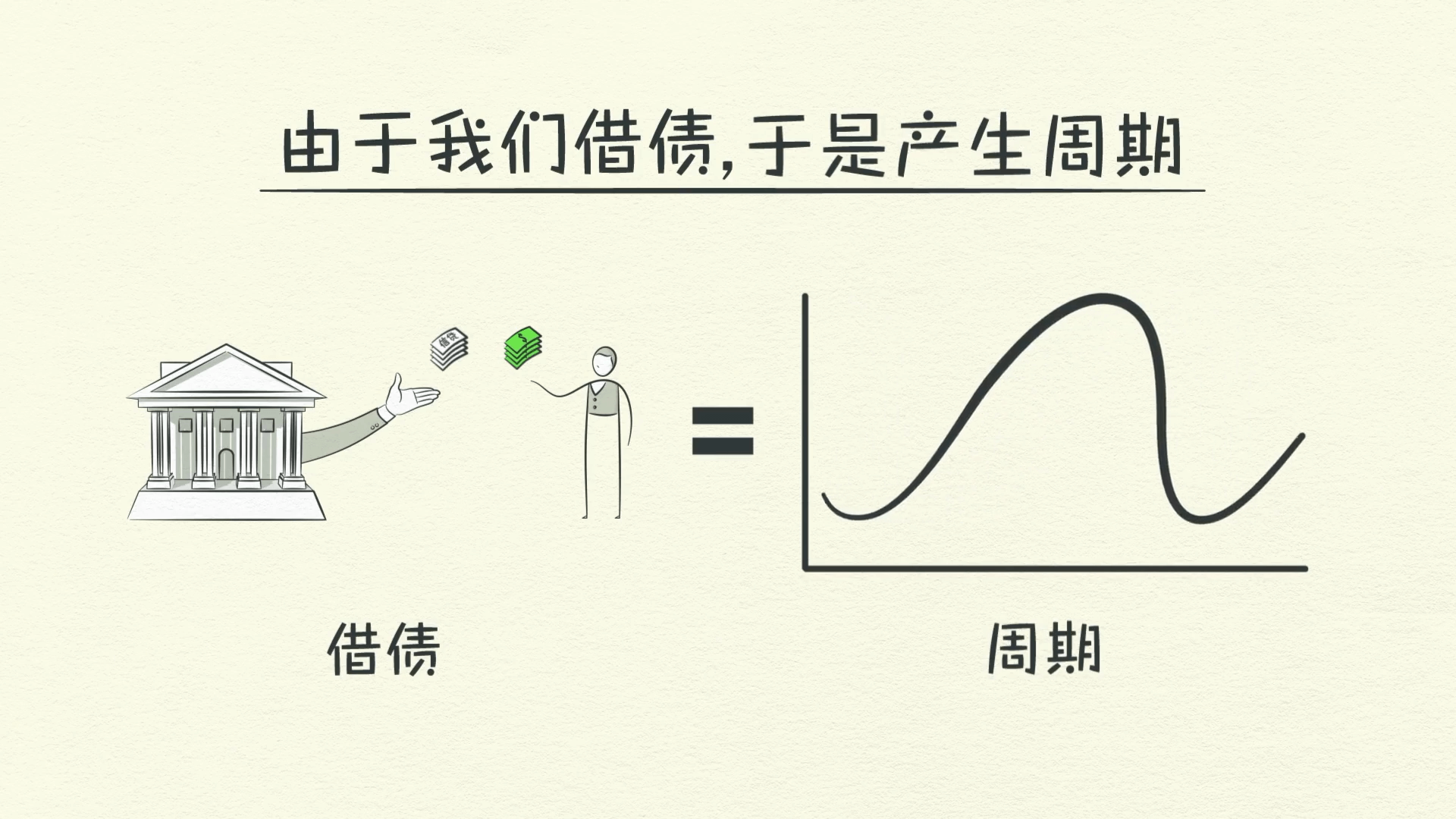

But because we borrow, we have cycles. This isn’t due to any laws or regulations, it’s due to human nature and the way that credit works.

Think of borrowing as simply a way of pulling spending forward. In order to buy something you can’t afford, you need to spend more than you make.

To do this, you essentially need to borrow from your future self. You do this by creating a time in the future when you need to spend less than you make in order to pay it back. It very quickly resembles a cycle.

Basically, anytime you borrow, you create a cycle. This is as true for an individual as it is for the economy. This is why understanding credit is so important because it sets into motion a mechanical, predictable series of events that will happen in the future.

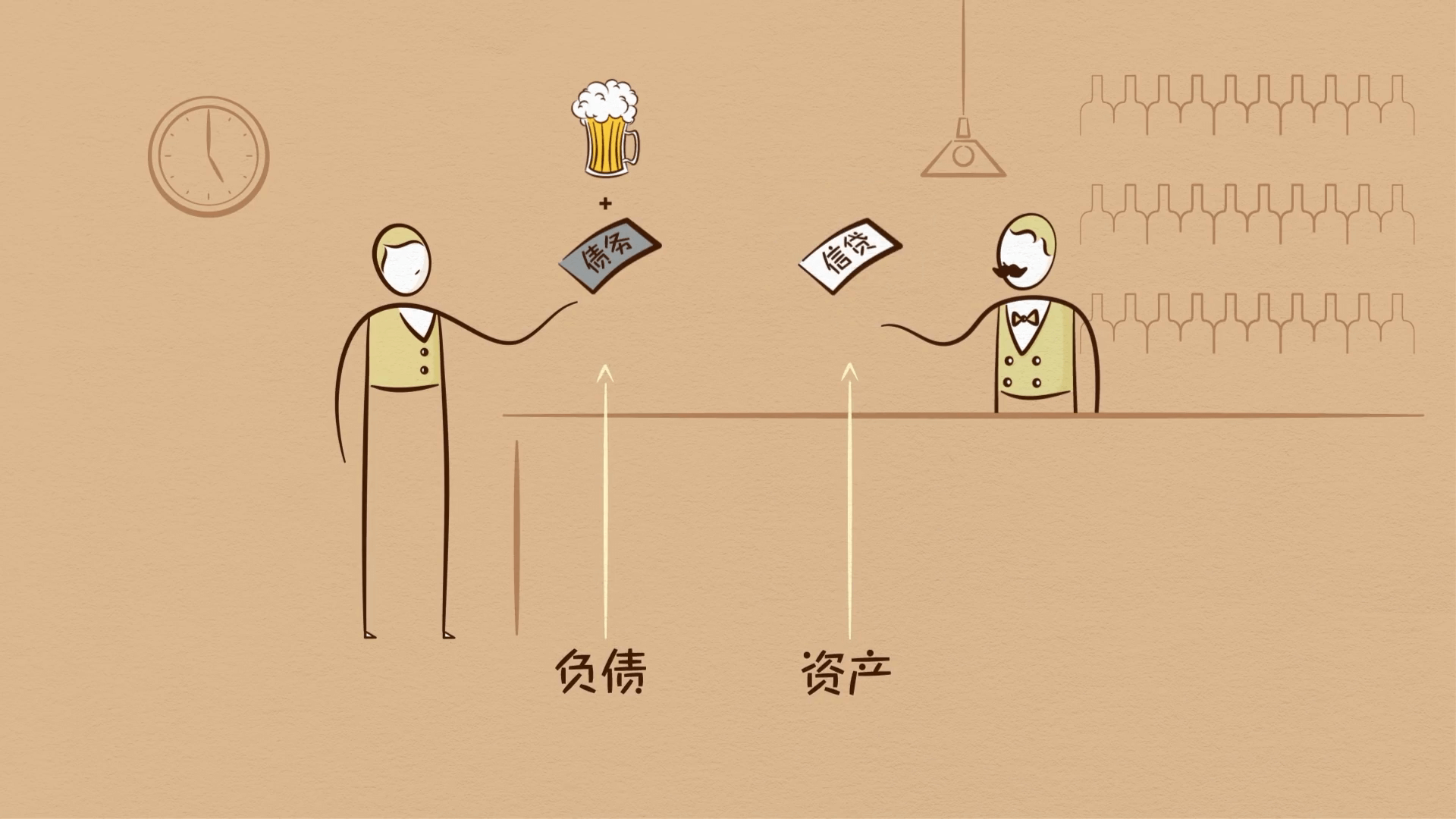

Credit vs Money

This makes credit different from money. Money is what you settle transactions with. When you buy a beer from a bartender with cash, the transaction is settled immediately.

But when you buy a beer with credit, like opening a bar tab, you’re saying you promise to pay in the future. Together you and the bartender create an asset and a liability. You just created credit out of thin air. It’s not until you pay the tab later that the asset and the liability disappear, the debt goes away, and the transaction is settled.

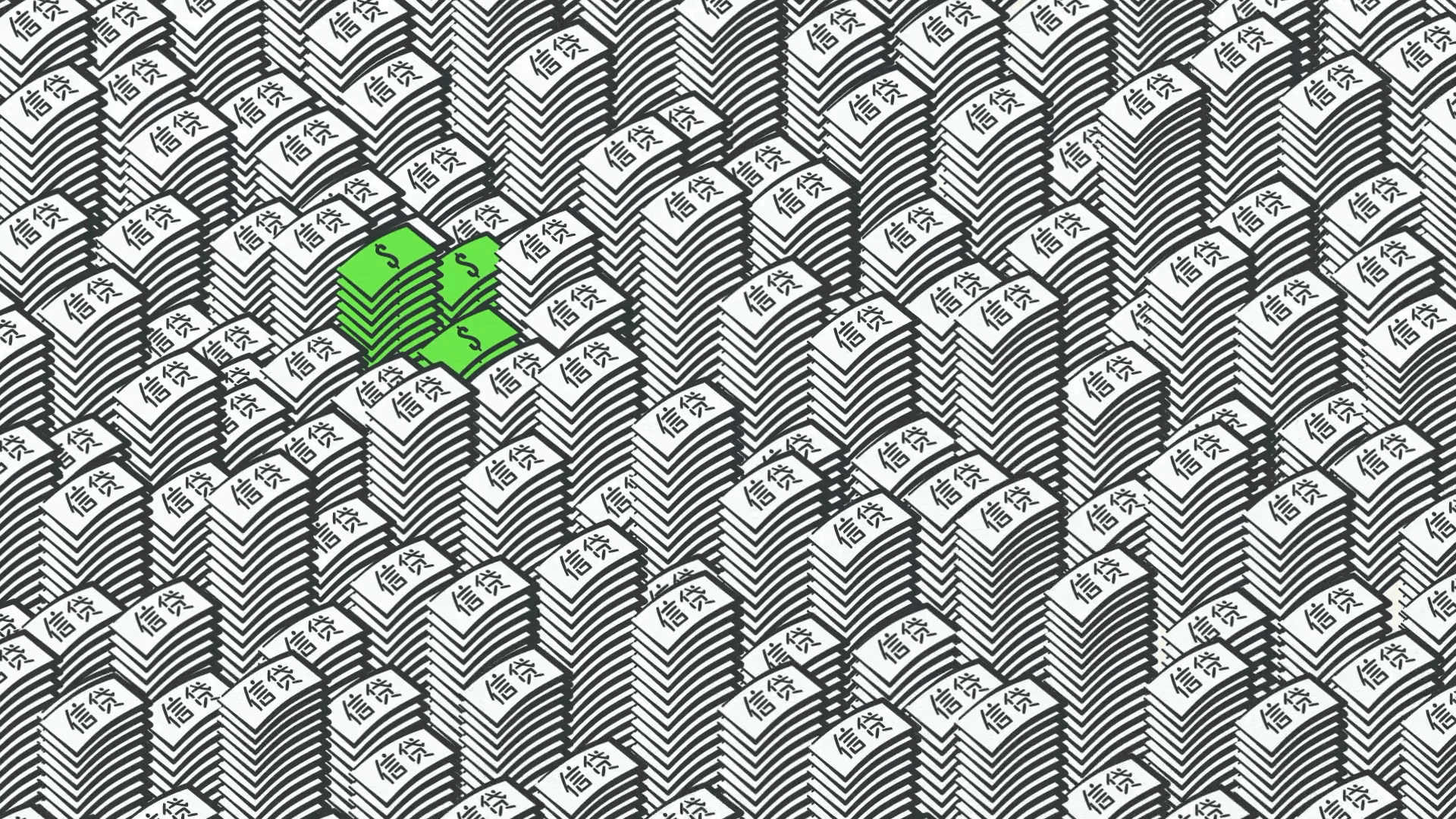

Much of What People Call Money is Actually Credit

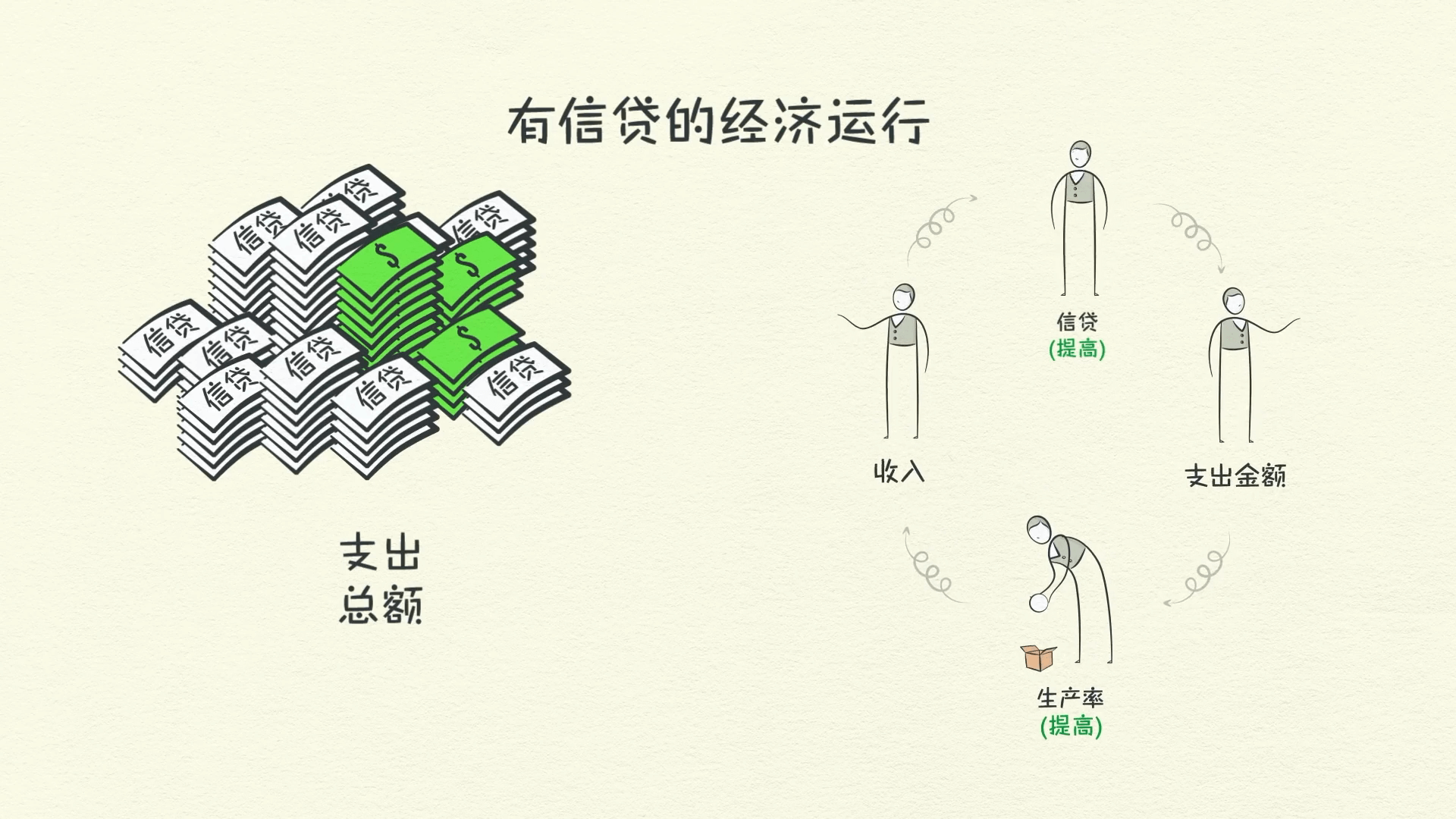

The reality is that most of what people call money is actually credit. The total amount of credit in the United States is about $50 trillion and the total amount of money is only about $3 trillion. Remember, in an economy without credit, the only way to increase your spending is to produce more. But in an economy with credit, you can also increase your spending by borrowing.

As a result, an economy with credit has more spending and allows incomes to rise faster than productivity over the short run, but not over the long run.

Now don’t get me wrong, credit isn’t necessarily a bad thing that just causes cycles.

Bad Credit vs Good Credit

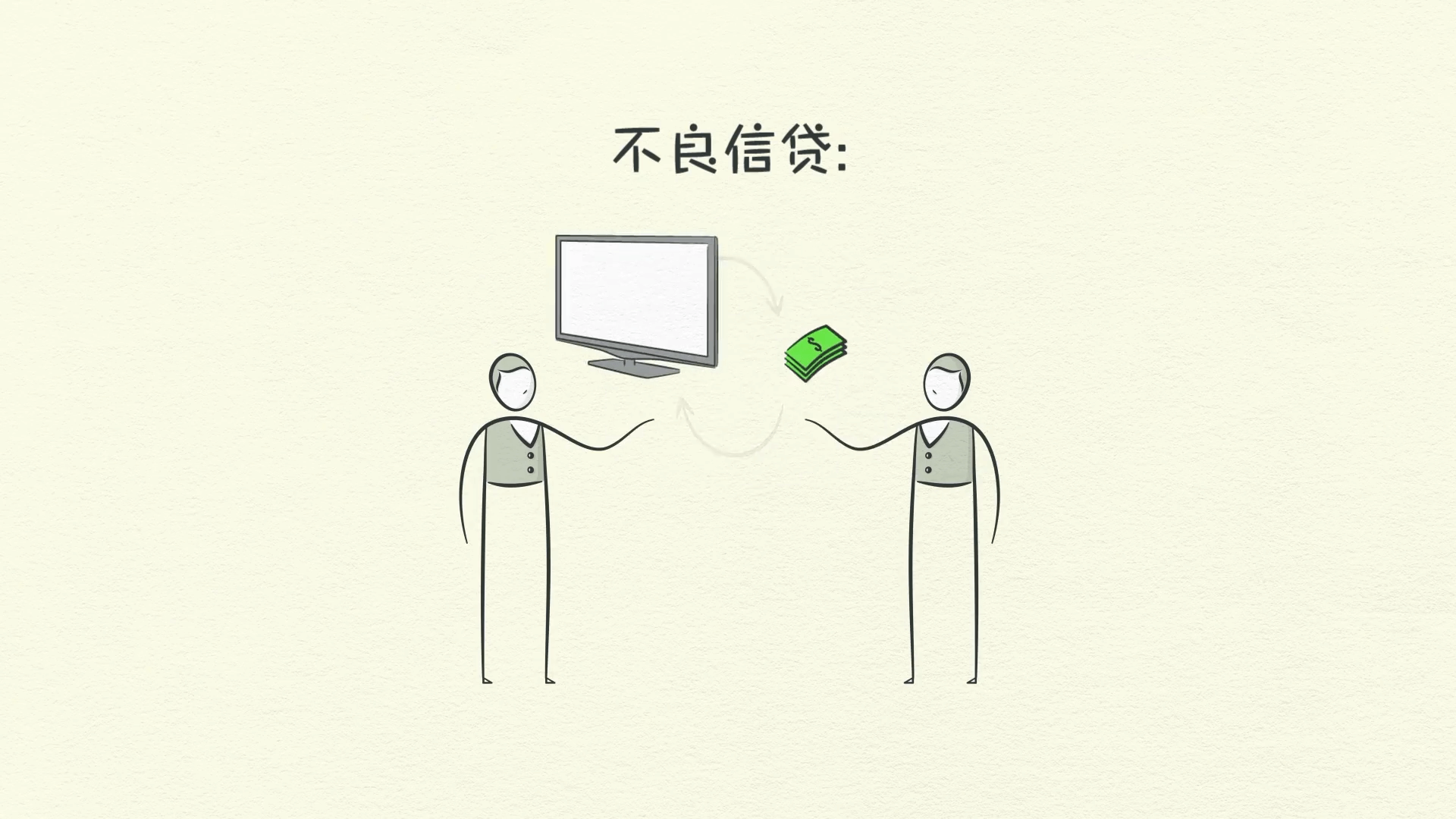

It’s bad when it finances overcapitalization that can’t be paid back.

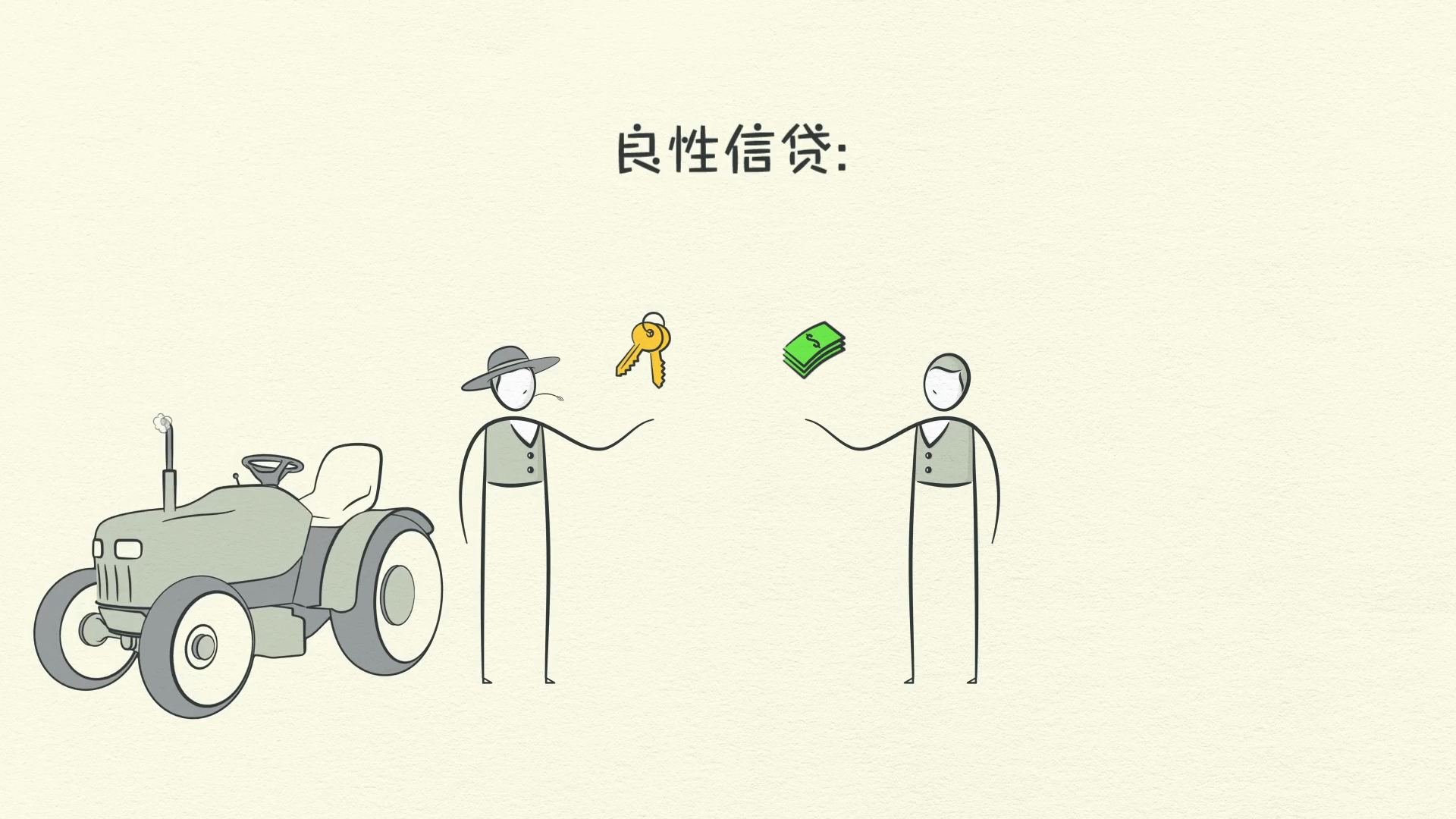

However, it’s good when it efficiently allocates resources and produces income so you can pay back the debt.

