This article is a transcript of a video, using text and images to record the key information from the original video. For detailed content, please refer to the original video: How is currency created? How much money does the country need to print? The wealth code everyone needs to understand - YouTube

There is a video on the internet like this, this grain of rice represents 100,000 US dollars.

Then this pile of rice represents 1 billion US dollars, a lot, right?

Then the world’s richest man, Bezos, would have this much assets, simply impossible to spend it all.

How is so much money created, on what basis is it distributed, and what exactly are the principles behind this? No one has ever told us.

Currency is the Foundation for a Modern Person to Understand the World

This is exactly what I want to tell you in this video, let’s begin.

In the TV show The Big Bang Theory, there is a funny chain of contempt: theoretical physicists look down on experimental physicists, experimental physicists look down on ordinary scientists, and these scientists all look down on engineers.

Then some economists lamented that if they were written into the script, they would probably be at the very bottom, worse than engineers by 100 ordinary scientists, not even considered human, probably scammers. Why is that?

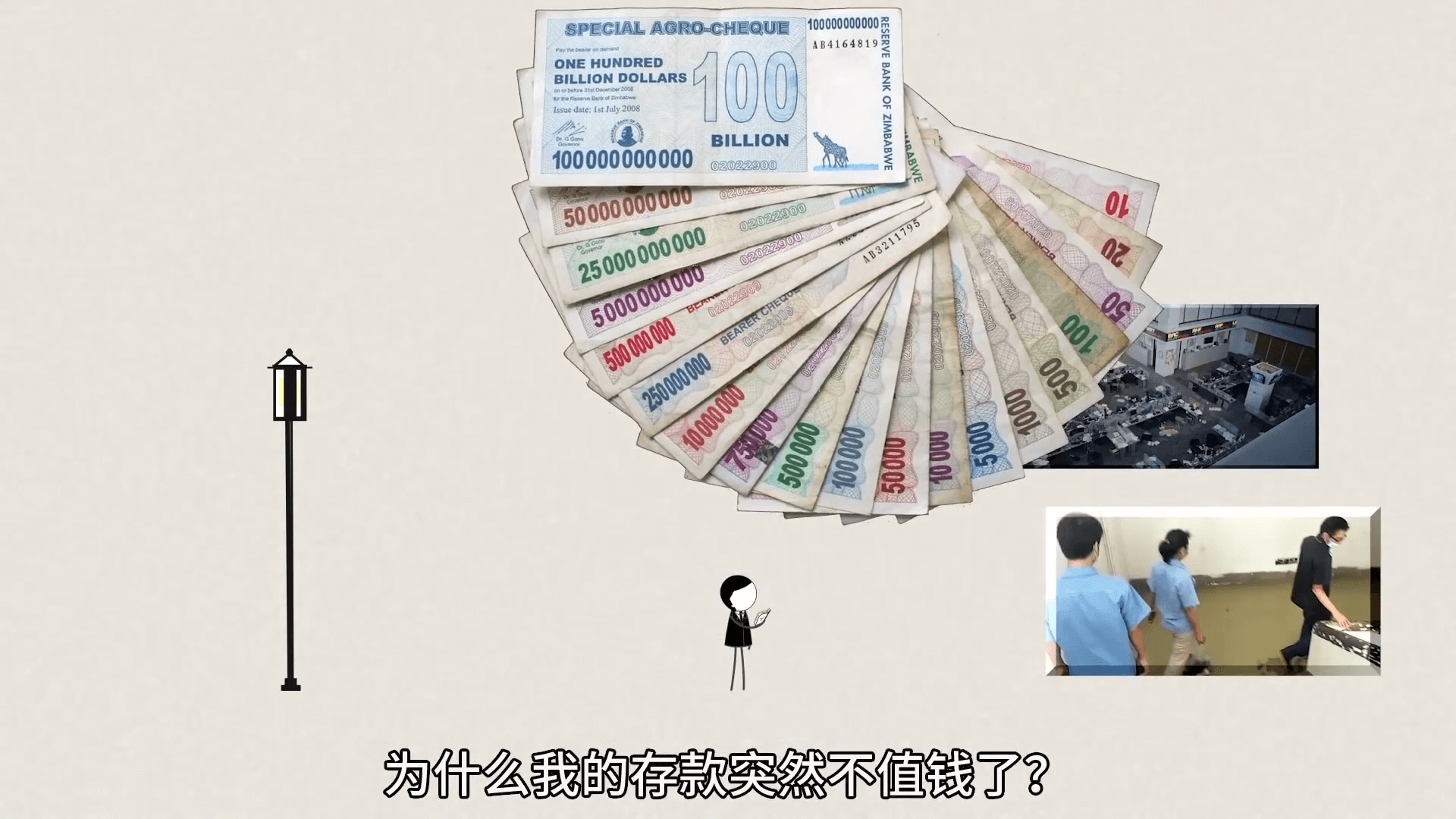

Because economists always make mistakes. Economists are supposed to help people solve economic problems. Why do workers suddenly get laid off on a large scale? Why does a country suddenly fall into recession? Why do my savings suddenly become worthless? These problems plague everyone, even the government, so everyone urgently needs a theory to explain phenomena and solve problems.