For example, if you borrow money to buy a big TV, it doesn’t generate income for you to pay back the debt.

But if you borrow money to buy a tractor and that tractor lets you harvest more crops and earn more money, then you can pay back your debt and improve your living standards.

How Credit Drives Economic Growth

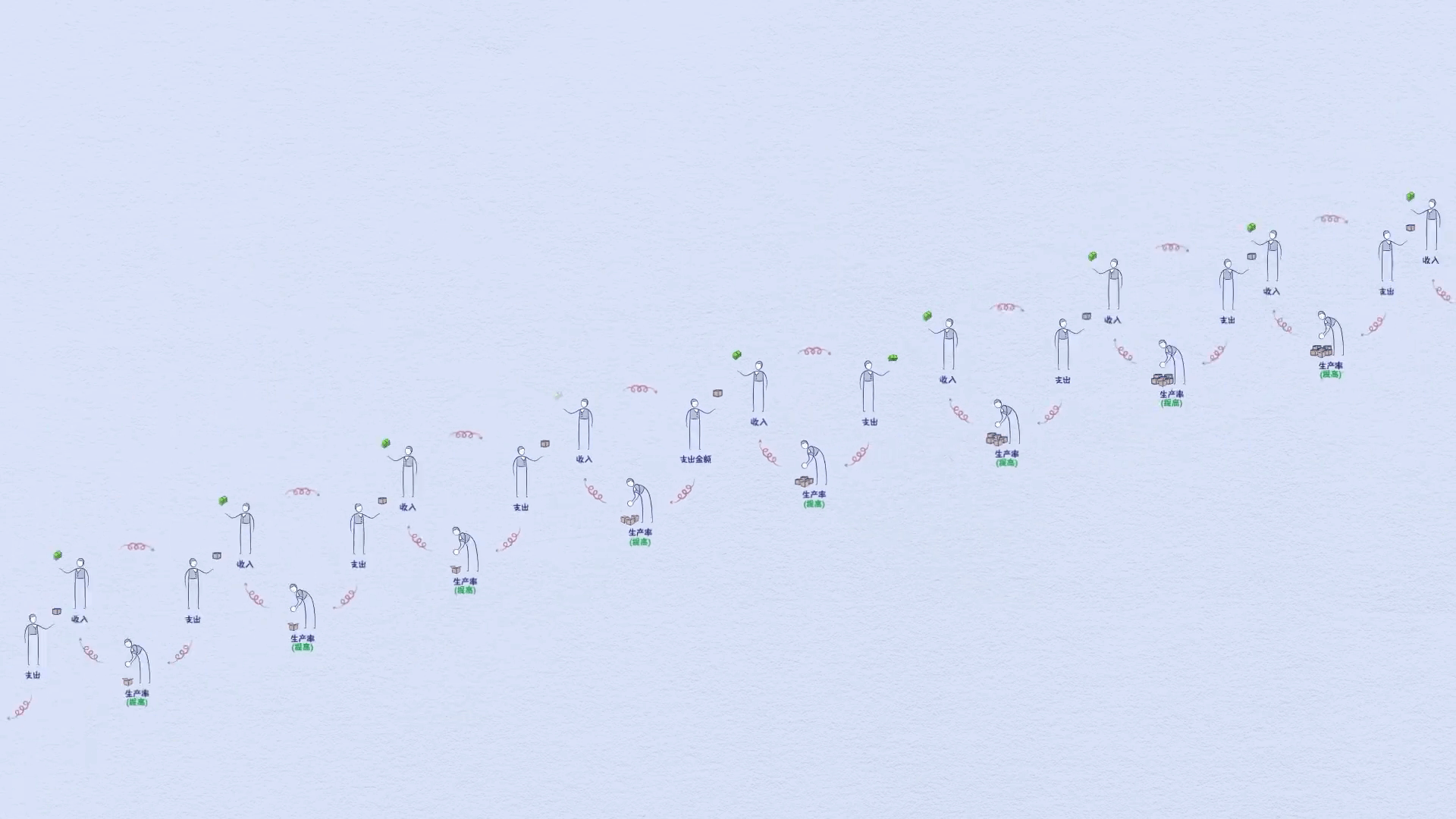

In an economy with credit, we can follow the transactions and see how credit creates growth.

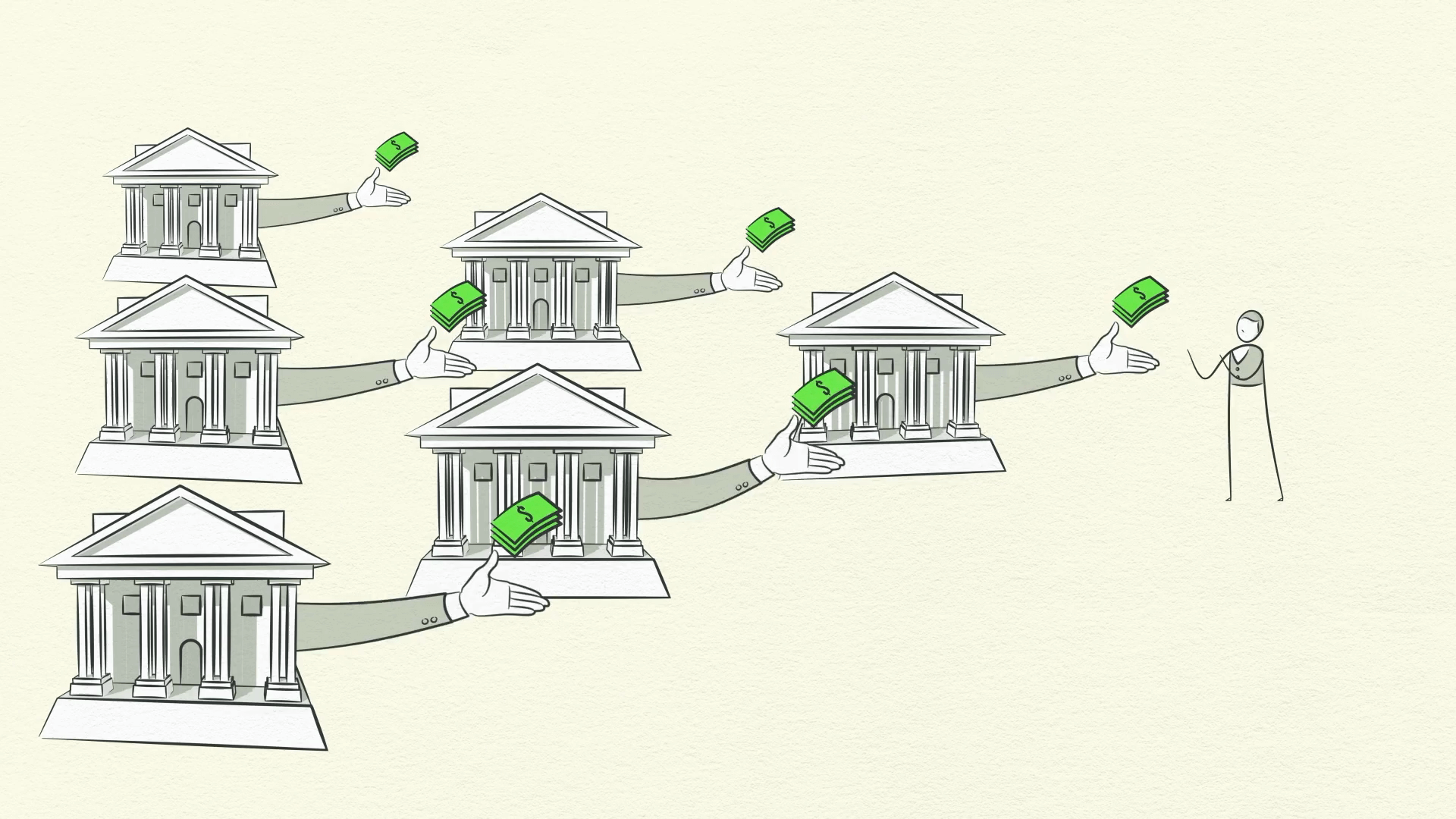

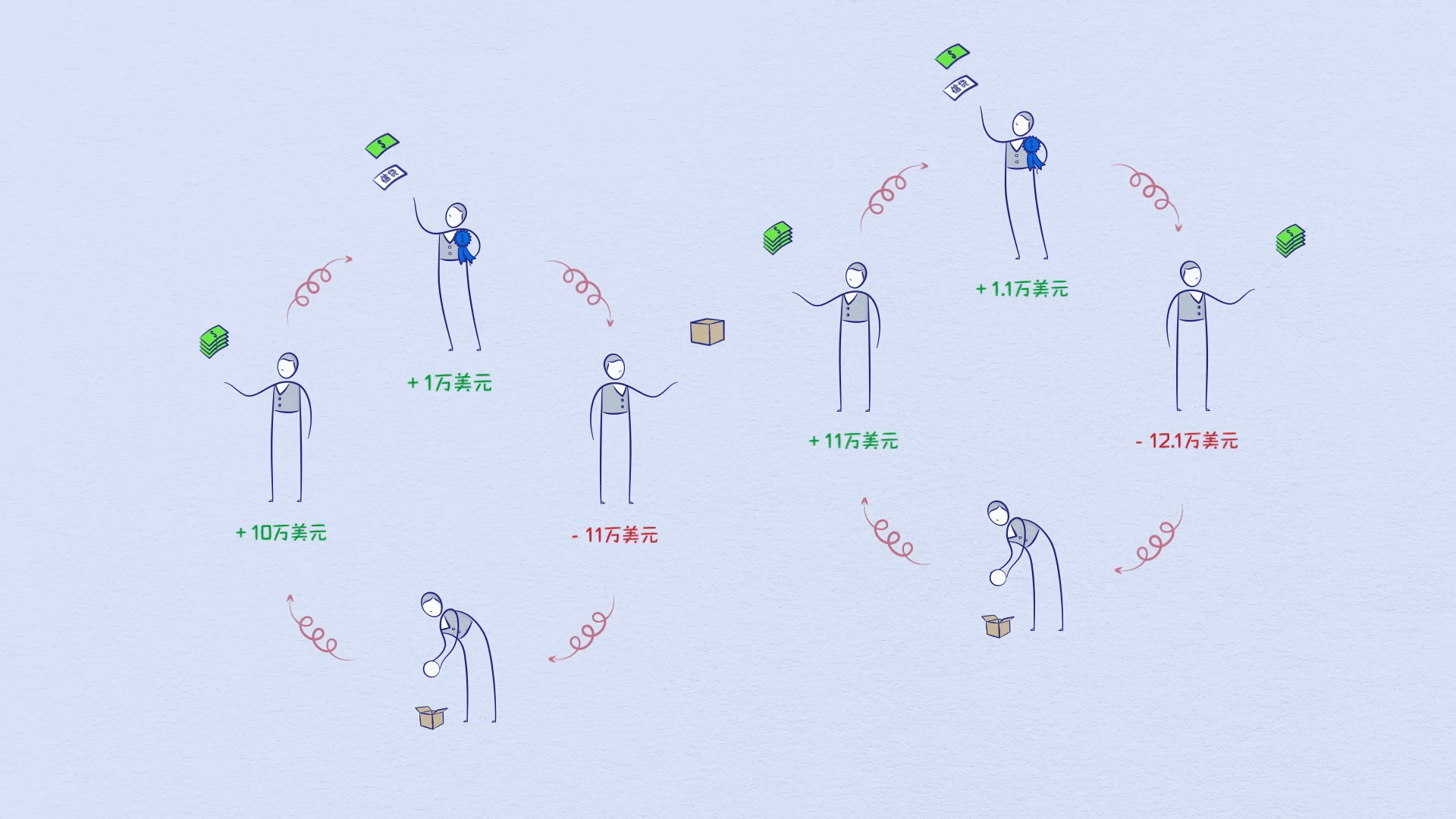

Let me give you an example: Suppose you earn $100,000 a year and have no debt. You are creditworthy enough to borrow $10,000, say on a credit card. So you can spend $110,000, even though you only earn $100,000. Since your spending is another person’s income, someone is earning $110,000. The person earning $110,000 with no debt can borrow $11,000, so he can spend $121,000, even though he has only earned $110,000.

His spending is another person’s income, and by following the transactions, we can see how this process works in a self-reinforcing pattern. But remember, borrowing creates cycles, and if the cycle goes up, it eventually must come down. This leads us into the Short Term Debt Cycle.

The Short Term Debt Cycle

As economic activity increases, we see an expansion - the first phase of the short-term debt cycle. Spending continues to increase, and prices start to rise. This happens because the increase in spending is fueled by credit – which can be created instantly out of thin air. When the amount of spending and incomes grow faster than the production of goods, prices rise.

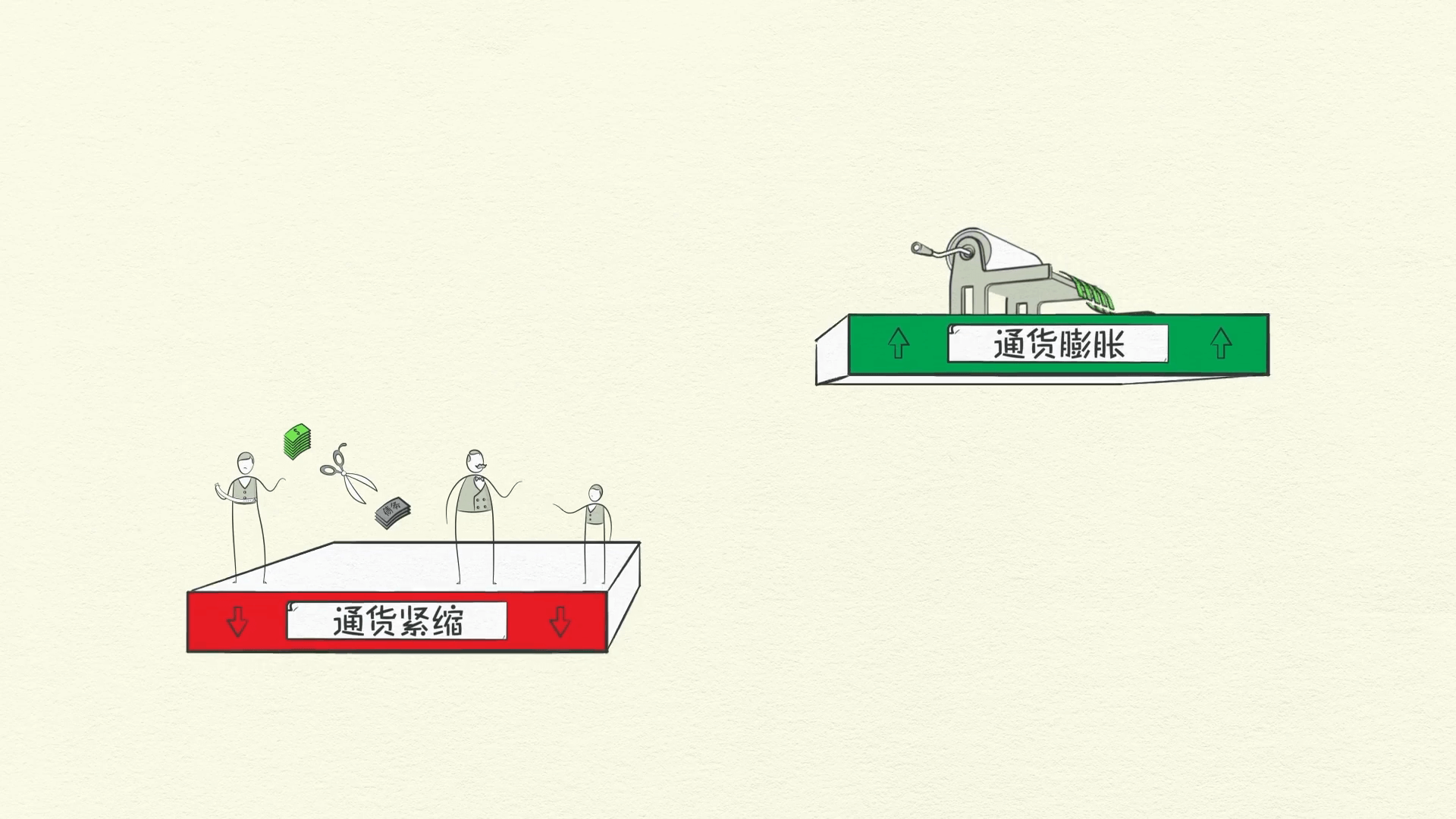

We call this price increase inflation.

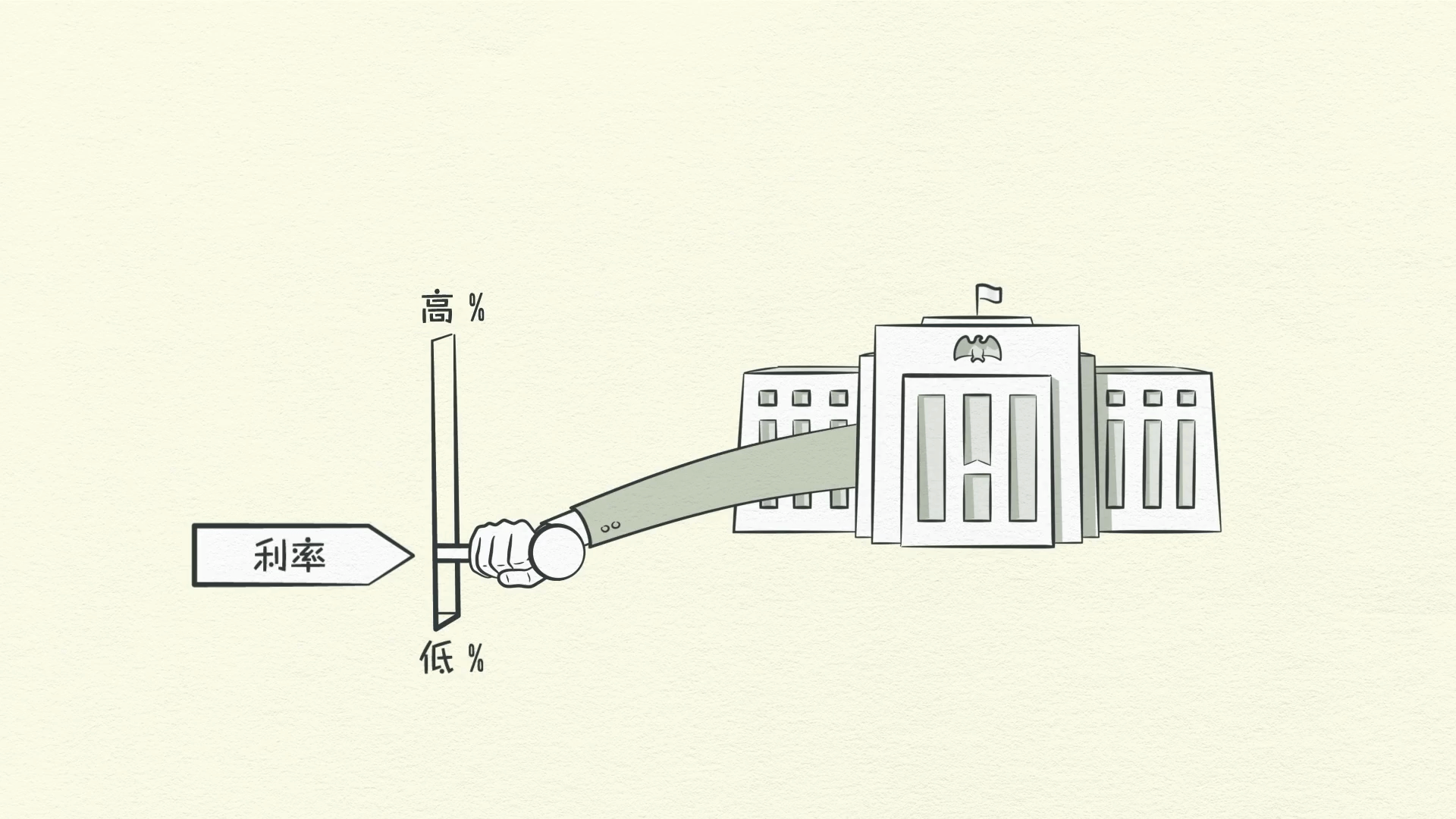

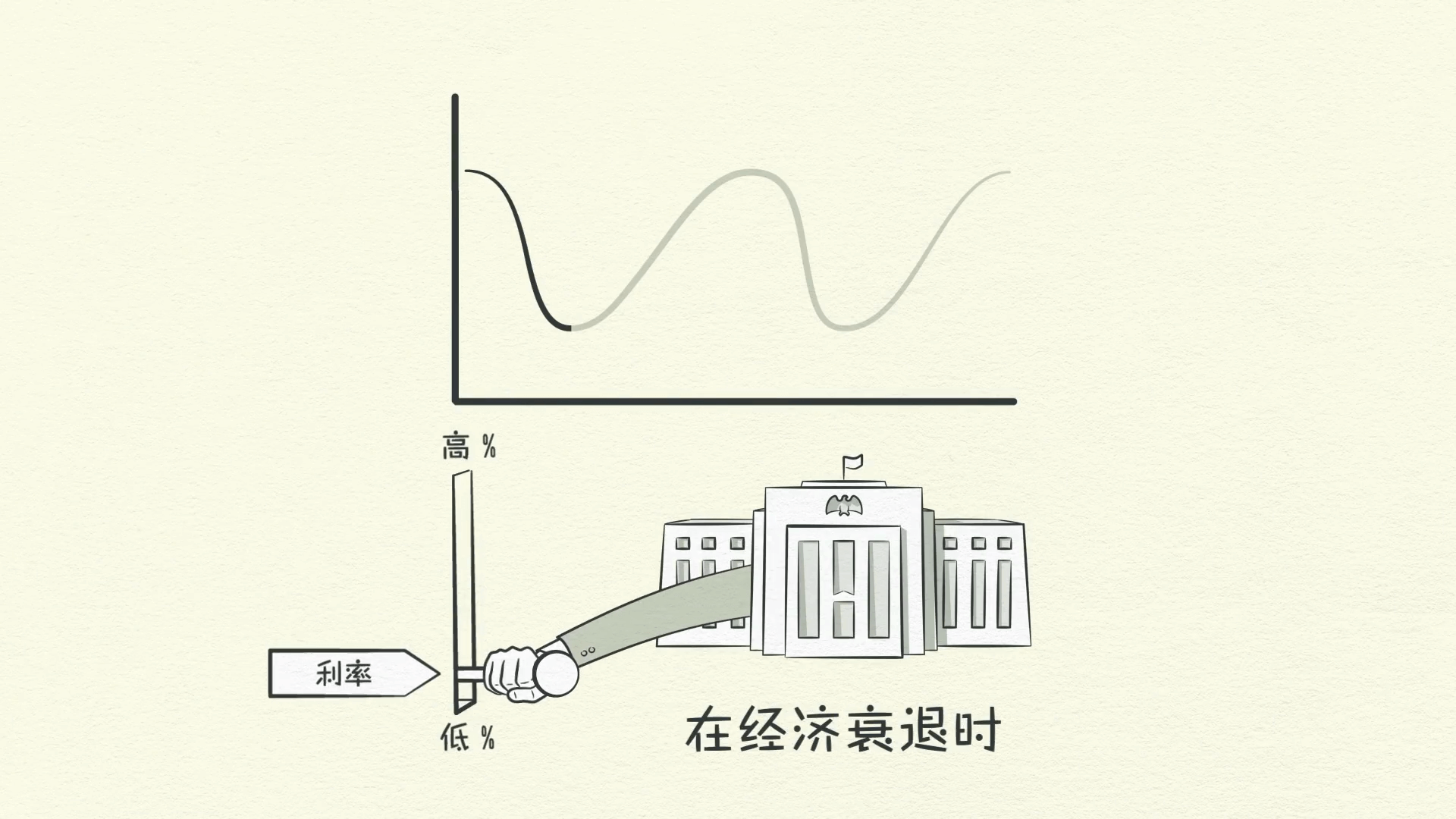

The Central Bank doesn’t want too much inflation because it causes problems. Seeing prices rise, it raises interest rates.

With higher interest rates, fewer people can afford to borrow money, and the cost of existing debts rises. Think about this as the monthly payments on your credit card going up. Because people borrow less and have higher debt repayments, they have less money left over to spend. So spending slows. And since one person’s spending is another person’s income, incomes drop, and so on.

When people spend less, prices go down. We call this deflation.

Economic activity decreases and we have a recession. If the recession becomes too severe and inflation is no longer a problem, the Central Bank will lower interest rates to cause everything to pick up again. With low interest rates, debt repayments are reduced and borrowing and spending pick up, and we see another expansion.

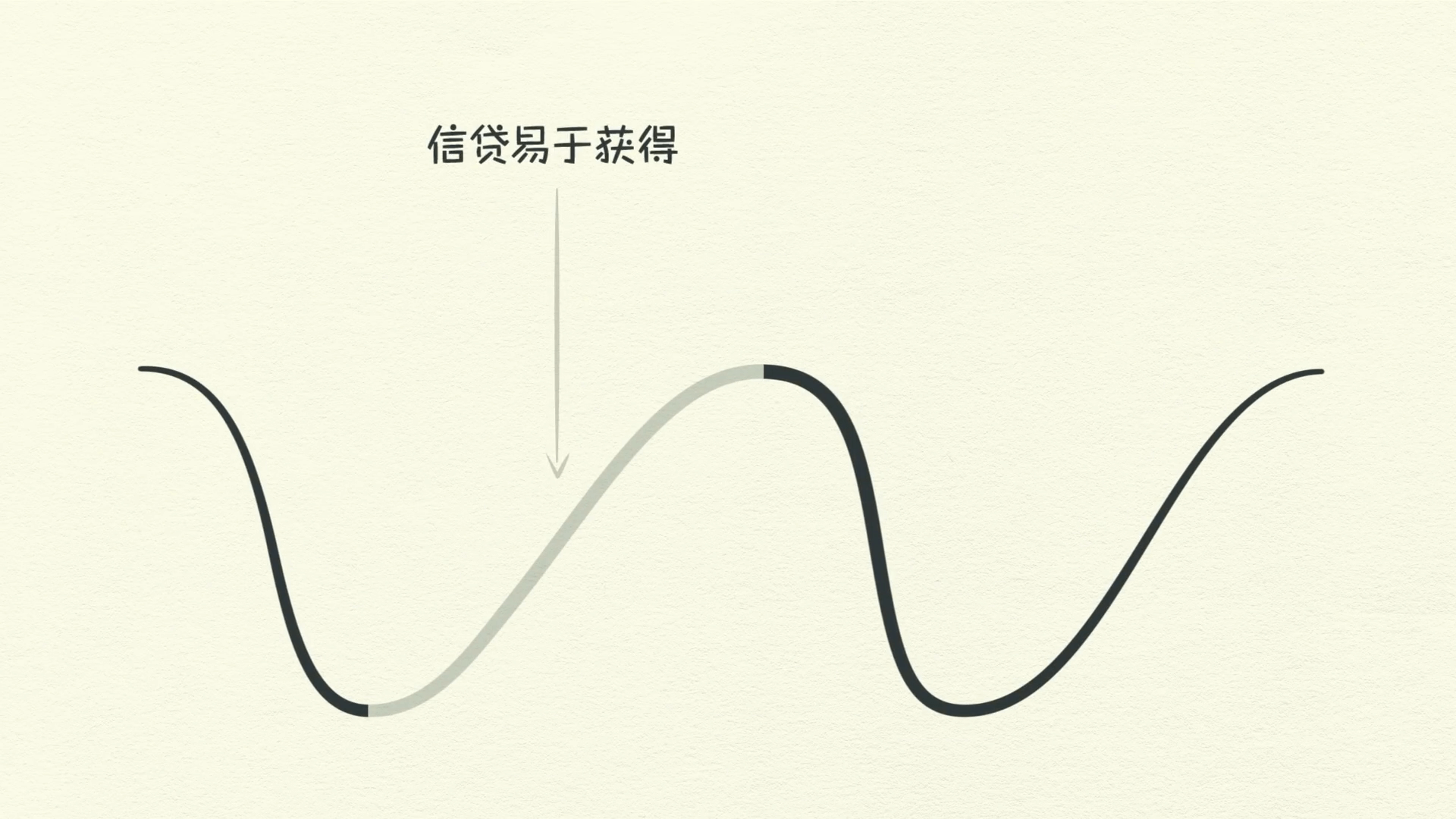

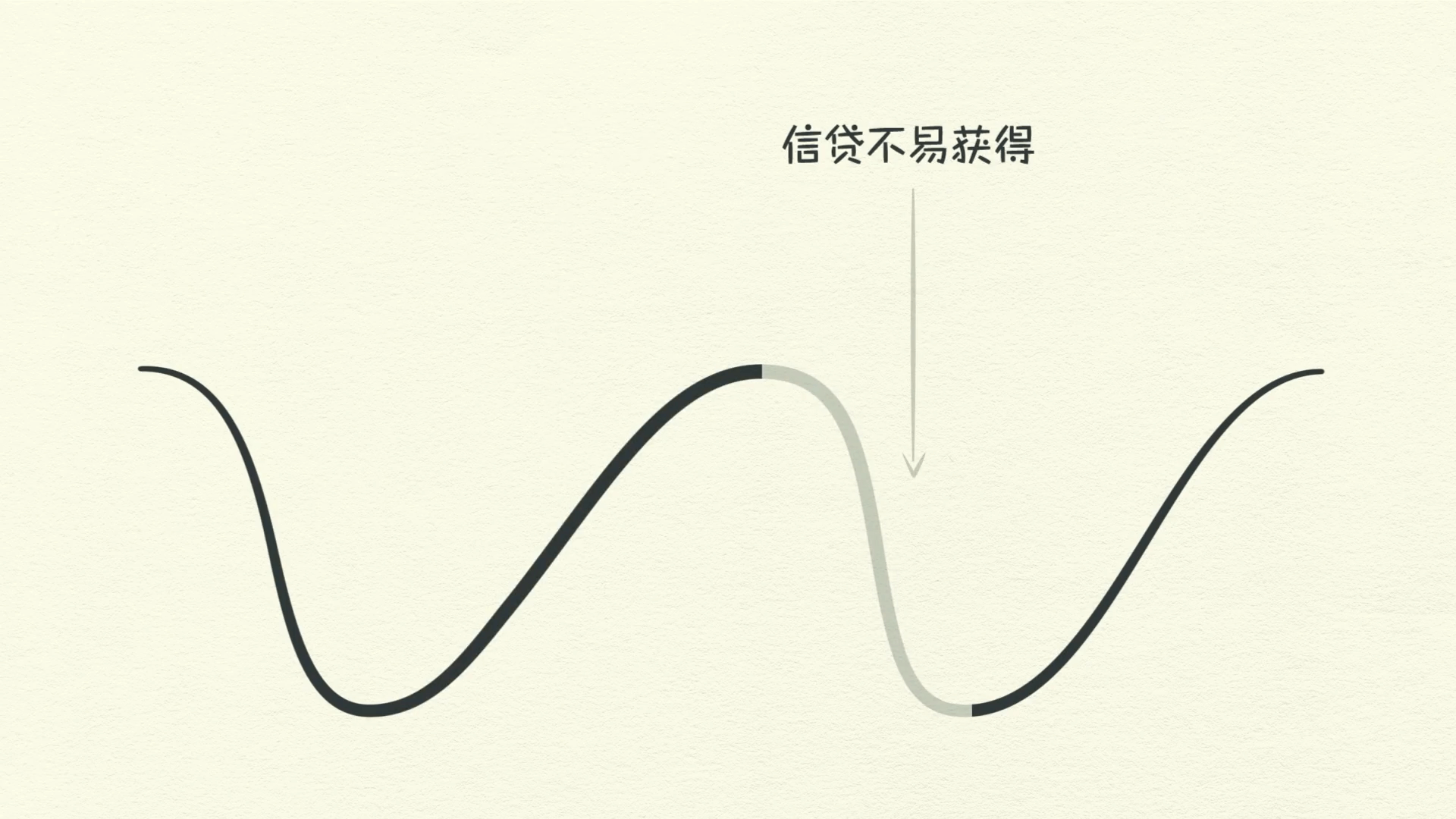

As you can see, the economy works like a machine. In the short-term debt cycle, spending is constrained only by the willingness of lenders and borrowers to provide and receive credit.

When credit is easily available, there’s an economic expansion. When credit isn’t available, there’s a recession.

And note that this cycle is controlled primarily by the Central Bank. The short-term debt cycle typically lasts 5 to 8 years and happens over and over again for decades.

But notice that the bottom and top of each cycle finish with more growth in the previous cycle and with more debt.

Why? Because people push it - they have an inclination to borrow and spend more instead of paying back debt. It’s human nature.

The Long Term Debt Cycle

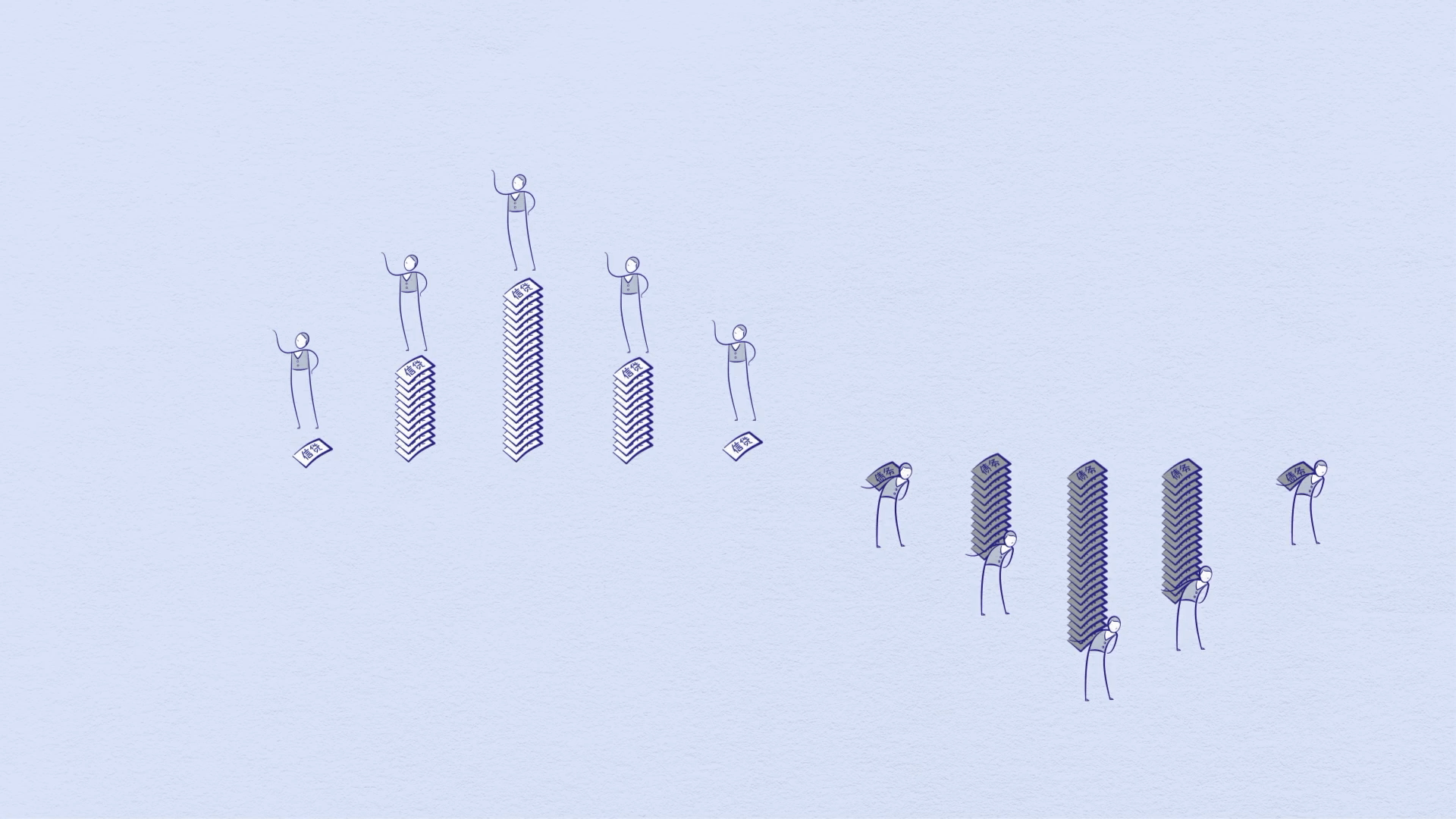

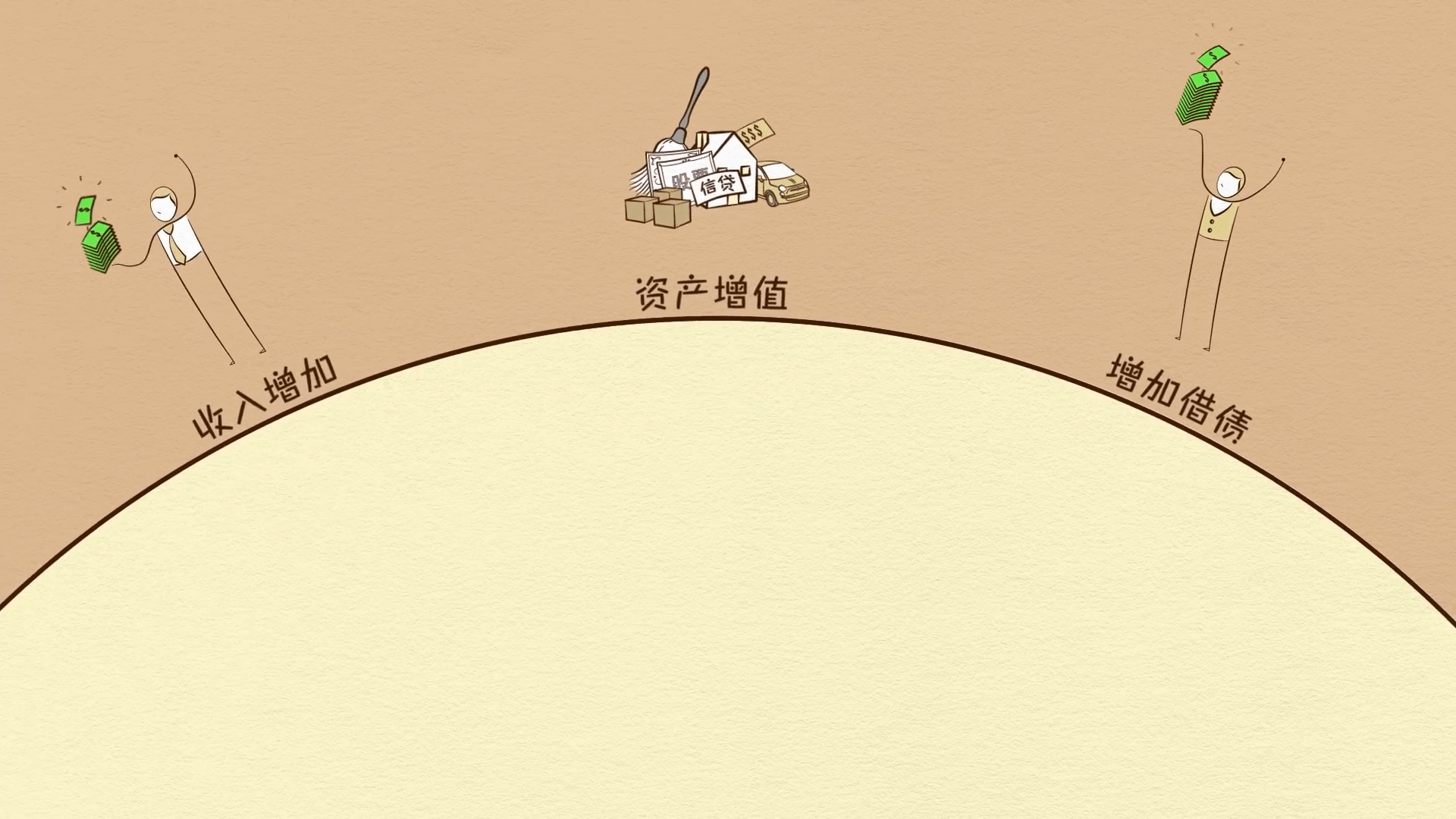

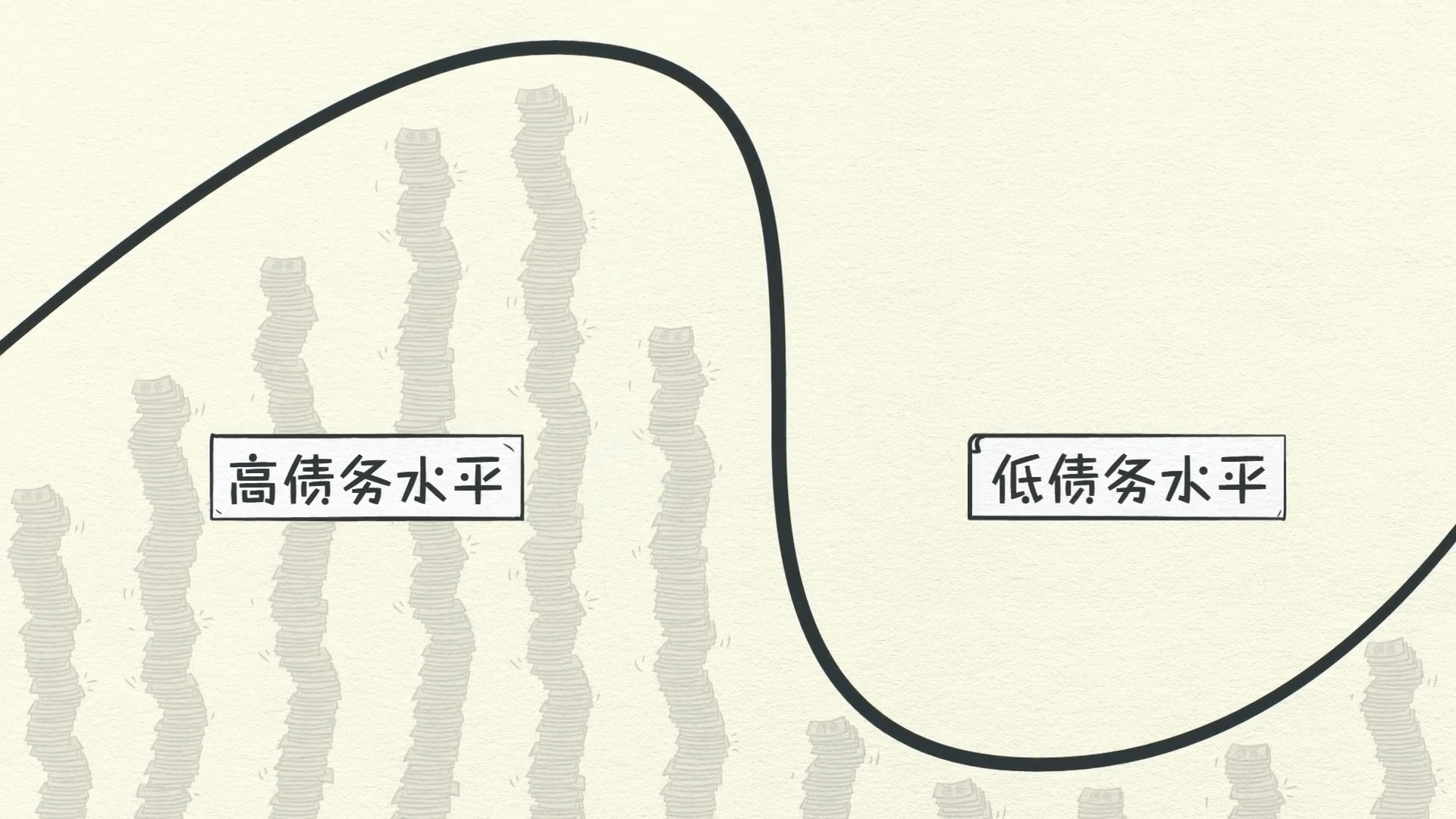

Because of this, over long periods of time, debts rise faster than incomes, creating the Long Term Debt Cycle. Despite people becoming more indebted, lenders are even more willing to extend credit. Why?

Because everyone thinks things are going great! People are just focused on what’s been happening lately. And what’s been happening lately? Incomes have been rising! Asset values are going up! The stock market roars!

It’s a boom!

It pays to buy goods, services, and financial assets with borrowed money! When people do a lot of that, we call it a bubble. So even though debts have been growing

incomes have been growing nearly as fast to offset them. We call the ratio of debt-to-income the debt burden. So long as incomes continue to rise, the debt burden stays manageable.

At the same time, asset values soar. People borrow huge amounts of money to buy assets as investments causing their prices to rise even higher. People feel wealthy. So even with the accumulation of lots of debt, rising incomes and asset values help borrowers remain creditworthy for a long time.