But unfortunately, because economic phenomena are extremely complex, when economists try to explain them by proposing simplified models one by one, they always attend to one thing and lose another, and they always contradict each other. Everyone keeps arguing, and the government has to listen to this one for a while and that one for a while based on the actual situation.

There are No Correct Economic Theories, Only Good Economic Theories

The government needs a good economics to deal with the current market, and our people also need a good economics to help themselves understand this industrial society operating mechanism controlled by capital, and to seek advantages and avoid disadvantages in market activities to earn more money.

Please note that this series of economics videos comes from my personal understanding of the market and economy over the years. It may not belong exclusively to a specific theory, but it is useful for my own understanding of economic phenomena. In expression, I will try my best to pursue simplicity and zero threshold.

And after finishing the basic economic principles in the first episode, let’s use this as a foundation to understand the things about Sino-US trade, which will be much smoother.

Let’s start.

The Truth About Currency

Little Ji is a fisherman, he can catch one fish every day, and Little De is a hunter, he can only catch a deer every three days.

If Little Ji and Little De are both smart people, then they will judge the value of fish and deer according to the amount of labor, and thus reach a transaction in the way of exchanging three fish for one deer. In this case, Little Ji and Little De can eat fish and deer at the same time, life is beautiful, long live transactions.

At the same time, if Little Ji and Little De trust each other in their subsequent lives, then they can focus on their own hunting memories. Little Ji, who is good at fishing, will find every fish nest in the river, from one fish a day to three fish a day.

And Little De, who is good at catching deer, will be familiar with the range of activities of each deer herd, from one deer every three days to one deer a day.

In this way, although the transaction method of fish and deer is still three fish for one deer, Little Ji and Little De can both go from being half full to eating until they are stuffed and lying on the ground basking in the sun telling stories, and so love happened.

The above process is called productivity improvement brought about by division of labor, and the most primitive happiness of human society comes from this.

At the same time, you may notice that I just mentioned a premise, that is, Little Ji and Little De trust each other. This is very important because trust is the cornerstone of the division of labor. Every change in human society is accompanied by the reconstruction of social trust relationships.

For example, in the Stone Age, trust relationships were based on tribes. The tribal chief said, listen to me, whoever doesn’t follow the rules, I will beat him to death. So the division of labor unfolded in the tribe. I fish, you build houses, he farms, his friend fights, we four are a happy family.

In the Middle Ages, trust relationships were based on the country. The king said, listen to me, whoever doesn’t follow the rules, I will put him in jail. So the division of labor expanded to the boundaries of the territory.

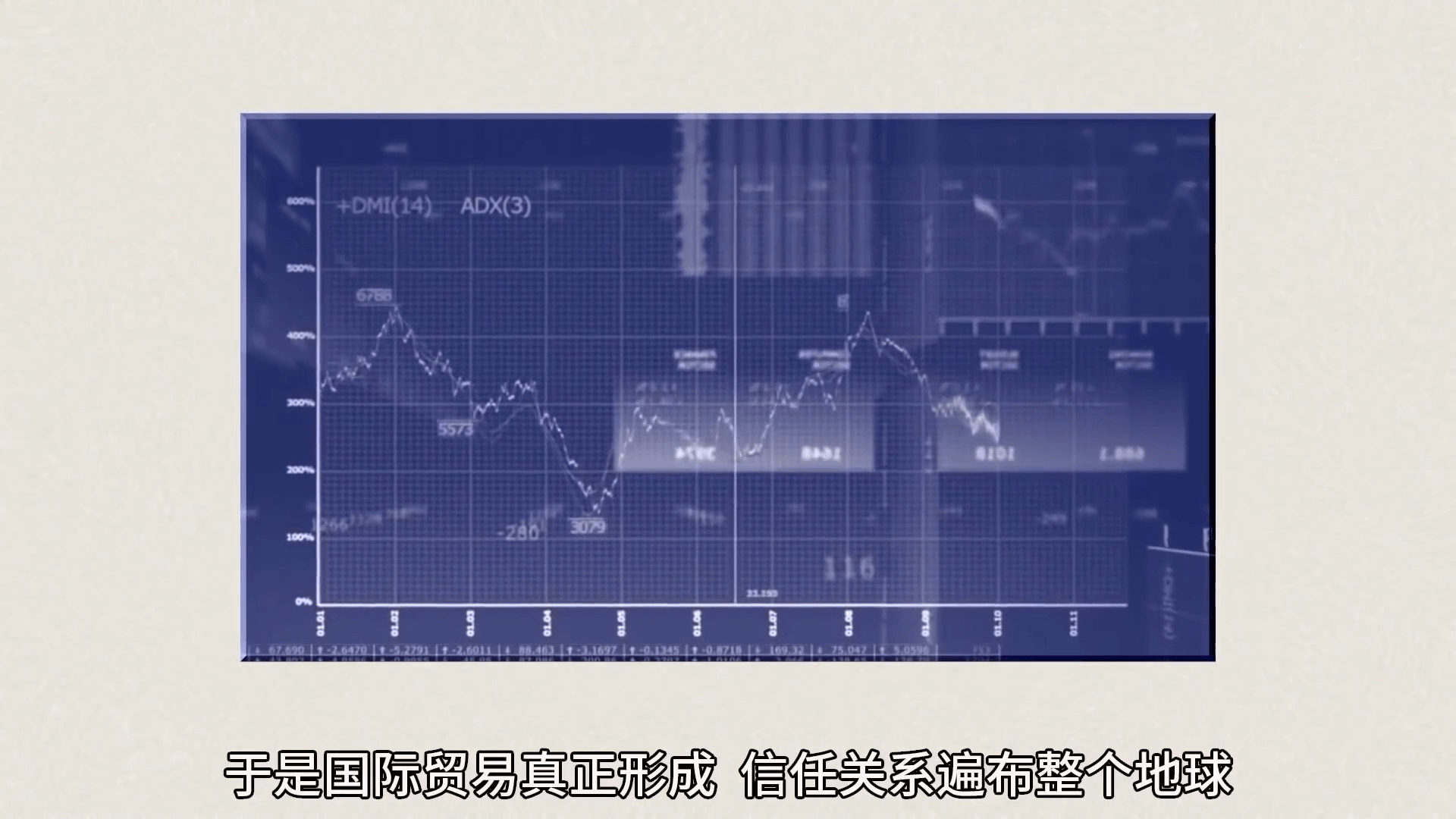

Then in modern times, the heads of various countries sat down and had a meeting and said, listen to us, whoever doesn’t follow the rules, we won’t play with him. So international trade was truly formed, trust relationships spread all over the earth, and mankind could finally challenge a huge industrial chain without worries.

For example, computers, mobile phones, and rockets. Please remember this, whether it is a single transaction or a large-scale transaction, the market relies on trust relationships.

Today we can also call this concept the “credit system”.

Credit System

Let’s go back to Little Ji and Little De. The idea seems to have become simple. Is it true that as long as we build a credit chain that is complete enough for everyone to participate in, we can make more transactions happen, thereby allowing the economy to develop and everyone to live a good life?

In theory, this is indeed the case, but at the same time, mankind has encountered a bunch of problems in the practice process, such as distribution problems, confrontations between countries, and financial crises.

The Birth of Currency

Now the smart Little Ji and Little De have grown up, they have given birth to more children, produced more products, and transactions have become more and more frequent. So in order to adapt to the development of productivity, Little Ji and Little De started to use some things that everyone recognized for transactions, such as shell money, knife money, copper coins, etc. These things have a characteristic, that is, they either have scarcity

Cannot be obtained at will, or there is strong power endorsement behind them, ordering everyone to accept these general commodities that can neither be eaten nor worn in addition to trading grain and cloth.

Of course, in this period, the scale of the commodity economy was very small and fragile, and everyone was still living a self-sufficient life of farming and weaving.

So the weak credit chain strung together based on copper coins could be inserted into the early trading system dominated by grain and silk.

Like in the long period of North-South division after the Han Dynasty, society was unstable, and Little Ji and Little De would generally use grain and silk for transactions again, unwilling to use copper coins, because everyone was afraid that the country would suddenly disappear and this money would be stuck in their hands.

Later in the Tang Dynasty, strong power brought social stability, and the credit chain between the people became stable again, so the commodity economy ushered in development again. In the Tang Dynasty during this period, the common people traded relatively frequently, and handicraft industry also developed well. Everyone did not like to carry grain to buy things because it was troublesome and too heavy, just like you are used to scanning codes for payment and don’t want to touch it, paper money is the same.

Deflation

The government still implemented an economic policy of parallel use of money and silk, which means that the people must accept copper coins and silk fabrics at the same time. Why is this?

Because early currencies such as shells and copper coins were too scarce. When the speed of their manufacture could not keep up with the increase in productivity, the currency circulating in the market would not be enough. If the currency was not enough, it would appear valuable.

Then when everyone tends to keep the currency in their hands, the desire to reach a transaction will decrease, thereby triggering a drop in prices. We call this phenomenon “deflation”.

Although the Tang Dynasty government tried every means, the problem of deflation still ran through the entire Tang Dynasty.