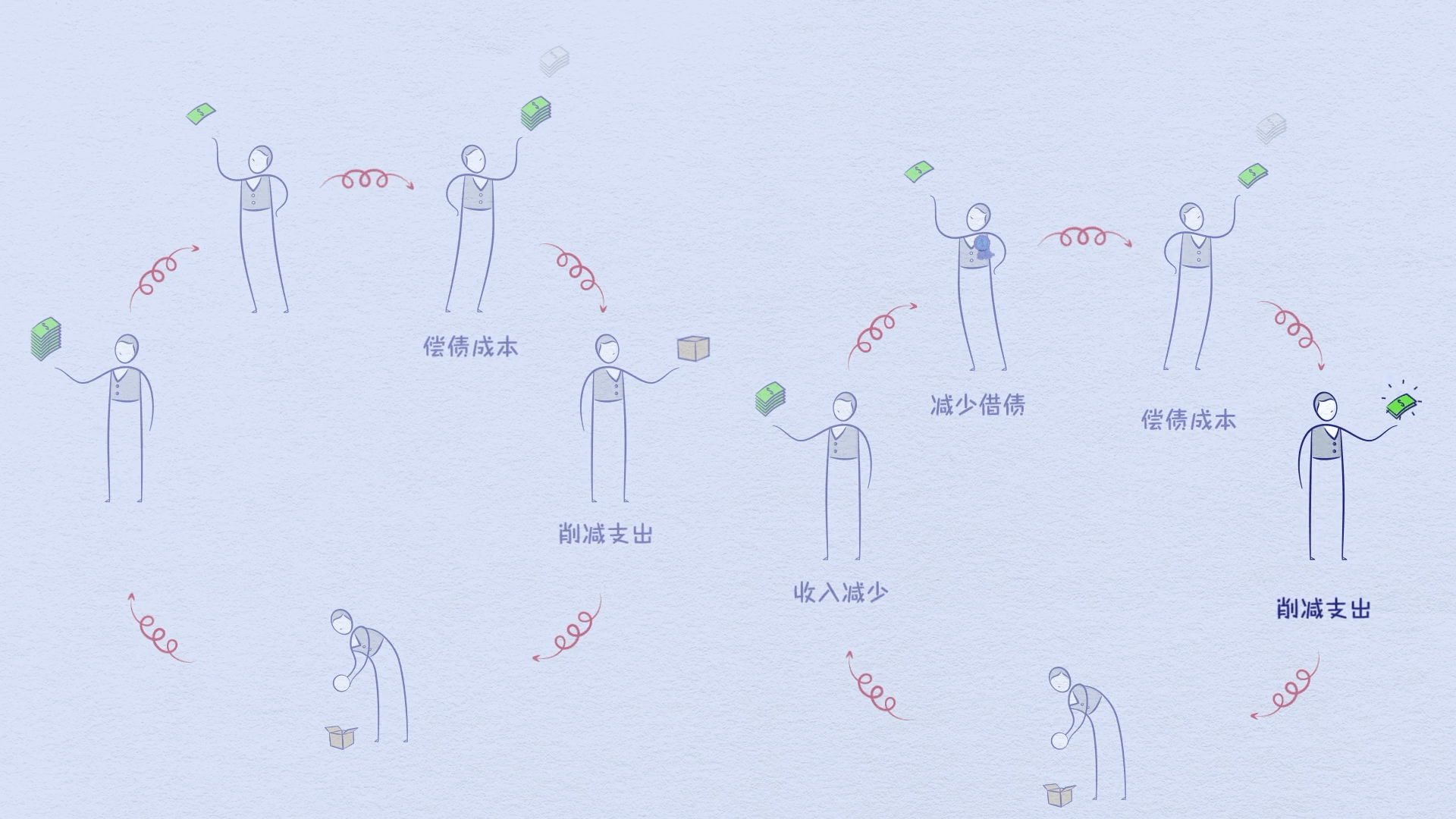

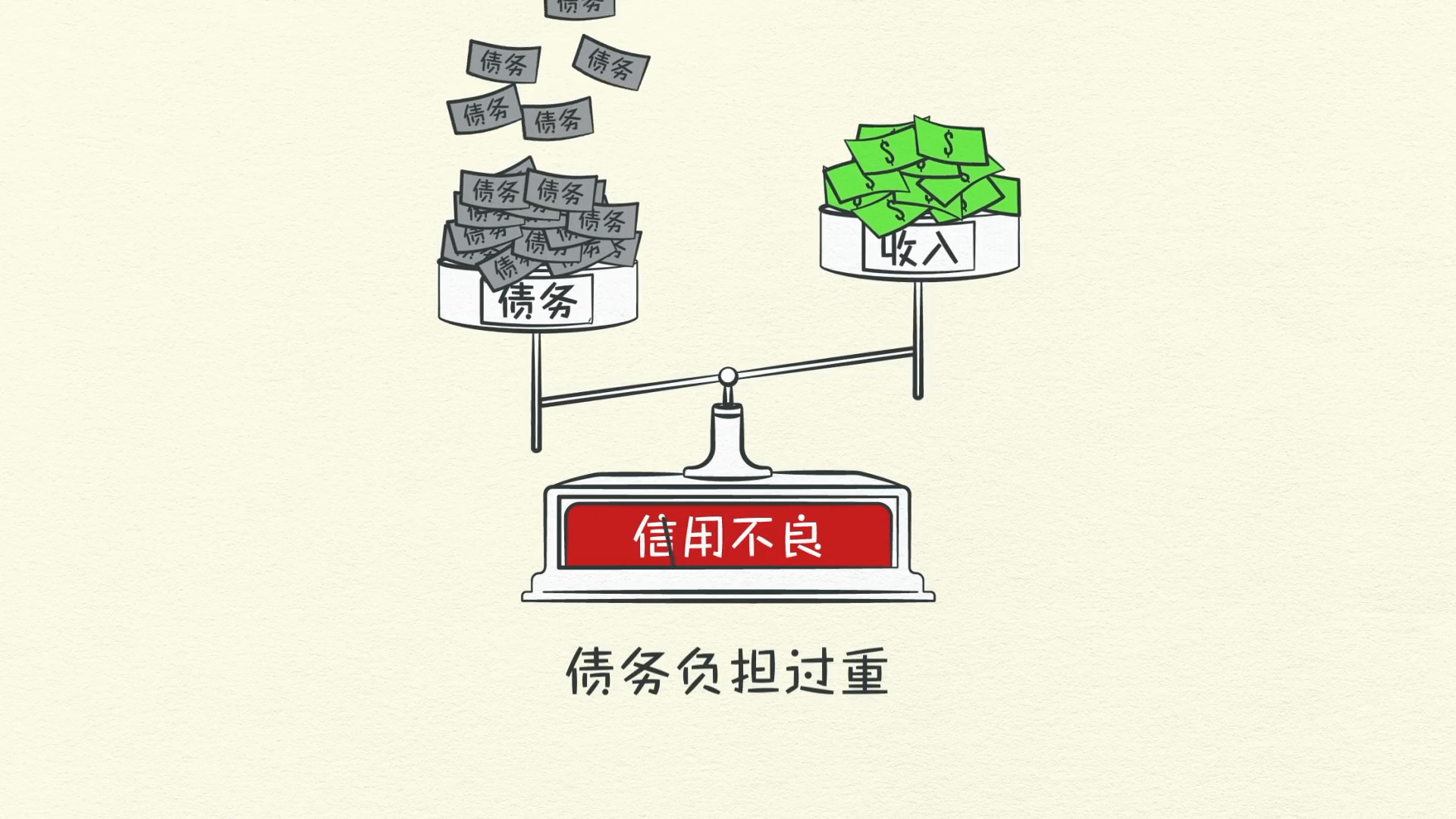

But this obviously cannot continue forever. And it didn’t. Over decades, debt burdens slowly increase creating larger and larger debt repayments. At some point, debt repayments start growing faster than incomes, forcing people to cut back on their spending. And since one person’s spending is another person’s income, incomes begin to go down, which makes people less creditworthy, causing borrowing to go down.

Debt repayments continue to rise, which makes borrowing drop even further. The cycle reverses itself. This is the long-term debt peak. Debt burdens have simply become too big.

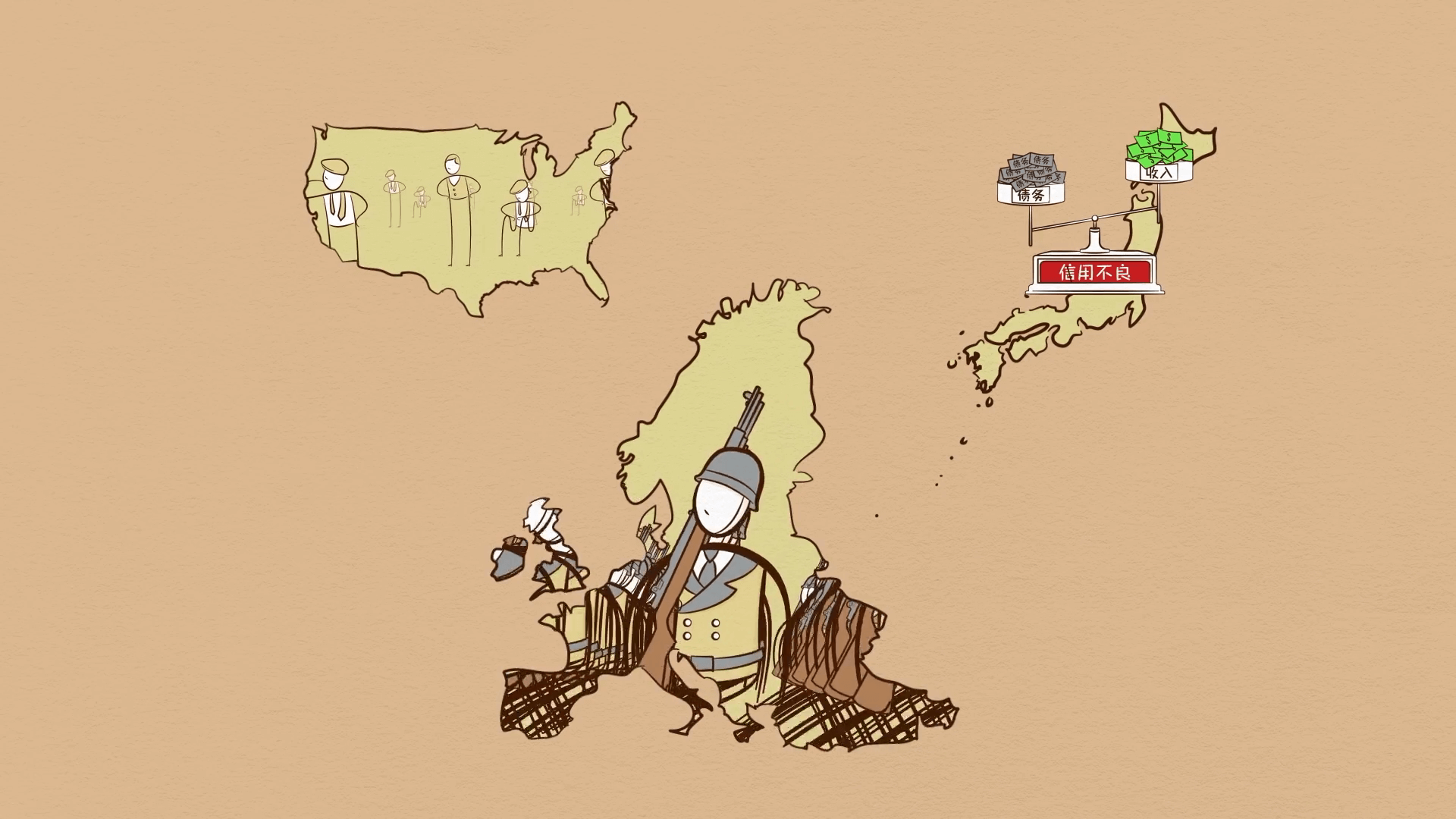

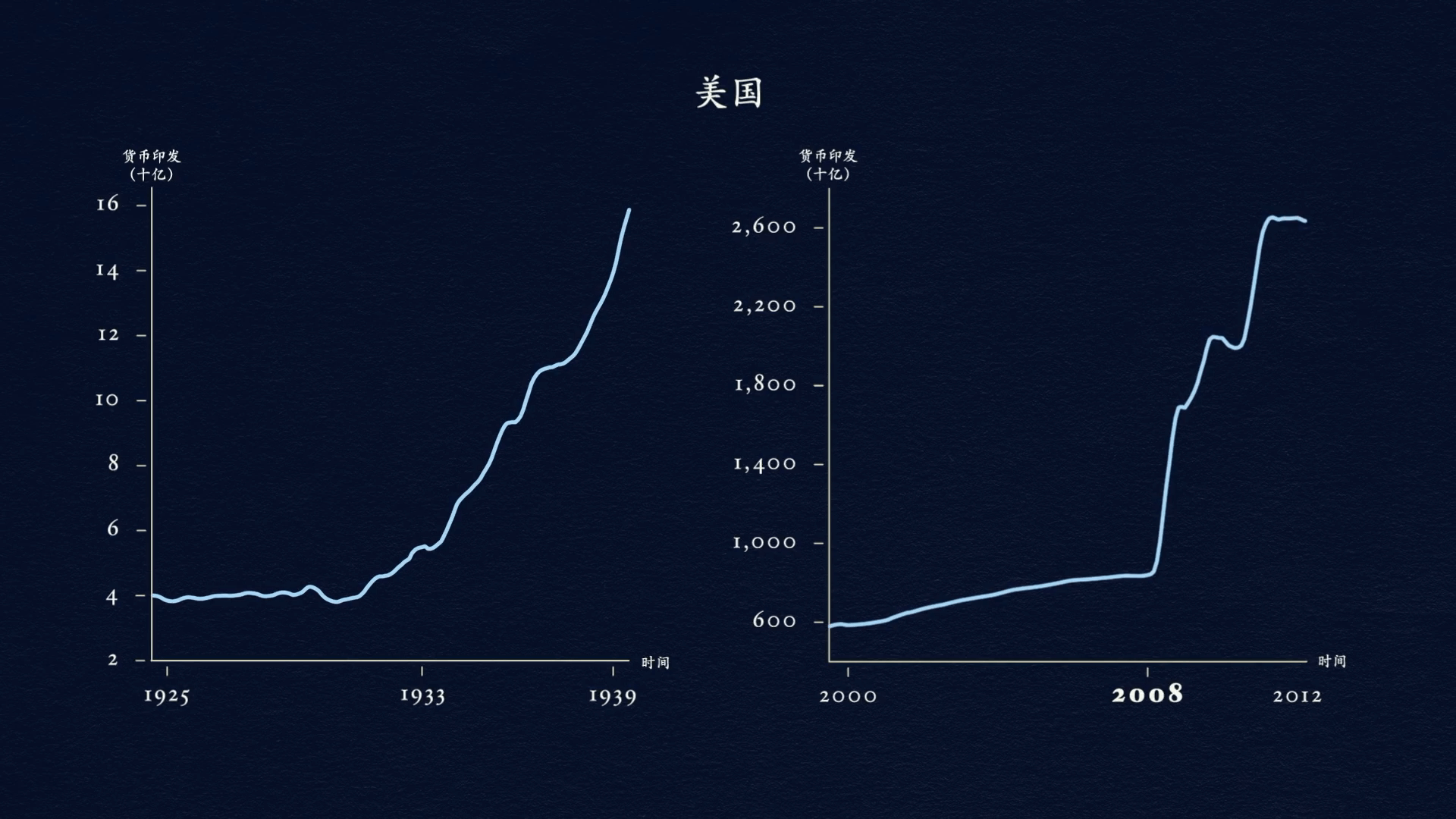

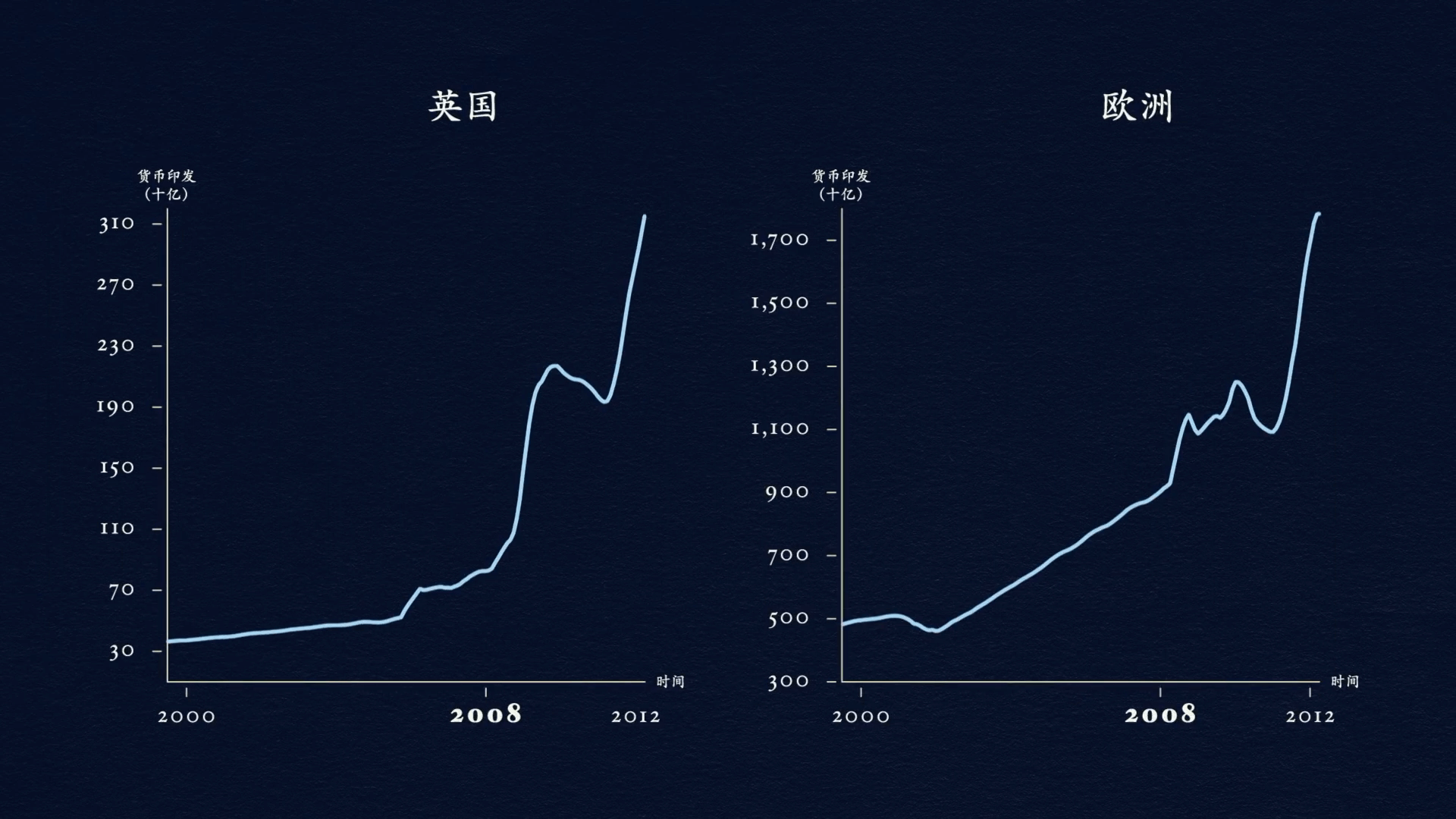

For the United States, Europe and much of the rest of the world this happened in 2008. It happened for the same reason it happened in Japan in 1989 and in the United States in 1929.