1. Backward Copper Smelting Technology

The speed of making copper coins was slow to begin with. In the Tianbao period, which had the largest amount of coin casting in the Tang Dynasty, 99 coin-making furnaces were built, and high-horsepower money printing was still not enough.

2. Casting Copper Coins Itself Cost Money

After the An Lushan Rebellion, the cost of casting money was so high that it cost 2,000 wen to cast every 1,000 wen. Printing money was actually unprofitable. The emperor had a headache. This caused the government’s coin casting volume to decrease significantly in the late Tang Dynasty.

3. Tang Dynasty Tax Law Aggravated the Money Shortage

Previously, the government mainly collected grain and silk fabrics for taxes, and very few copper coins. However, after the tax reform in the Tang Dynasty, taxes were determined by money.

The tax system changed from a food tax to a currency tax. Although in actual collection, many people took out messy things like silk fabrics to make up the number, overall it still increased the pressure on the people’s demand for currency.

Think about it, the government lacks copper coins, they have to spend copper coins to make copper coins, so of course they can only collect as many copper coins as possible. It was obviously out of good intentions, but ended up evolving into a result of grabbing copper coins from the common people.

Then the people, in order to pay taxes with money, were forced to sell their own grain and silk fabrics cheaply in the market before the tax payment deadline. This led to oversupply, and no one wanted the cheaply sold silk fabrics.

Prices fell, and everyone wanted copper coins, so the value of currency rose further. Isn’t it magical?

4. Money Hoarding Habit

Four is the point that makes the emperor vomit blood the most. Humans also have the habit of hoarding money out of nature. Starting from the middle of the Tang Dynasty, high-ranking officials and rich people liked to hide large amounts of copper coins at home. After work, they would just watch quietly and feel full of happiness. Then think about it, the copper coins in circulation are money.

Can the copper coins hidden in the basement still be considered money? That’s worse than cat poop. After all, cat poop can make coffee.