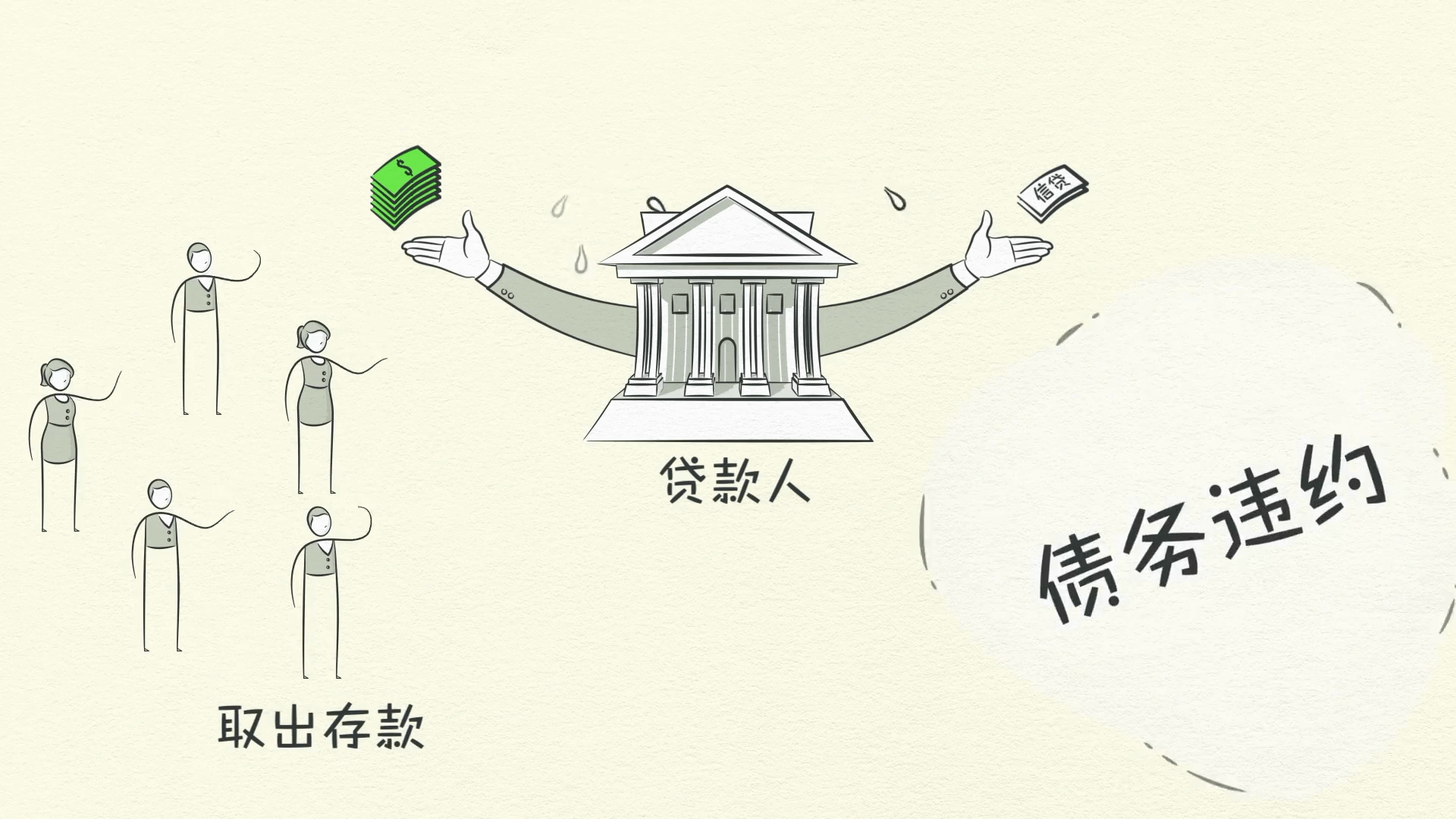

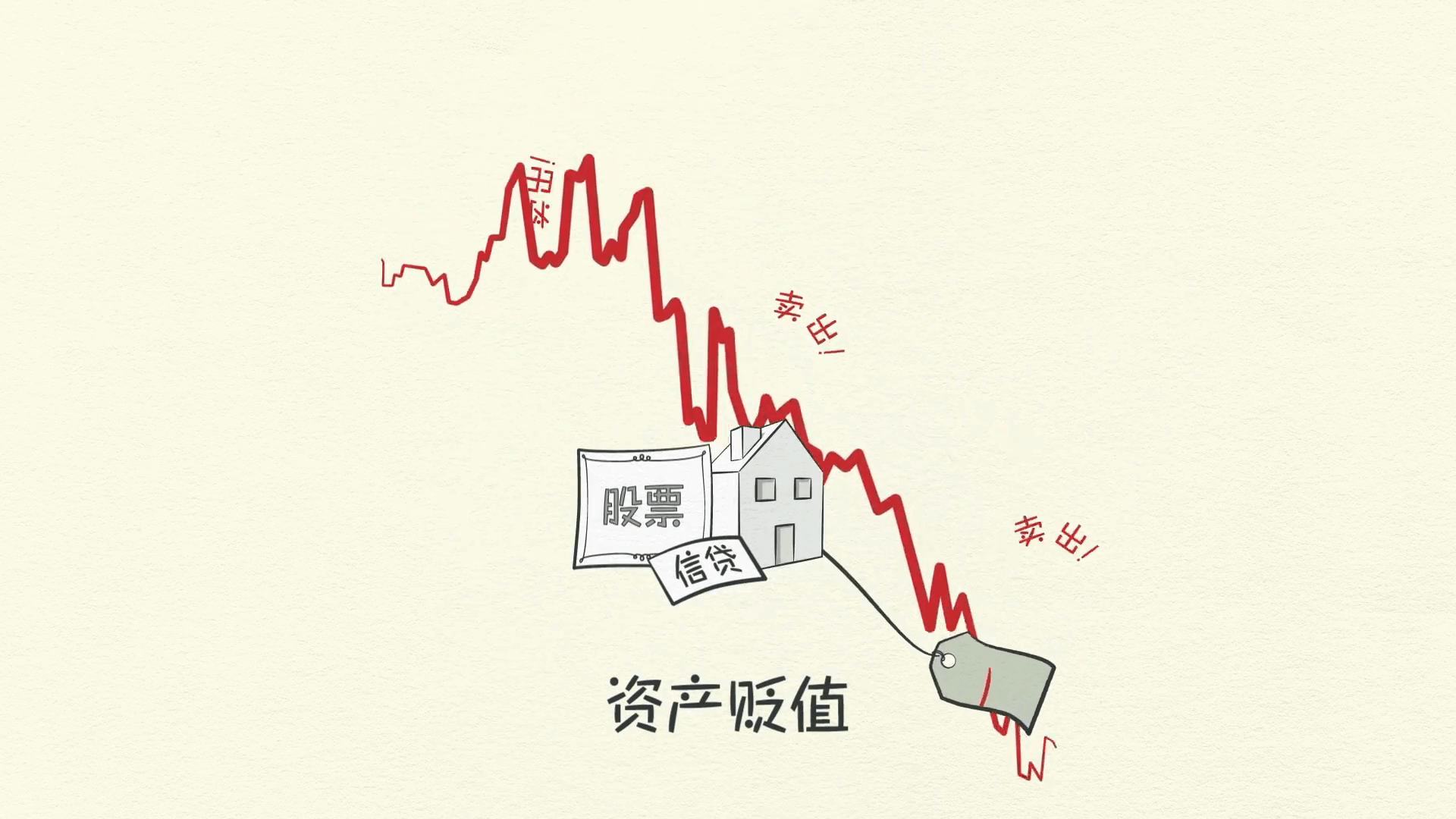

Deleveraging

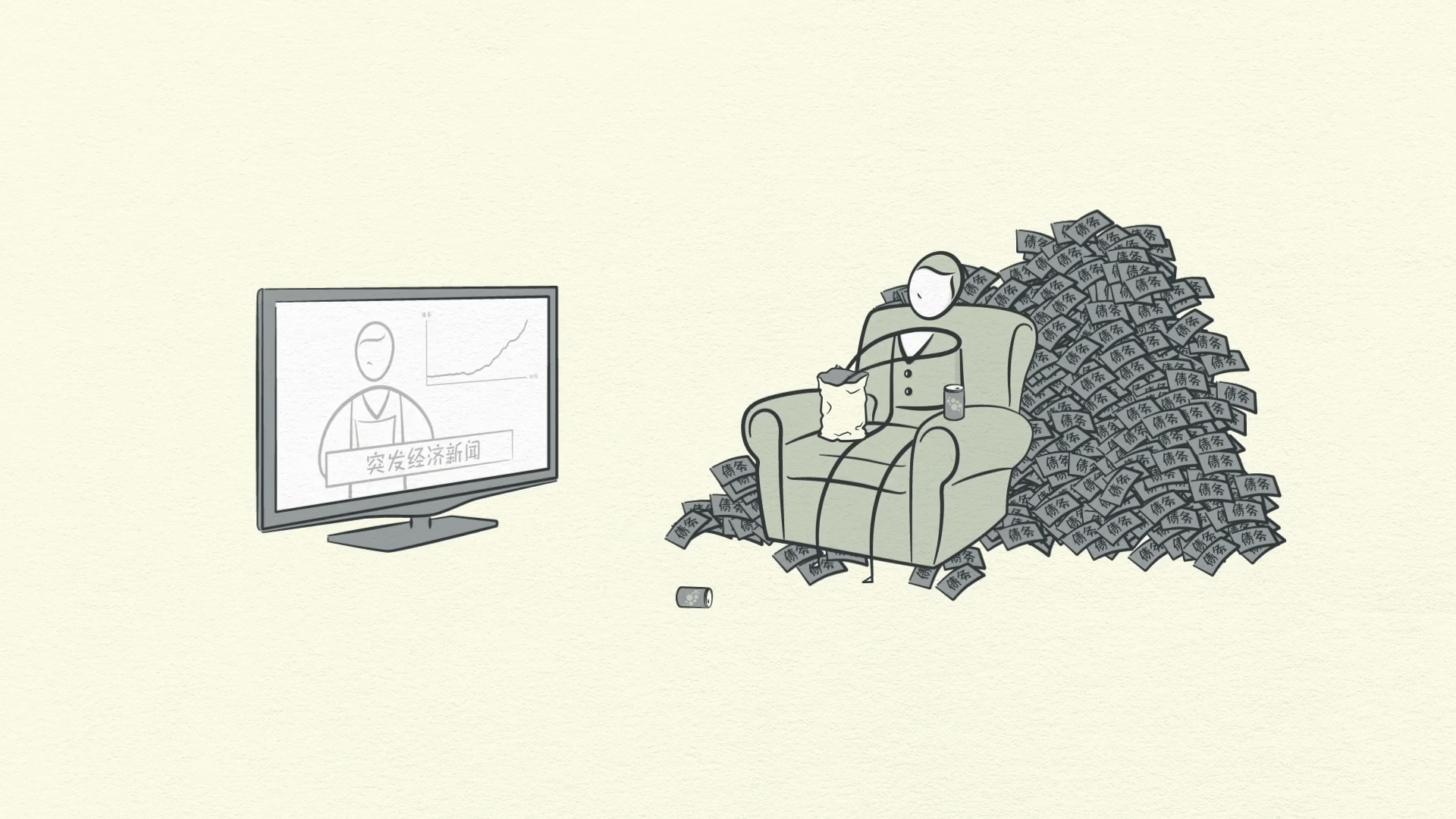

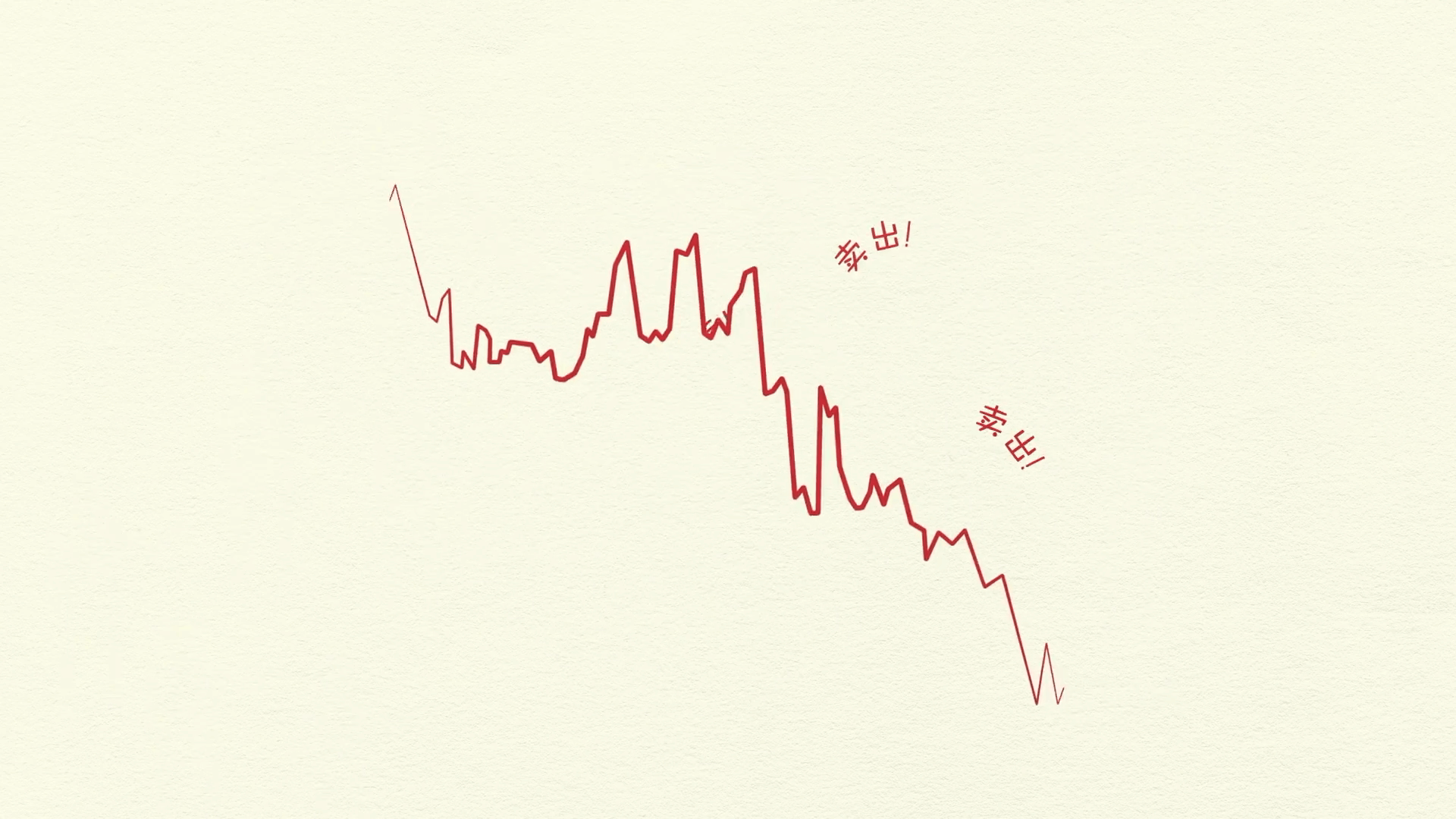

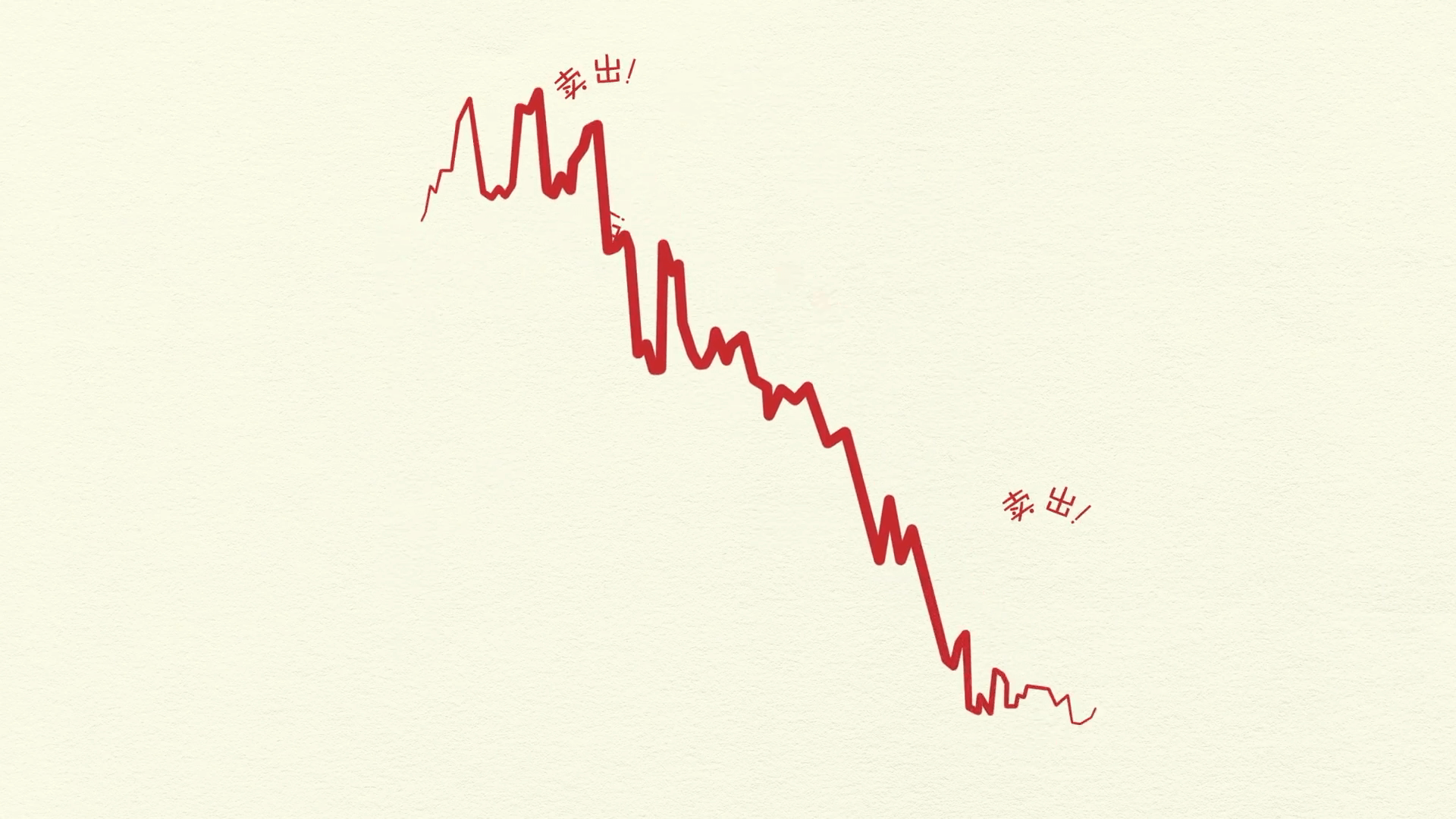

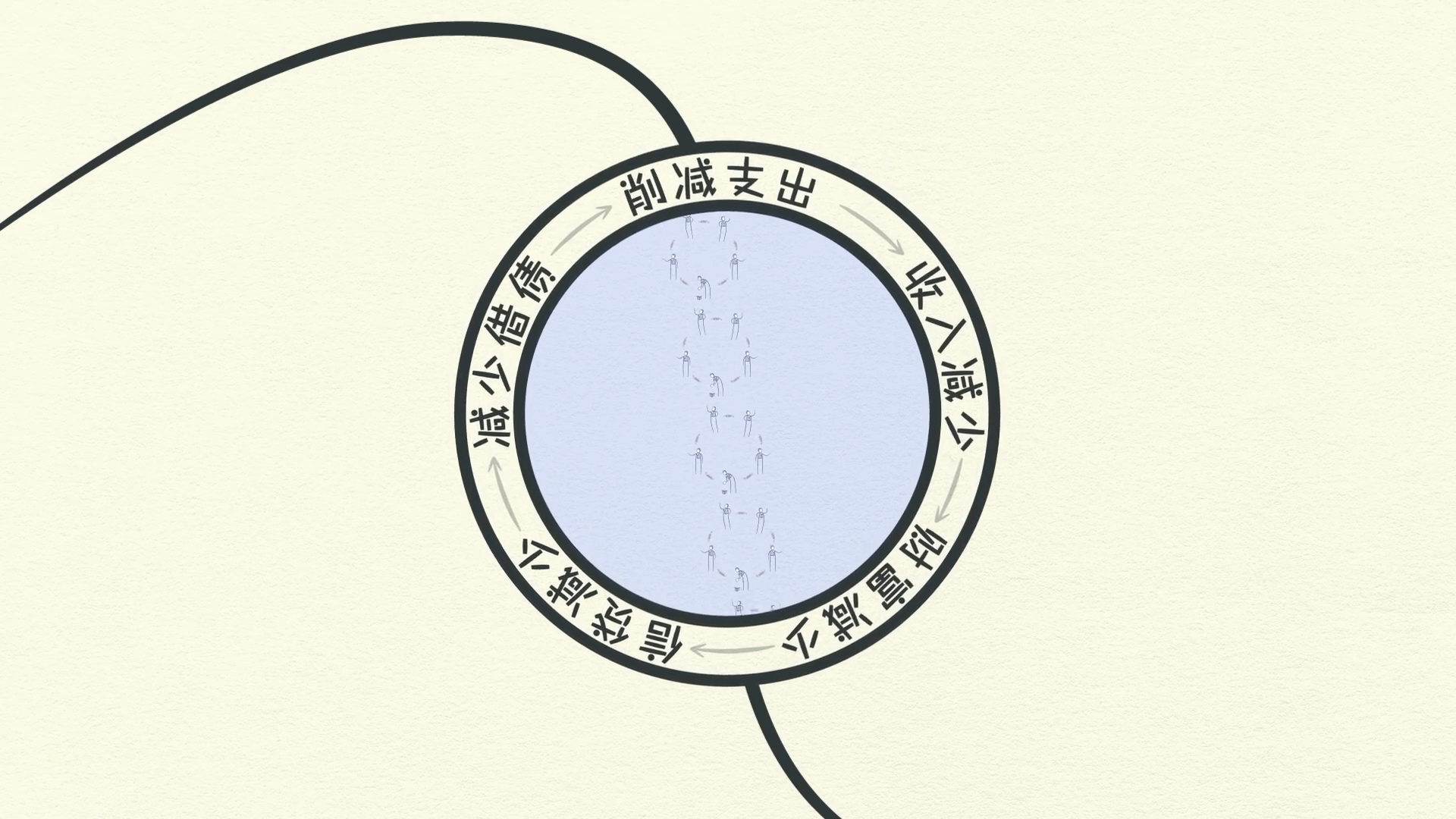

Now the economy begins Deleveraging. In a deleveraging, people cut spending, incomes fall, credit disappears.

Asset prices drop, banks get squeezed, the stock market crashes, social tensions rise.

The whole thing starts to feed on itself the other way. As incomes fall and debt repayments rise, borrowers get squeezed. No longer creditworthy, credit dries up and borrowers can no longer borrow enough money to make their debt repayments. Scrambling to fill this hole, borrowers are forced to sell assets. The rush to sell assets floods the market at the same time as spending falls. This is when the stock market crashes, the real estate market tanks and banks get into trouble.

As asset prices drop, the value of the collateral borrowers can provide drops. This makes borrowers even less creditworthy. People feel poor. Credit rapidly disappears.

Less spending, less income, less wealth, less credit, less borrowing, and so on. It’s a vicious cycle.

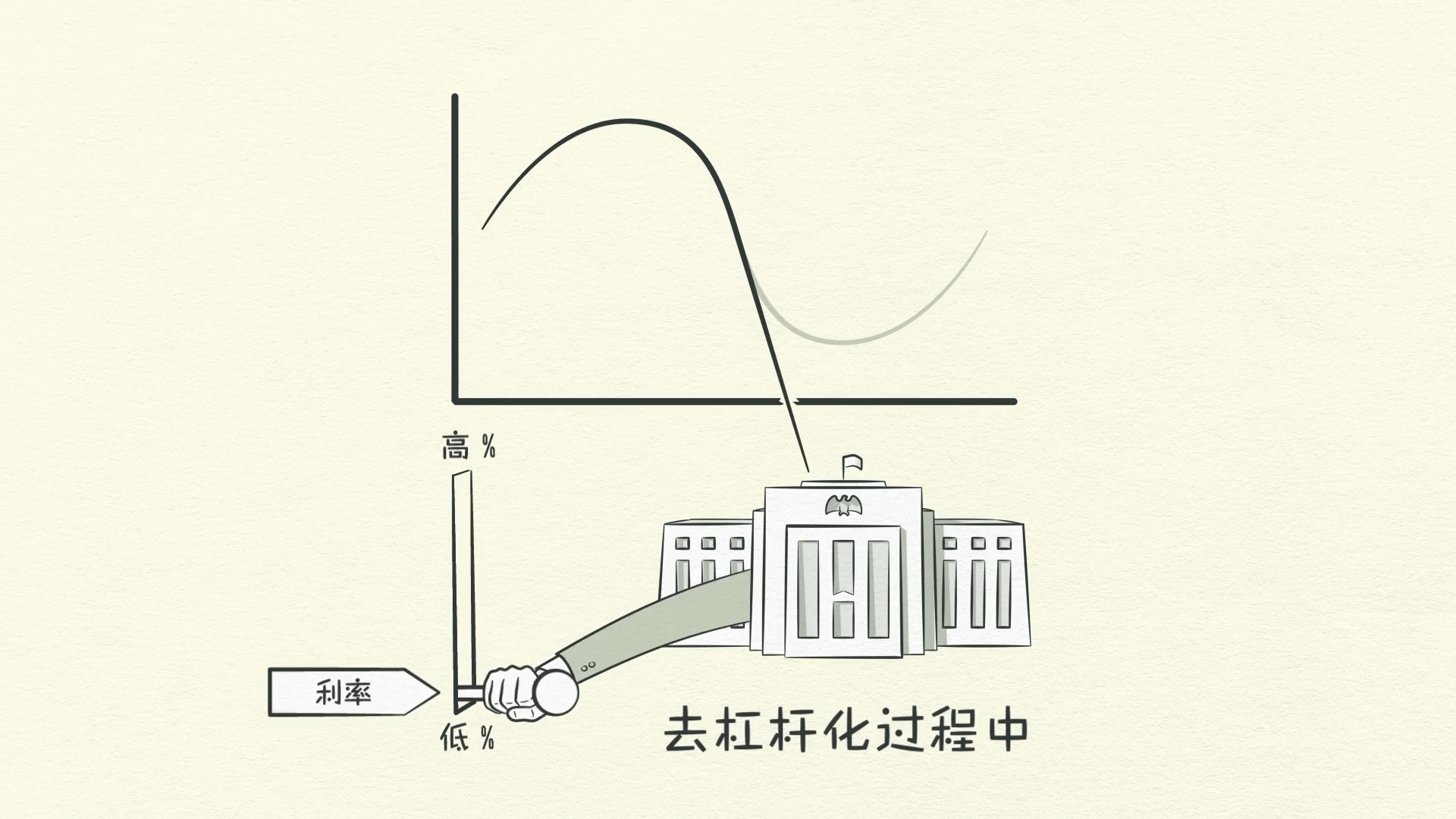

This appears similar to a recession but the difference here is that interest rates can’t be lowered to save the day. In a recession, lowering interest rates works to stimulate borrowing.