Ban on Saving Money

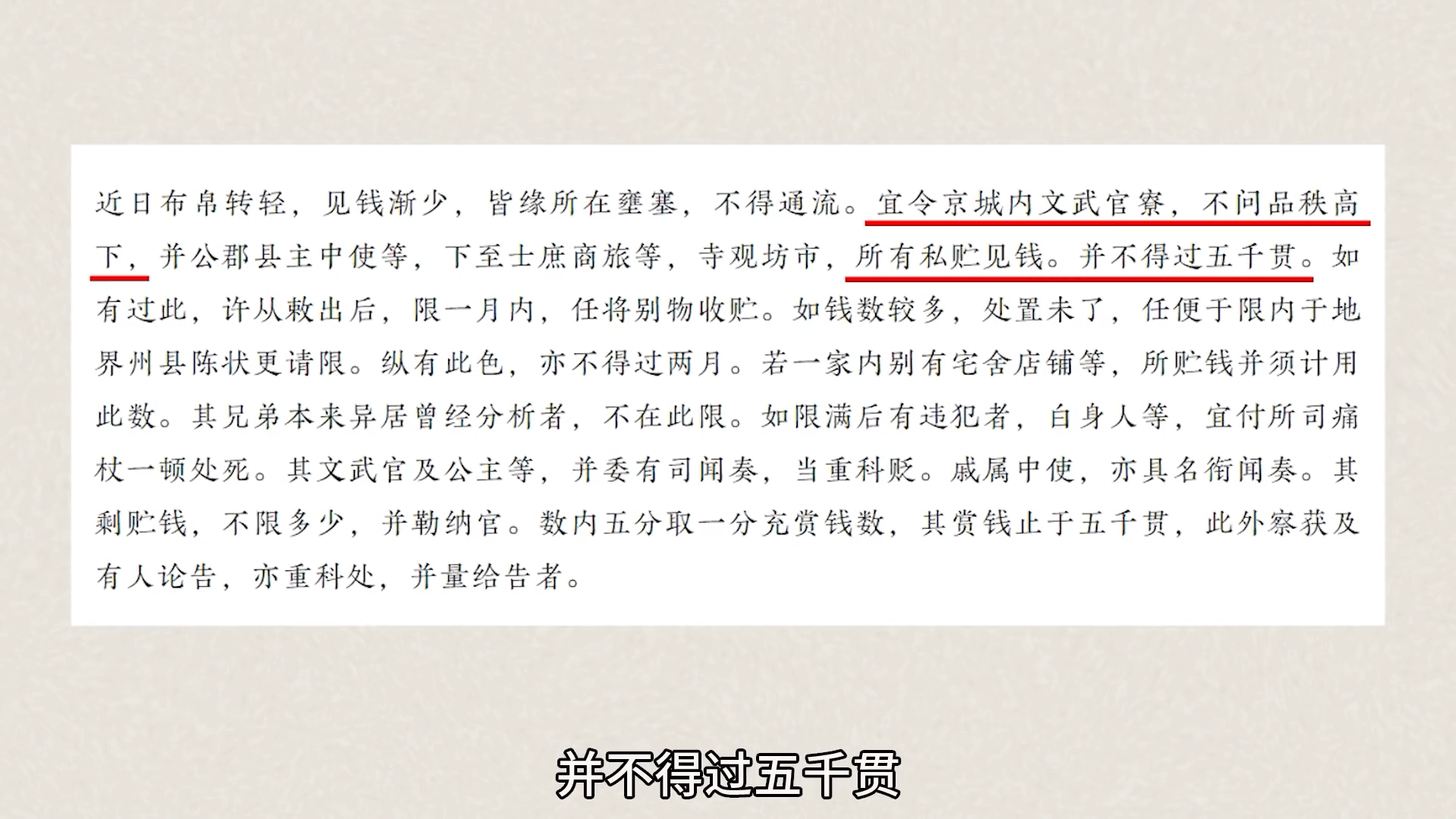

When the emperor went to court and looked at the civil and military officials, it was like looking at Pixius (mythical creatures) that only swallowed and didn’t excrete. He was extremely annoyed, so he promulgated a decree that everyone as a modern person would not dare to think about, “Ban on Saving Money”.

Civil and military officials in the capital, regardless of quality, were not allowed to store more than 5,000 strings of cash privately. Sounds like this is a very extreme and inhumane method, but it was still useless.

Inflation

In the late Tang Dynasty, the emperor was forced to have no choice in order to raise military funds. He listened to the suggestions of economists and directly cast a new type of copper coin “Qianyuan Zhongbao”, setting the face value 10 times higher than the original currency “Kaiyuan Tongbao”, which was still not enough.

So he listened to the suggestions of economists again and cast “Zhonglun Qianyuan” again. The face value was set to 50 times that of “Kaiyuan Tongbao”. Print money, just press print. The face value was large, but the weight of the copper coin did not increase much.

What result would this cause? The common people are not fools either. They directly used “Kaiyuan Tongbao” as raw material to recast “Zhonglun Qianyuan”.

The profit could reach ten times. So prices soared among the people, and everyone started the money printing press, fearing that they would be one step behind and print money too slowly. Farmers without conditions saw their family property become worthless overnight and starved to death on the streets.

What is called truly killing people without seeing blood? A sentence of unreasonable economic policy put forward made tens of thousands of people displaced and lose their fortunes. This is the power of bad economics. And that unlucky economist was of course demoted by the emperor.

Let’s summarize. Early currencies cast with metal as raw material, because of their scarcity and relatively easy control characteristics, were selected by the government to replace grain and silk fabrics and become the currency (circulating currency) of ancient traditional society.

These circulating copper coins strung together the common people one by one, establishing a long credit chain. For the people, seeing money is like seeing the army. Although they cannot eat or wear it, the strong power guarantees each of them that as long as the government exists for one day, copper coins can circulate for one day.

Credit, The Foundation of Currency Trading

This right is the foundation supporting the occurrence of large-scale transactions. However, early currencies represented by copper coins came with the attribute of triggering “deflation” phenomenon. This immature currency system brought a series of problems. In order to deal with problems, the government intervened in the market all the time. This intervention sometimes brought good results and sometimes brought extremely bad results.

For people like Little Ji and Little De, the primitive happiness brought by the division of labor had long been worn away in the slow evolution process of the early currency system over thousands of years. They were kidnapped like strings of copper coins strung together by ropes.

Modern Economics

Now we can finally enter the scope of modern economics. Due to space limitations, I will skip the series of quarrels and open strife and veiled struggle caused by various countries fighting for currency dominance after World War I, skip the evolution of those currency rules, and start directly talking about modern times, the meaning represented by the string of numbers in your bank account, that is, the bank credit currency system where banks issue loans to create deposit currency. It’s a bit convoluted, don’t worry, let’s take it slowly.

Let’s go back to Little Ji and Little De again. In the beginning, they traded fish and deer. You can view the fish Little De obtained as a kind of food, but change your concept, you can also view the fish as a kind of “short-term” currency. As long as the fish hasn’t gone bad, Little De can resell the fish to exchange for other items. Then going a step deeper, you can even view the fish as a kind of “bond”.

Little De paid labor to catch a deer, but out of desire for fish, he traded the deer out and got three fish back, but he didn’t want to eat them now, but eat them tomorrow.

Then at this time if we do not regard this fish as a fish, but as a kind of bond, actually the meaning represented by this bond is a promise from Little Ji on the second day regarding catching fish.

Wait until the second day when Little De takes out the bond, God fulfills the promise, snap, the bond turns back into a fish perfectly. Regardless of whether the bond is a fish or a stone or a shell in the above situation, its essence is credit.