However, in a deleveraging lowering interest rates doesn’t work because interest rates are already low and soon hit 0% - so the stimulation ends.

Interest rates in the United States hit 0% during the deleveraging of the 1930s and again in 2008.

The difference between a recession and a deleveraging is that in a deleveraging, borrowers’ debt burdens have simply gotten too big

and can’t be relieved by lowering interest rates. Lenders realize that debts have become too large to ever be fully paid back. Borrowers have lost their ability to repay and their collateral has lost value. They feel crippled by the debt - they don’t even want more!

Lenders stop lending, borrowers stop borrowing. Think of the economy as being not creditworthy, just like an individual.

What Do You Do About a Deleveraging?

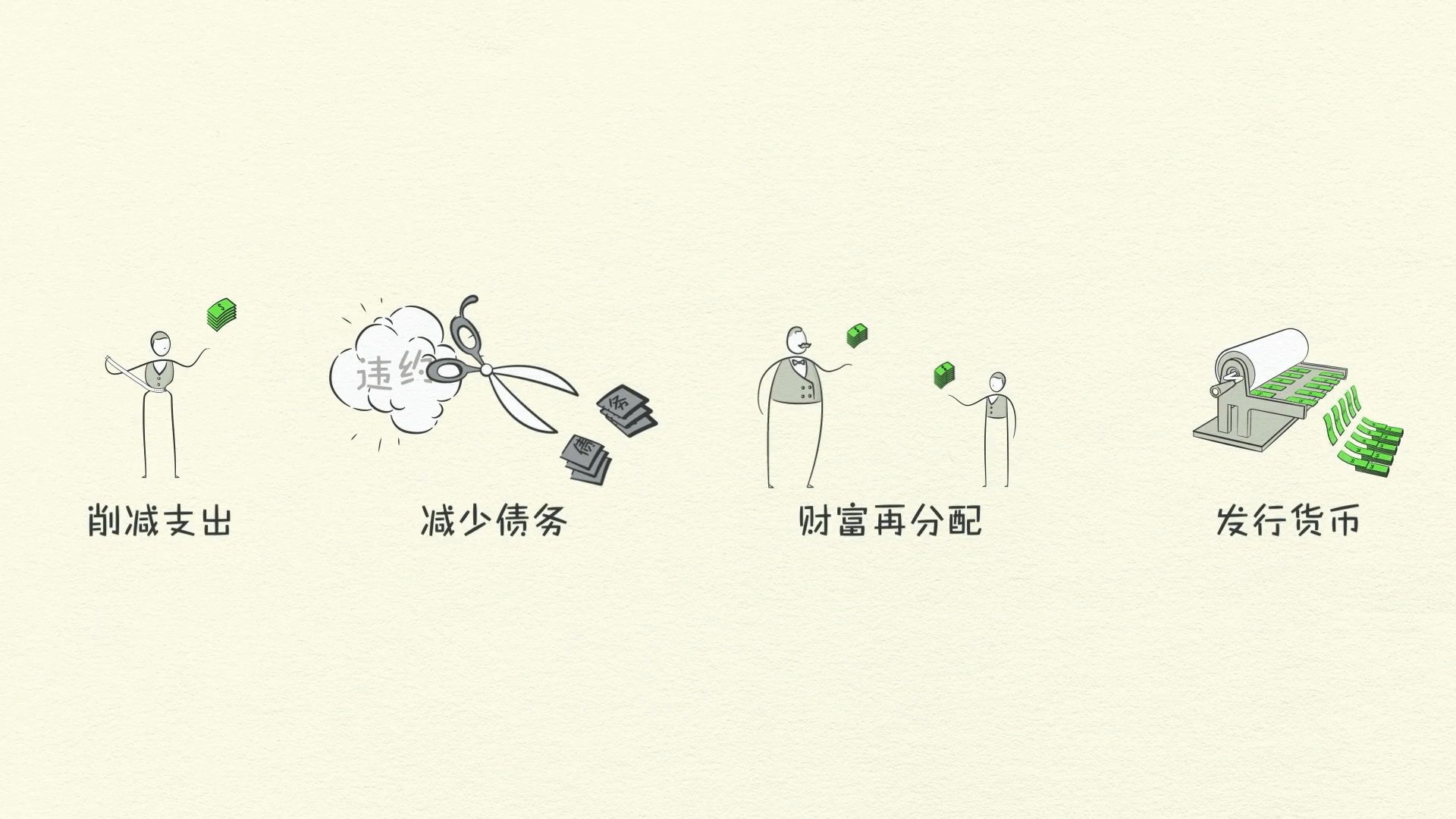

The problem is that debt burdens are too high and must come down. There are four ways this can happen:

- People, businesses, and governments cut their spending.

- Debts are reduced through defaults and restructurings.

- Wealth is redistributed from the ‘haves’ to the ‘have-nots’.

- Finally, the Central Bank prints new money.

These 4 ways have happened in every deleveraging in modern history.

Cutting Spending

Usually, spending cuts happen first.

We just saw that people, businesses, banks, and governments tighten their belts and cut spending so that they can pay down their debt. This is often referred to as austerity. When borrowers stop taking on new debts, and start paying down old debts, you might expect the debt burden to decrease. But the opposite happens! Because spending is cut - and one man’s spending is another man’s income - it causes incomes to fall.

Incomes fall faster than debts are repaid so the debt burden actually gets worse. As we’ve seen, this cut in spending is deflationary and painful.

Businesses are forced to cut costs, which means less jobs and higher unemployment.

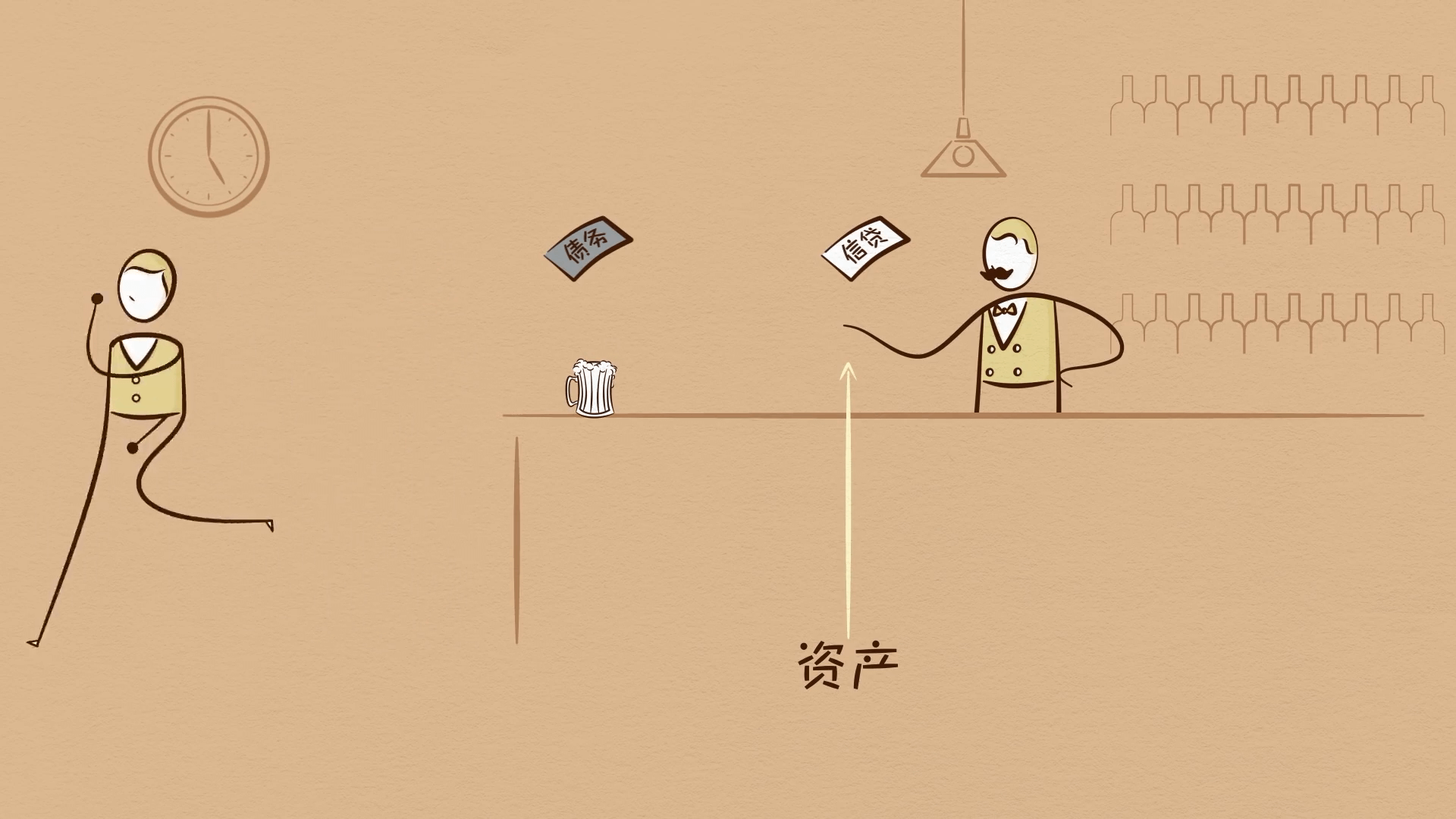

Debt Reduction

This leads to the next step: debts must be reduced! Many borrowers find themselves unable to repay their loans.

And a borrower’s debts are a lender’s assets. When borrowers don’t repay the bank, people get nervous that the bank won’t be able to repay them, so they rush to withdraw their money from the bank. Banks get squeezed and people, businesses, and banks default on their debts.

This severe economic contraction is a depression. A big part of a depression is people discovering that much of what they thought was their wealth isn’t really there.

Let’s go back to the bar. When you bought a beer and put it on a bar tab, you promised to repay the bartender. Your promise became an asset of the bartender.

But if you break your promise, if you don’t pay him back and default on your bar tab, then that “asset” he has isn’t really worth anything. It has essentially disappeared.

Many lenders don’t want their assets to disappear and agree to debt restructuring.

Debt Restructuring

Debt restructuring means lenders get paid back less, or get paid back over a longer timeframe, or at a lower interest rate than was first agreed.

Somehow a contract is broken in a way that reduces debt. Lenders would rather have a little of something than all of nothing.

Even though debt disappears, debt restructuring causes income and asset values to disappear faster, so the debt burden continues to get worse.

Like cutting spending, debt reduction is also painful and deflationary.

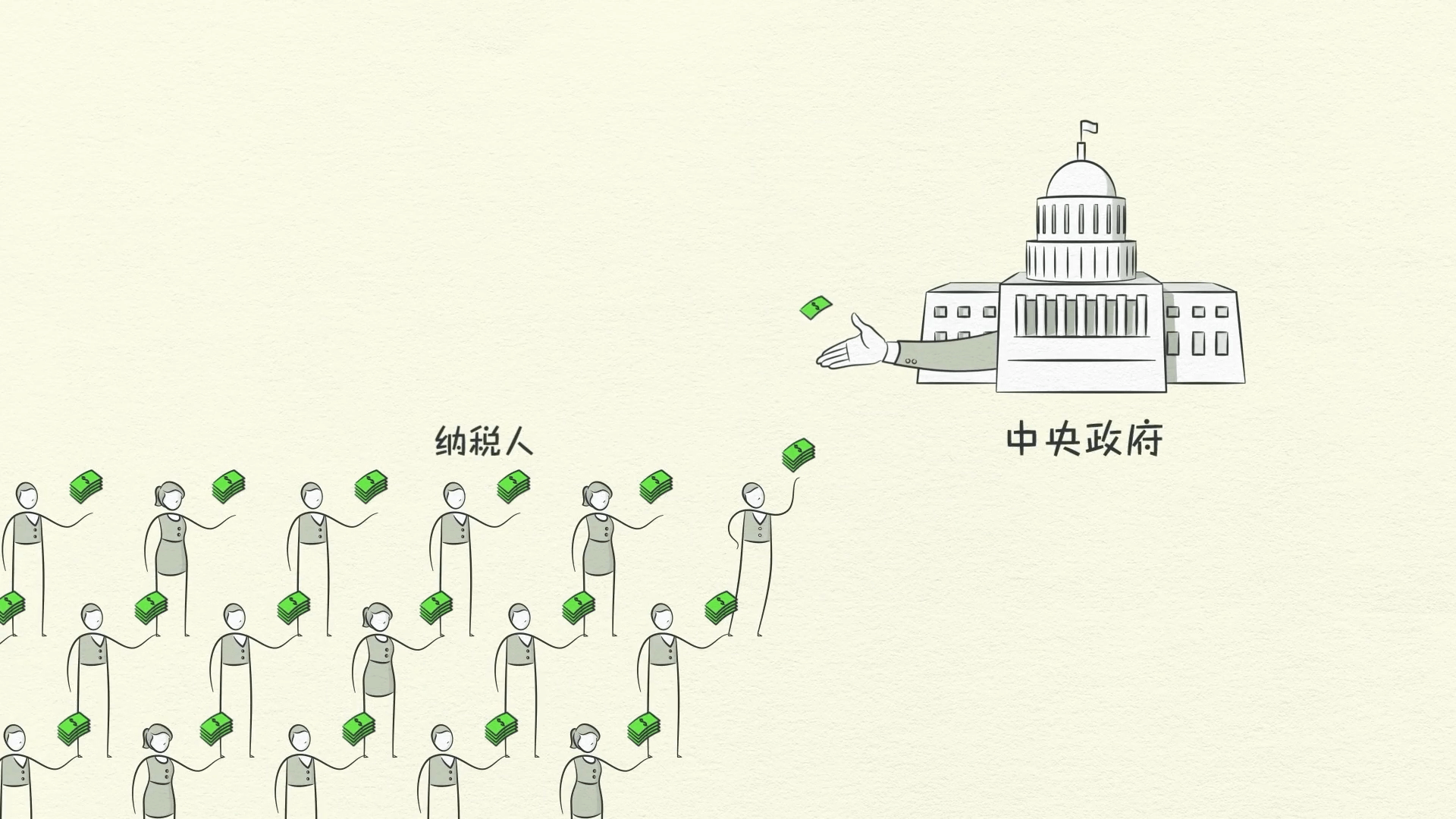

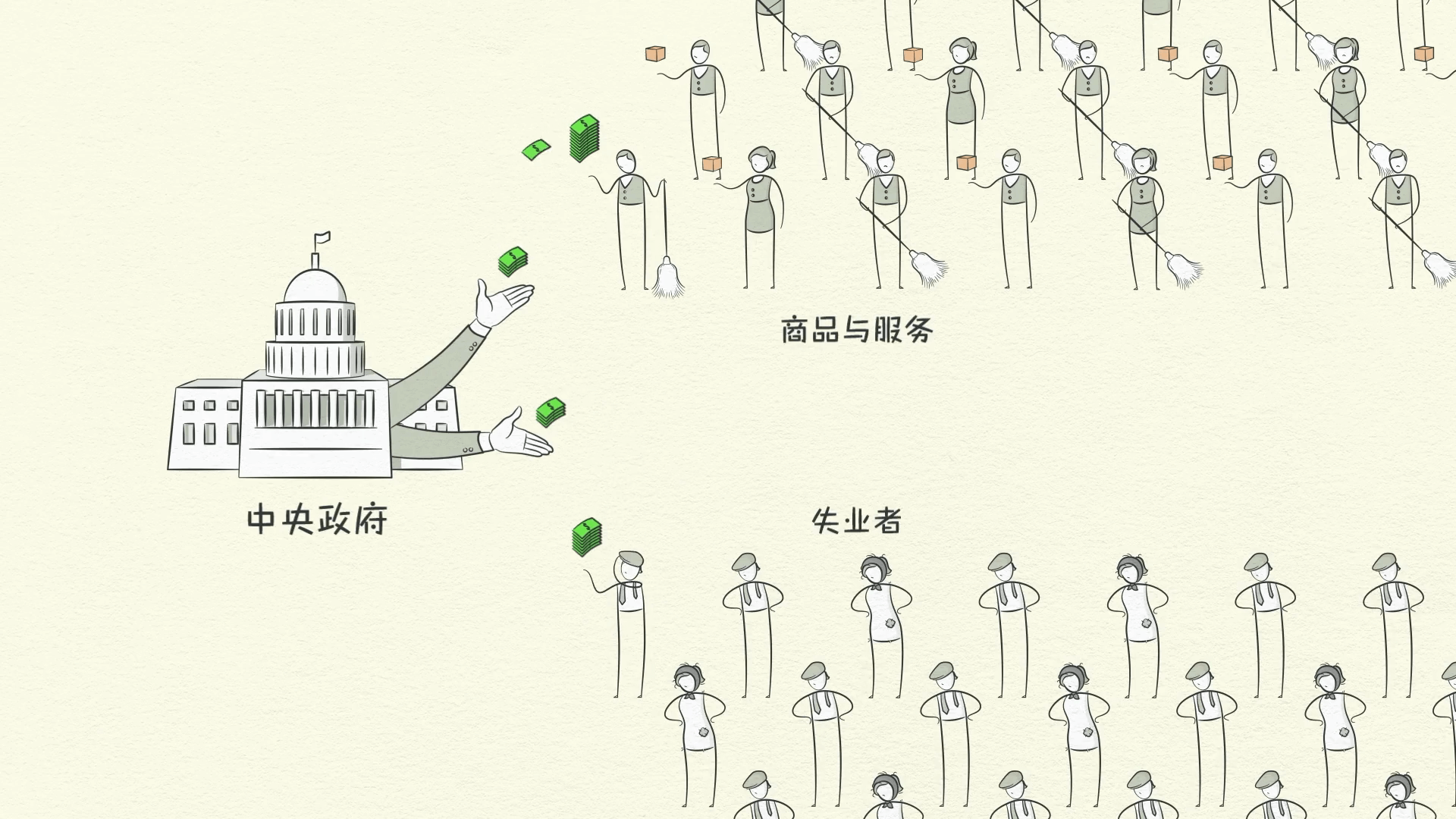

All of this impacts the Central Government because lower incomes and less employment means the government collects fewer taxes.

At the same time it needs to increase its spending because unemployment has risen. Many of the unemployed have inadequate savings and need financial support from the government.

Additionally, governments create stimulus plans and increase their spending to make up for the decrease in the economy.

Governments’ budget deficits explode in a deleveraging because they spend more than they earn in taxes. This is what’s happening when you hear about the budget deficit on the news.

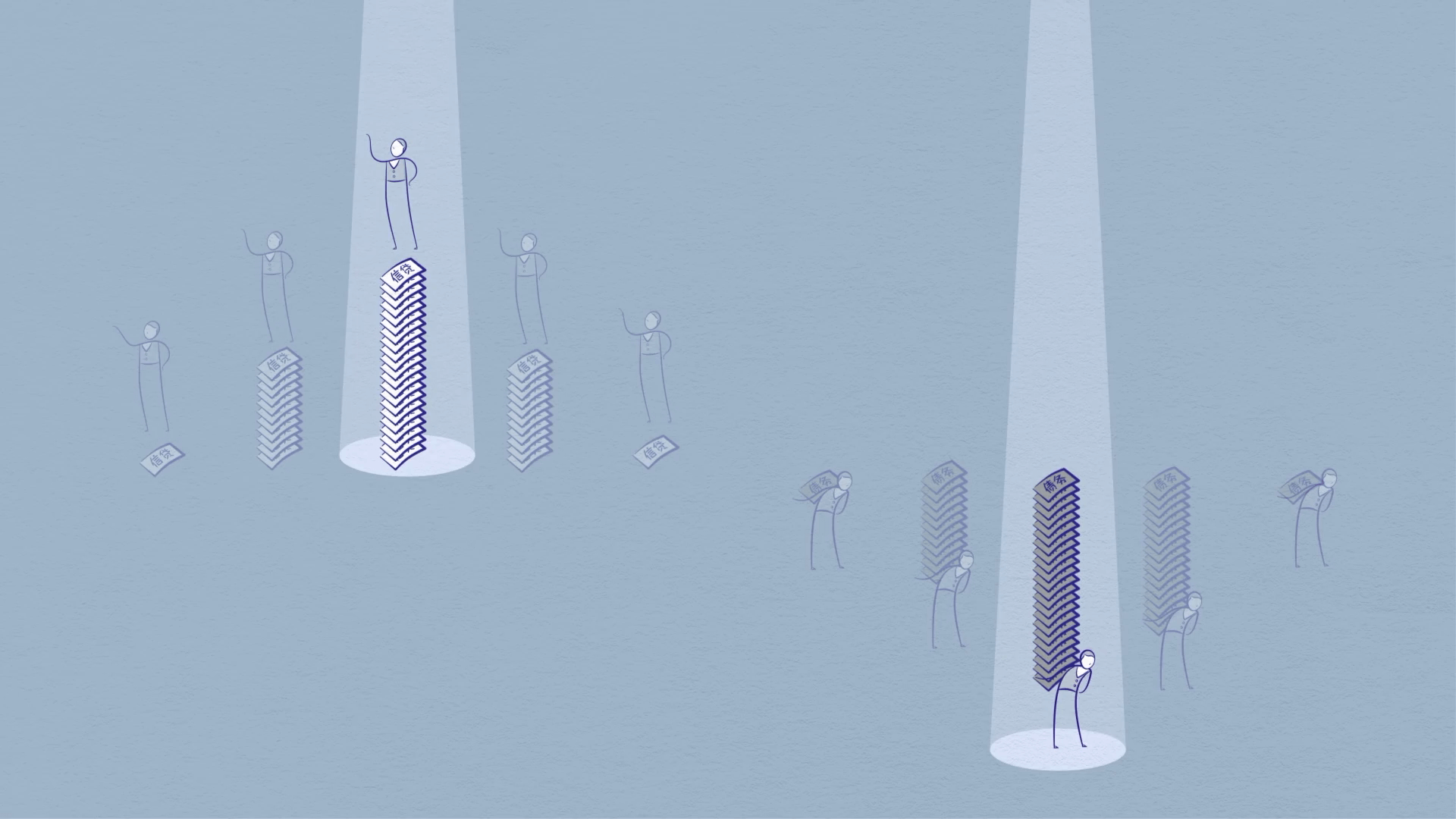

To fund their deficits, governments need to either raise taxes or borrow money. But with incomes falling and so many unemployed, who is the money going to come from? The rich.

Wealth Redistribution

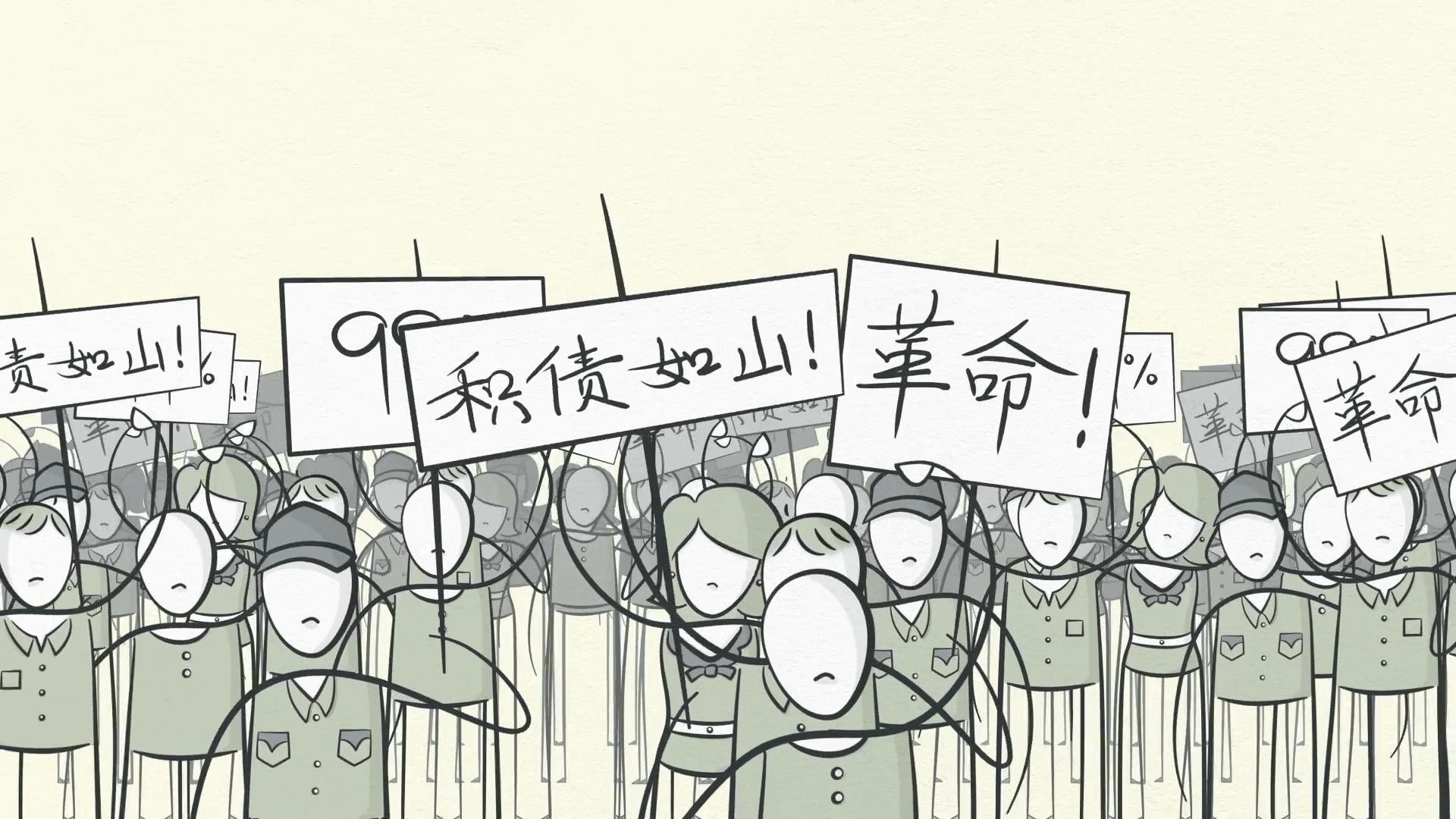

Since governments need more money and since wealth is heavily concentrated in the hands of a small percentage of the people, governments naturally raise taxes on the wealthy which facilitates a redistribution of wealth in the economy.

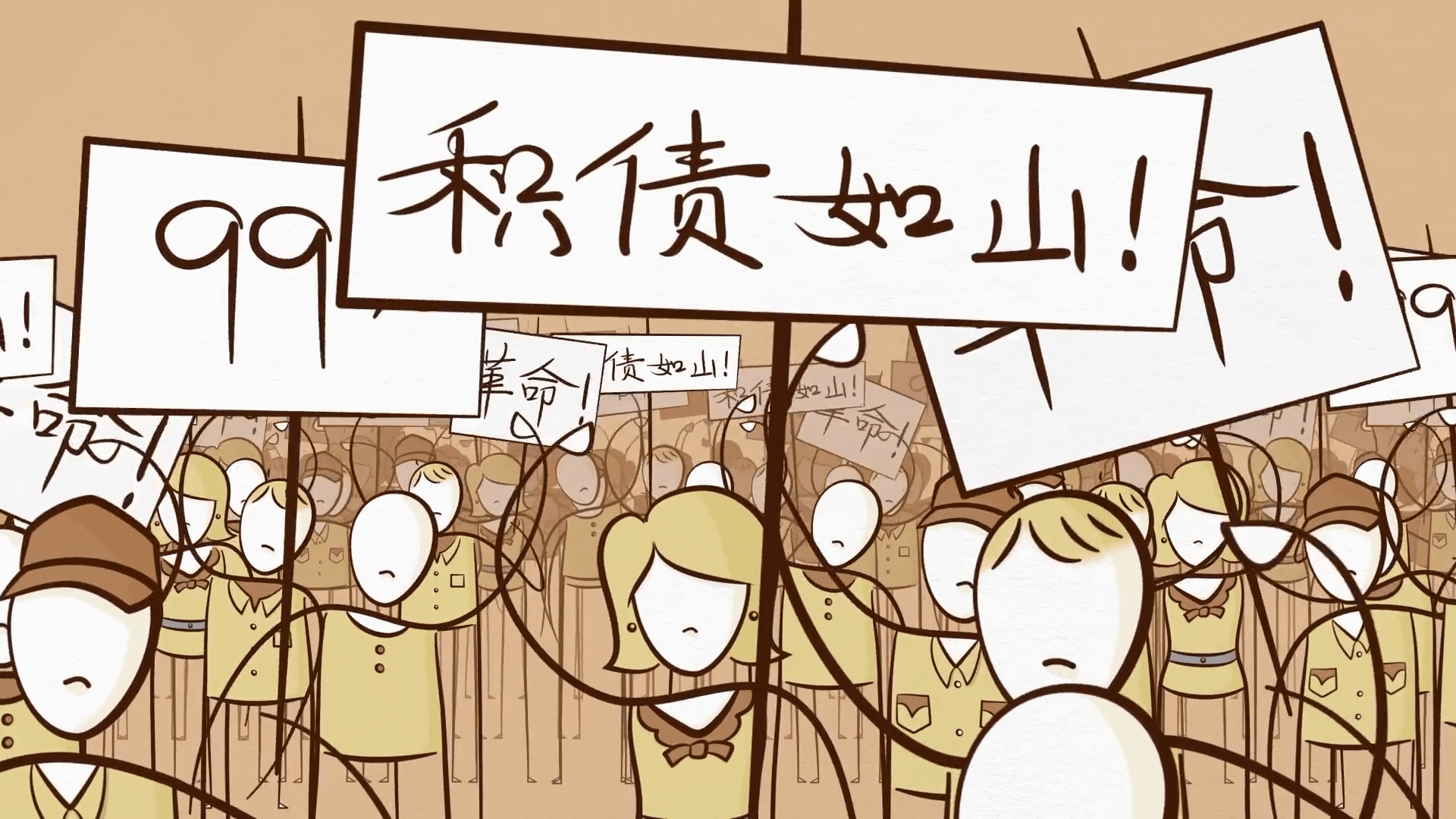

From the ‘haves’ to the ‘have-nots’. The ‘have-nots,’ who are suffering, begin to resent the wealthy ‘haves.’ The wealthy ‘haves,’ being squeezed by the weak economy, falling asset prices, and higher taxes, begin to resent the ‘have-nots.’

If the depression continues, social disorder can break out.

Not only do tensions rise within countries, but they can rise between countries, especially debtor and creditor countries. This situation can lead to political change that can sometimes be extreme. In the 1930s, this led to Hitler coming to power, war in Europe, and depression in the United States.

Pressure to do something to end the depression increases. Remember, most of what people thought was money was actually credit. So when credit disappears, people don’t have enough money.

Printing Money

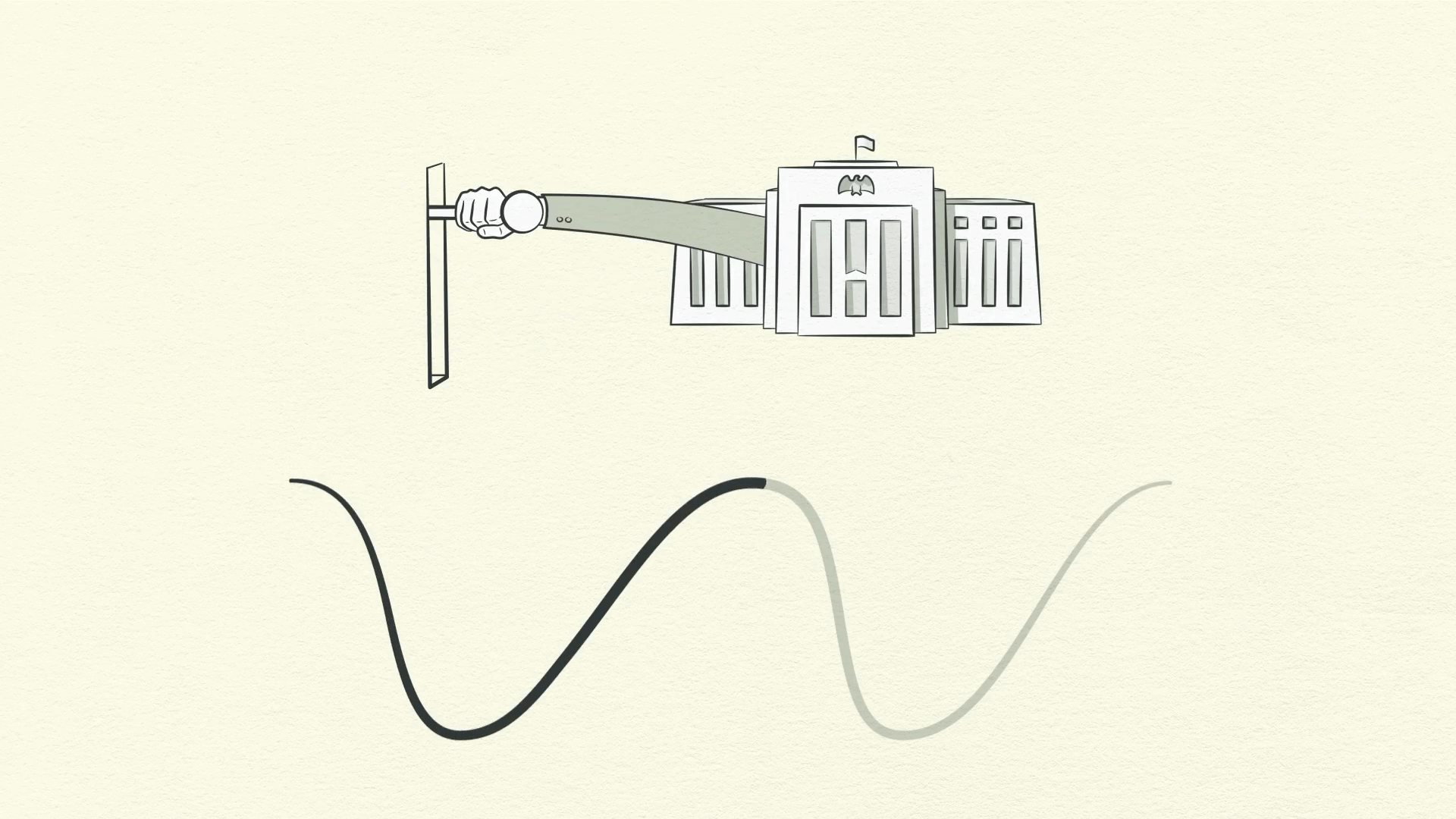

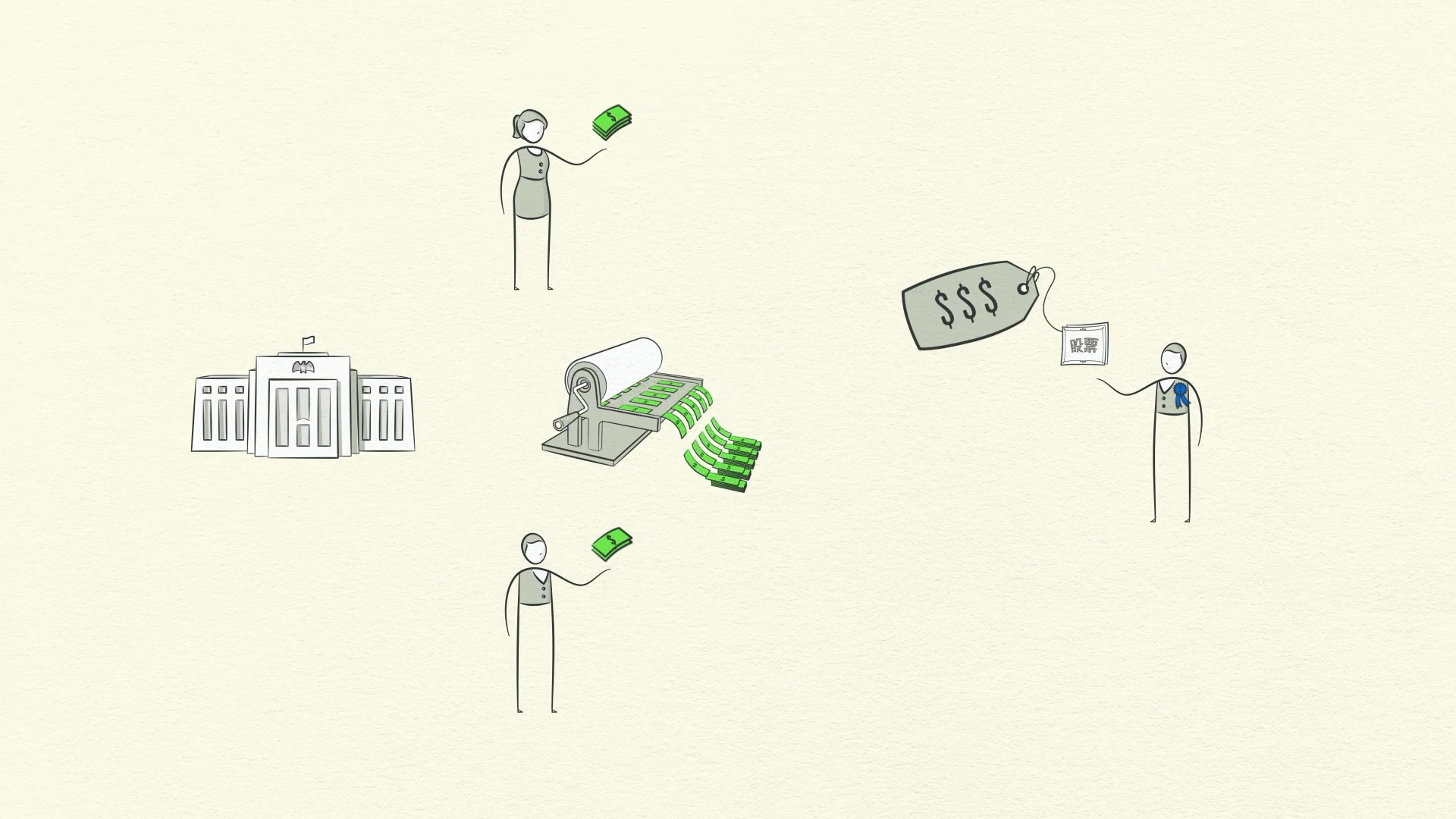

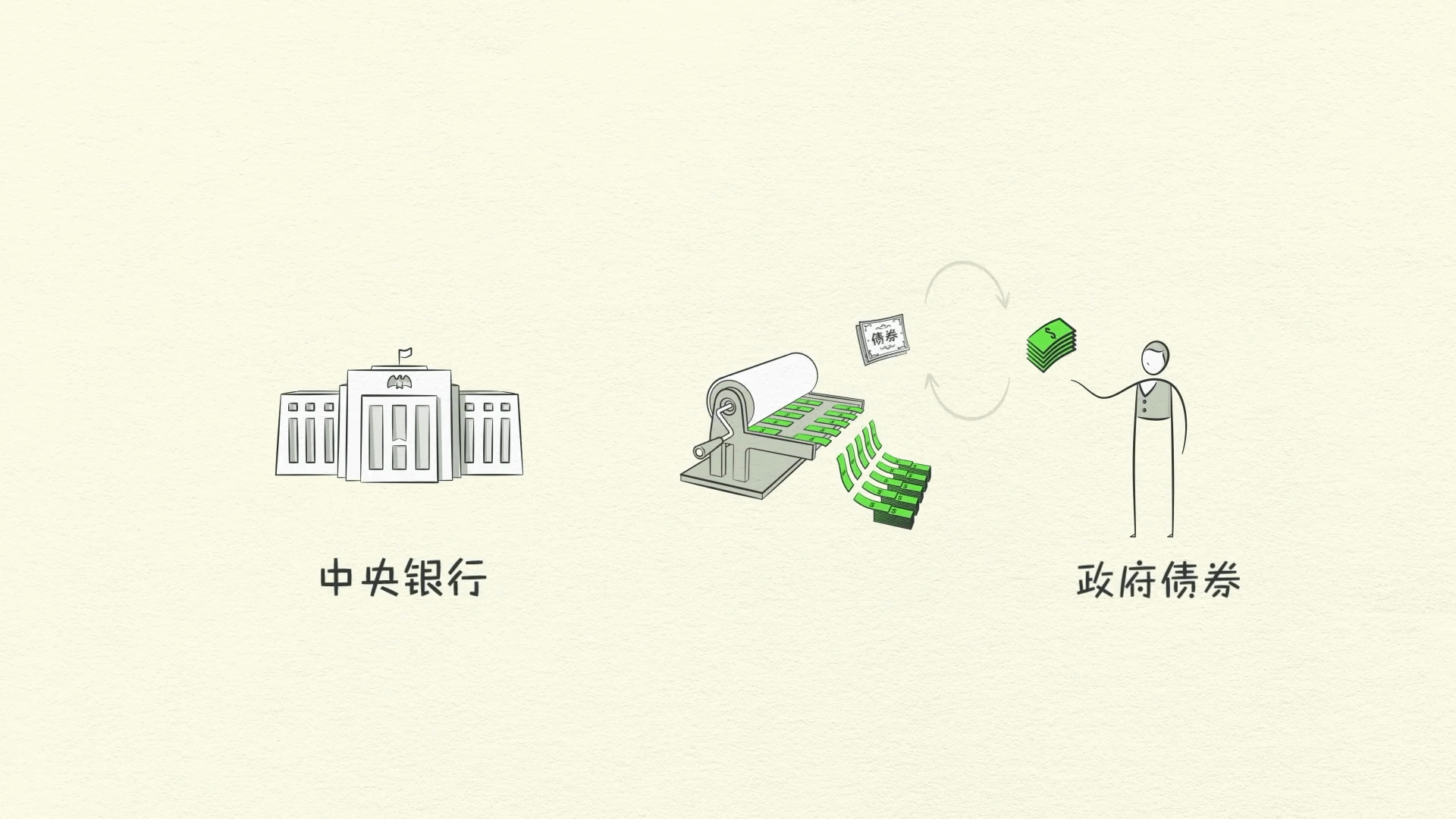

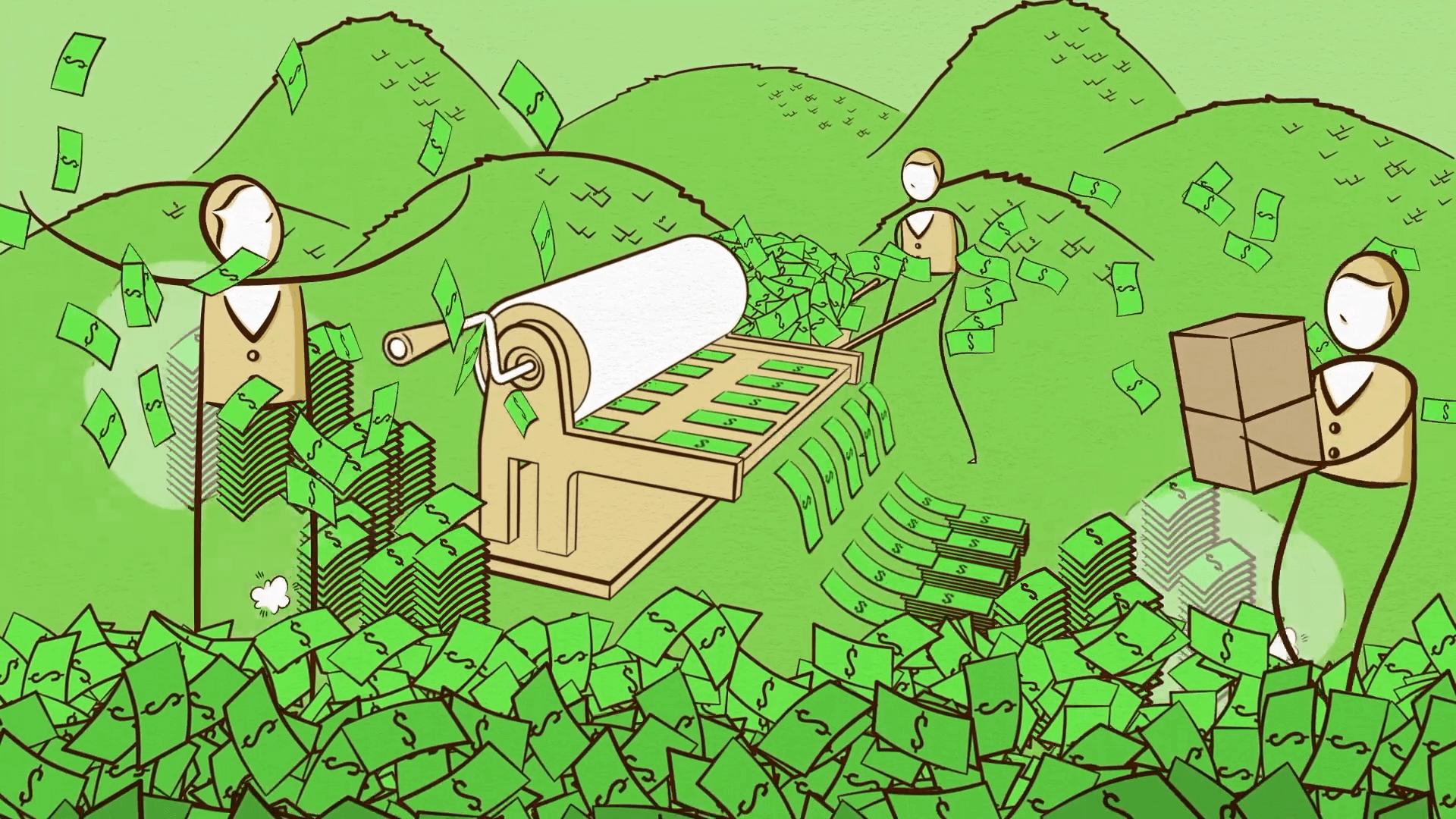

People are desperate for money, and you remember who can print money. The Central Bank can. Having already lowered its interest rates to nearly 0, it’s forced to print money.