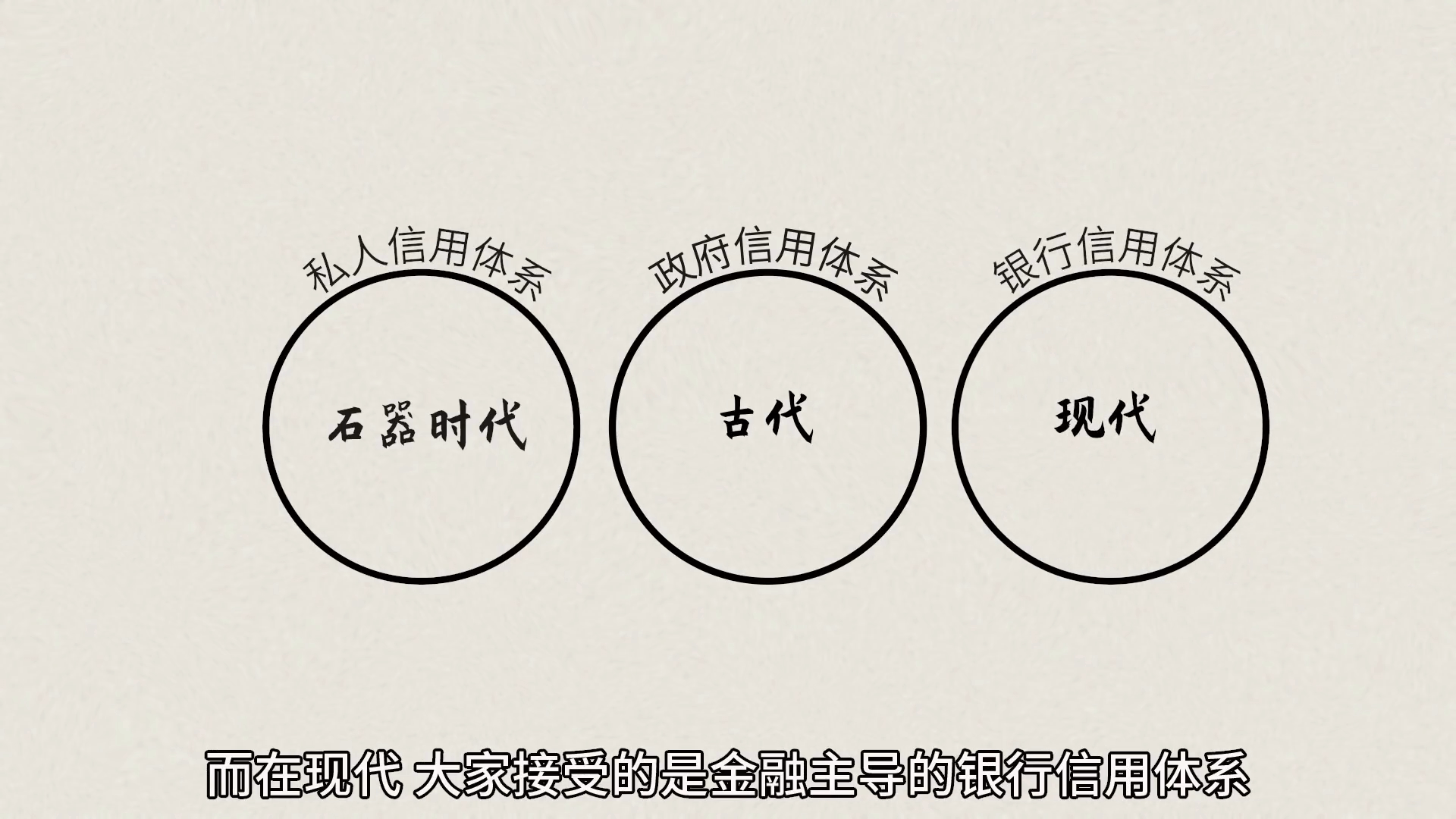

It’s just that in the Stone Age, everyone accepted the “private credit system”, such a weak credit chain. In ancient times, everyone accepted finance, the government credit system with “taxation as the dominant factor”. While in modern times, everyone accepts the banking credit system with “finance as the dominant factor”.

So in the era of metal currency, we understood currency as a special commodity that everyone could accept. But in modern times, as transactions become more and more digital and fewer people use physical currency, we understand currency as a kind of debt. It is not a concrete paper note, but a “debt system” composed of credit and clearing systems.

In ancient times, the emperor paid the copper coins cast to officials, soldiers, and craftsmen because the latter paid labor for the emperor, and the emperor owed them.

And the copper coins used for payment were a kind of creditor’s right, a repayment contract owed by the emperor using power.

When officials, soldiers, and craftsmen got this creditor’s right, they would reach secondary transactions with the common people. The essence of these secondary transactions was the transfer of debt. Finally, large-scale transaction behaviors occurred in the whole society, which was actually the large-scale transfer of the emperor’s credit.