Unlike cutting spending, debt reduction, and wealth redistribution, printing money is inflationary and stimulative. Inevitably, the Central Bank prints new money, out of thin air.

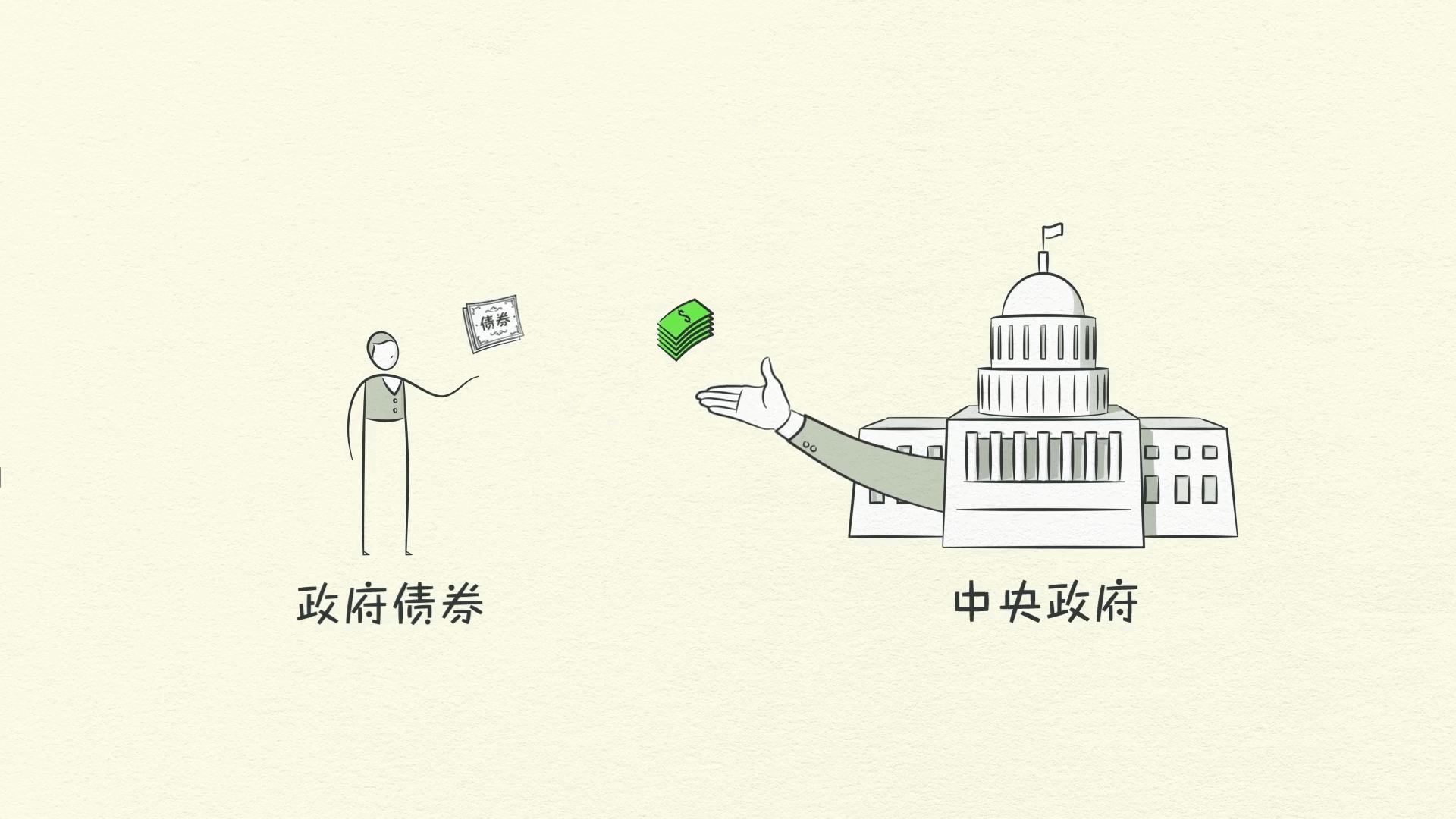

And uses it to buy financial assets and government bonds.

It happened in the United States during the Great Depression, and again in 2008 when the US’s Central Bank, the Federal Reserve, printed over $2 trillion.

Other Central Banks around the world that could, printed a lot of money, too.

By buying financial assets with this money, it helps drive up asset prices, which makes people more creditworthy. However, this only helps those who own financial assets.

You see, the Central Bank can print money, but it can only buy financial assets.

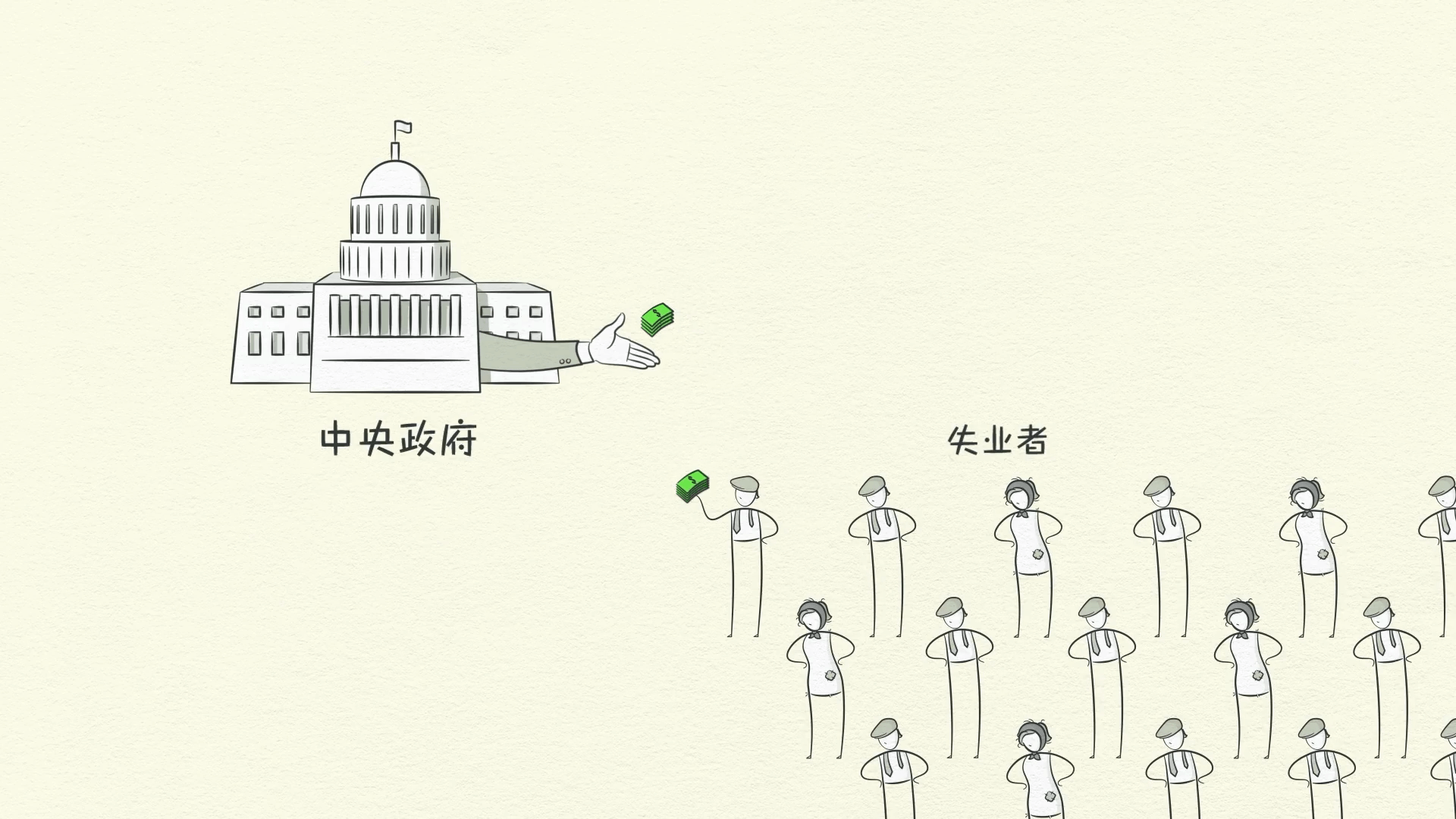

The Central Government, on the other hand, can buy goods and services and put money in the hands of the people, but it can’t print money.

So, in order to stimulate the economy, the two must cooperate. By buying government bonds, the Central Bank effectively lends money to the government, allowing it to run a deficit

and increase spending on goods and services through its stimulus programs and unemployment benefits. This increases people’s income, as well as the government’s debt.

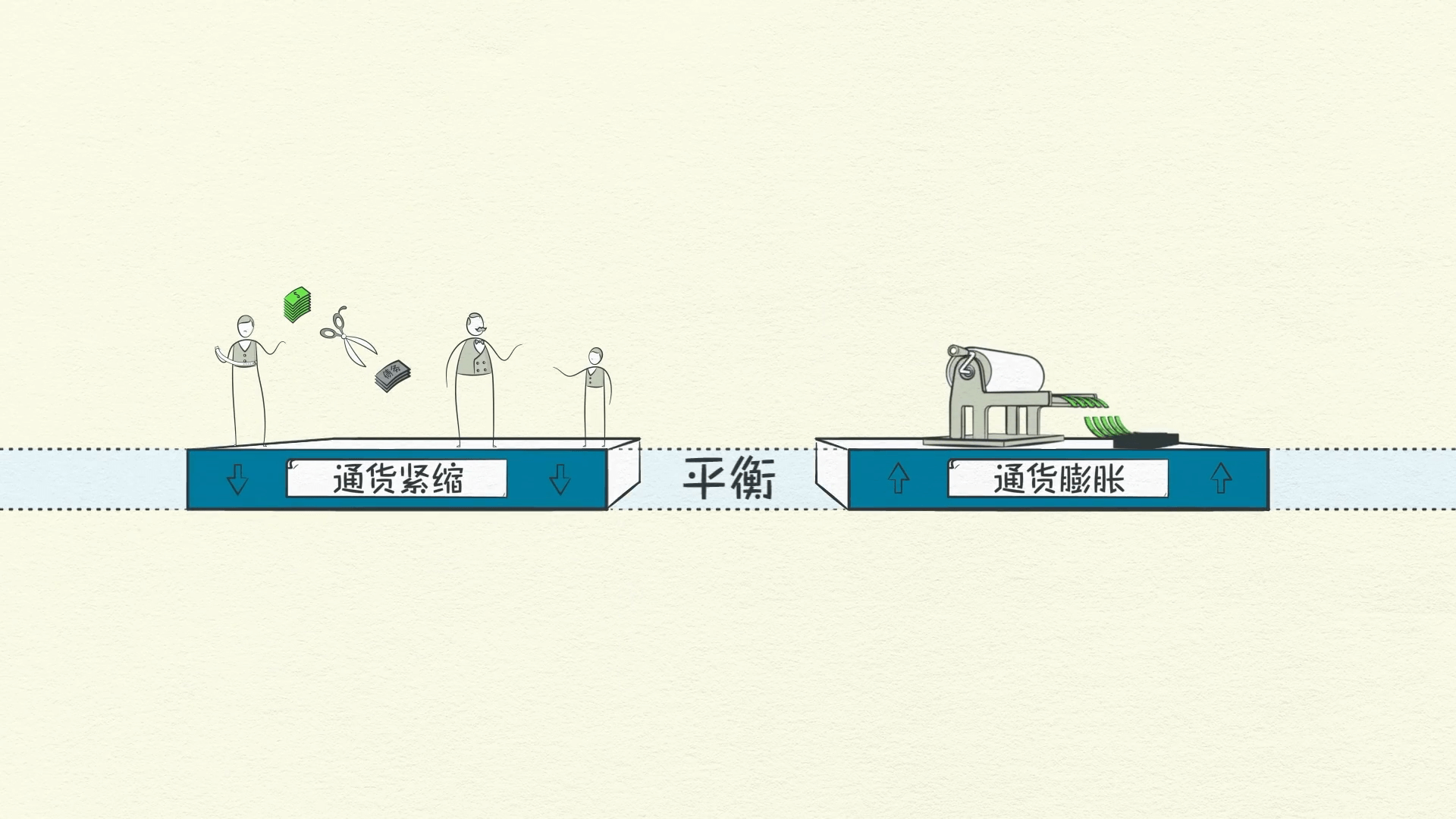

However, it will lower the economy’s total debt burden. This is a very risky time. Policymakers need to balance the four ways that debt burdens come down. The deflationary ways need to balance with the inflationary ways in order to maintain stability.

Beautiful Deleveraging

If balanced correctly, there can be a “Beautiful Deleveraging.”

You see, a deleveraging can be ugly or it can be beautiful. How can a deleveraging be beautiful?

Even though a deleveraging is a difficult situation, handling a difficult situation in the best possible way is beautiful. Much more beautiful than the debt-fueled, unbalanced excesses of the leveraging phase. In a beautiful deleveraging, debts decline relative to income, real economic growth is positive,

and inflation isn’t a problem. It is achieved by having the right balance. The right balance requires a certain mix of cutting spending, reducing debt, transferring wealth, and printing money so that economic and social stability can be maintained.

Will Printing Money Raise Inflation?

People ask if printing money will raise inflation?

It won’t if it offsets falling credit. Remember, spending is what matters. A dollar of spending paid for with money has the same effect on price as a dollar of spending paid for with credit.

By printing money, the Central Bank can make up for the disappearance of credit. In order to turn things around, the Central Bank needs to not only pump up income growth, but get the rate of income growth higher than the rate of interest on the accumulated debt. So what do I mean by that?

Basically, income needs to grow faster than debt grows. For example, let’s assume that a country going through a deleveraging has a debt-to-income ratio of 100%. That means that the amount of debt it has is the same as the amount of income the entire country makes in a year. Now think about the interest rate on that debt, let’s say it’s 2%. If debt is growing at 2% because of that interest rate and income is only growing at around 1%, you will never reduce the debt burden. You need to print enough money to get the rate of income growth above the rate of interest.

However, printing money is easily abused because it’s so easy to do and people prefer it to the alternatives. The key is to avoid printing too much money and causing unacceptably high inflation, the way Germany did during its deleveraging in the 1920s.

If policymakers achieve the right balance, a deleveraging isn’t so dramatic. Growth is slow, but debt burdens go down. That’s a beautiful deleveraging. When incomes begin to rise, borrowers begin to appear more creditworthy. And when borrowers appear more creditworthy, lenders begin to lend money again.

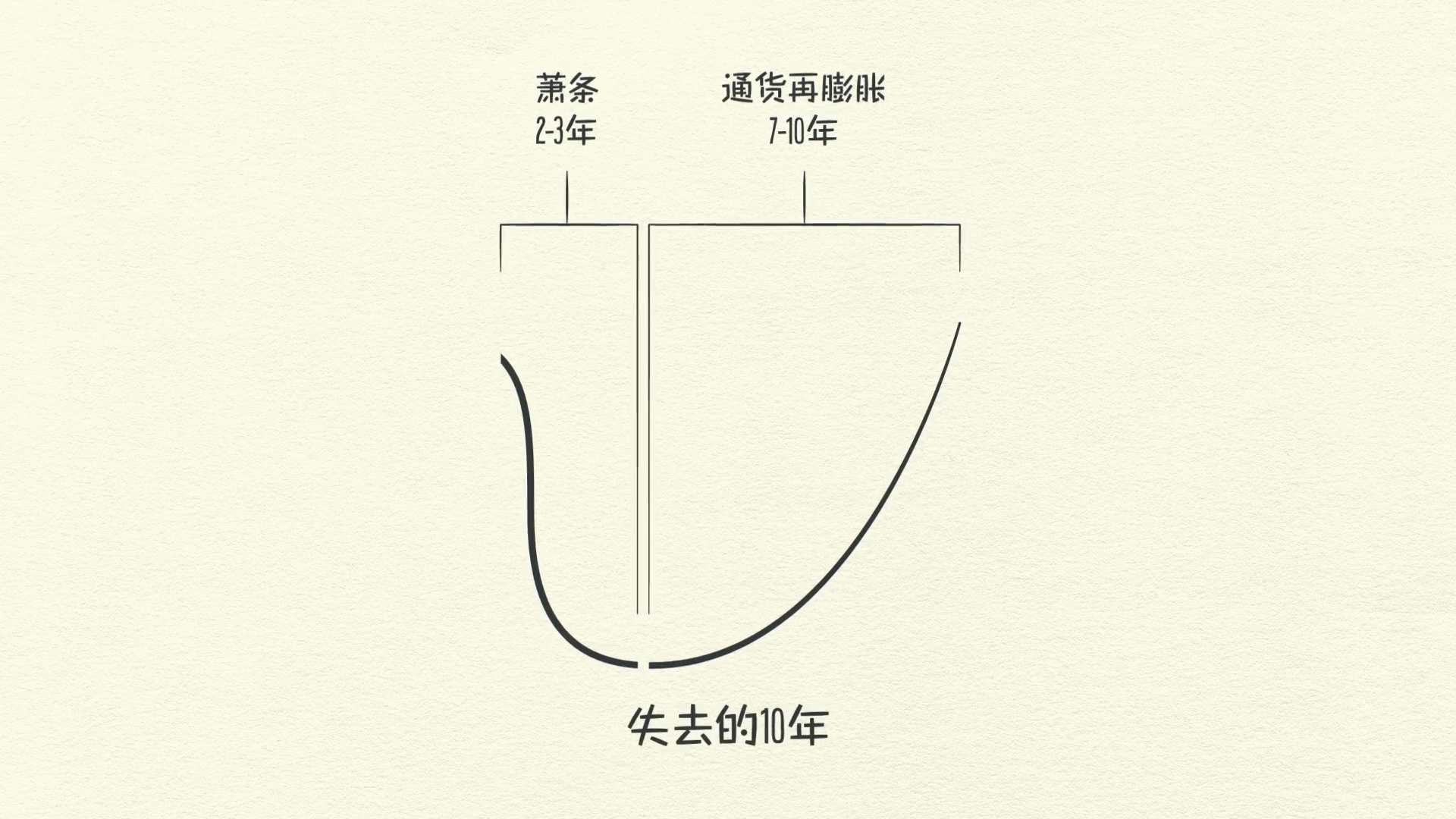

Debt burdens finally begin to fall. Able to borrow money, people can spend more. Eventually, the economy begins to grow again, leading to the reflation phase of the long-term debt cycle. Though the deleveraging process can be horrible if handled badly, if handled well, it will eventually fix the problem.

It takes about a decade or more for debt burdens to fall and economic activity to get back to normal - hence the term “lost decade.”

In conclusion. Of course the economy is a little bit more complicated than this template suggests.

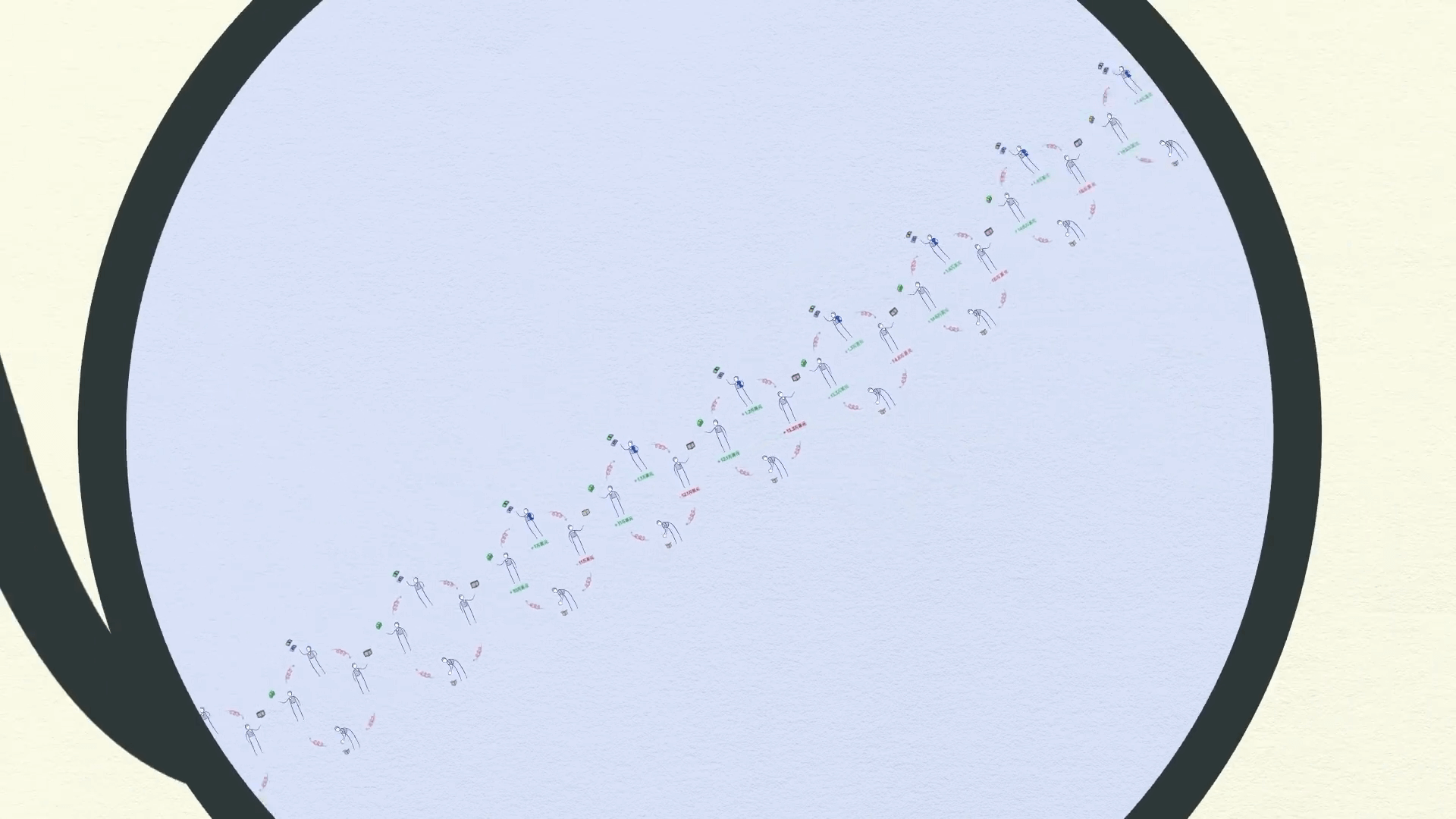

However, laying the short-term debt cycle on top of the long-term debt cycle, and then laying both of them on top of the productivity growth line, gives a reasonably good template for seeing where we’ve been, where we are now, and where we’re probably headed.

Three Rules of Thumb

In summary, there are three rules of thumb that I’d like you to take away from this.

-

Don’t let debt rise faster than income, because your debt burdens will eventually crush you.

-

Don’t let income rise faster than productivity, because you’ll eventually become uncompetitive.

-

Do all that you can to raise your productivity, because in the long run that’s what matters most.

This is simple advice for you and wealthy advice for policymakers. You might be surprised, but most people, including most policymakers, don’t pay enough attention to this.

This template has worked for me, and I hope it will work for you. Thank you.