It is also because of this that in ancient times, once society was turbulent and the regime was unstable, the emperor’s credit system guaranteed by fiscal revenue would be crumbling. The people were anxious to sell the bonds in their hands, eventually causing the bonds to be worthless, circulation to increase, and inflation to occur.

So based on the above knowledge, now let’s re-describe the transaction that occurred between Little Ji and Little De completely once. As the buyer, Little Ji used the credit in his hand to exchange for the goods provided by Little De as the seller. And Little De’s goods could be deer, industrial products, services, or some kind of financial asset, such as shares of a company.

Described in this way, Little Ji and Little De can be anyone, any organization, because all traders in the market trade in this way, including the government, banks, companies, and everyone. Everyone composes the economy you understand with every transaction.

But you will very easily observe that modern economy and ancient economy are very different. Ancient people used copper coins to buy things, while we scan codes to pay, we can’t even see money, only strings of numbers. So how is modern currency created? Who is responsible for increasing and decreasing those numbers behind the mobile phone?

The Credit Chain of Modern Economy

Okay, after so much foreshadowing, we are finally going to enter the focus of today’s video. Let me tell you what the credit chain supporting the modern economy is all about.

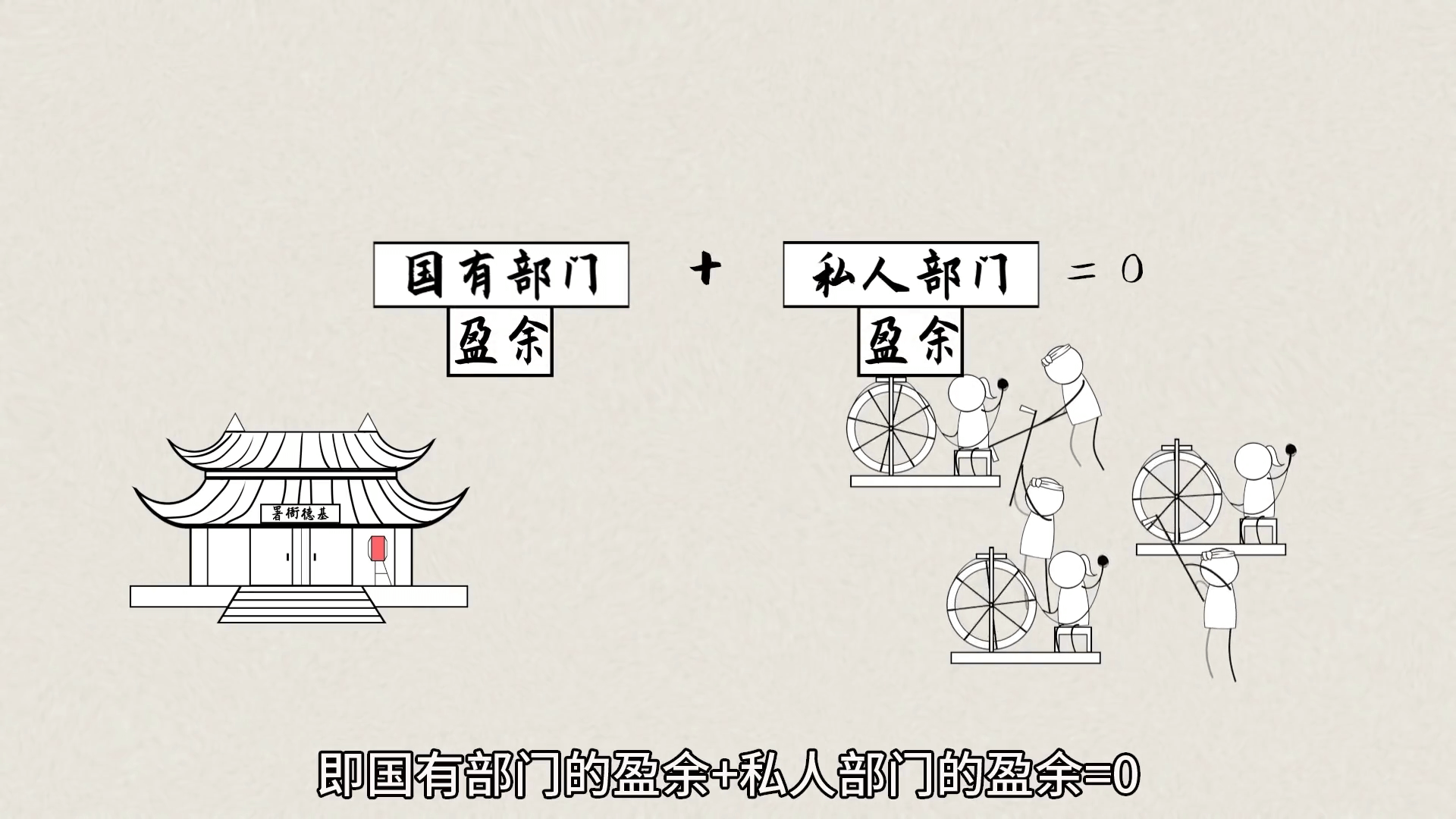

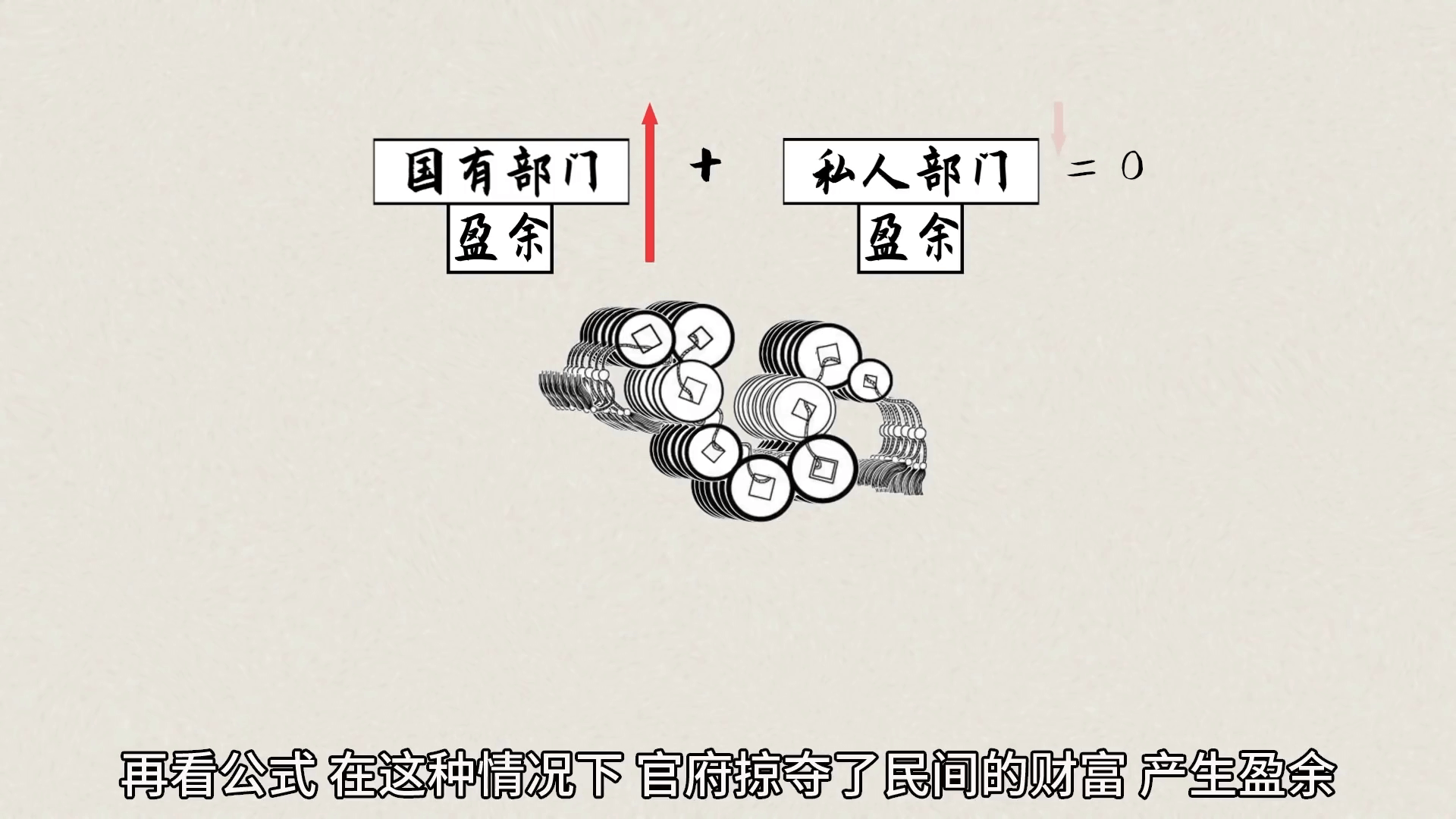

We know that ancient governments used tax revenue as a guarantee and issued copper coins, this kind of debt, for the people to use. So if we regard the government as the state-owned sector and the people as the private sector, assuming there is no trade with foreign countries, we can write an equation: the surplus of the state-owned sector plus the surplus of the private sector equals 0.

This equation is very simple to understand, because in a transaction, one person’s expenditure equals another person’s income. This is the same for the government. The expenditure of the government and other state-owned sectors equals the people’s income.

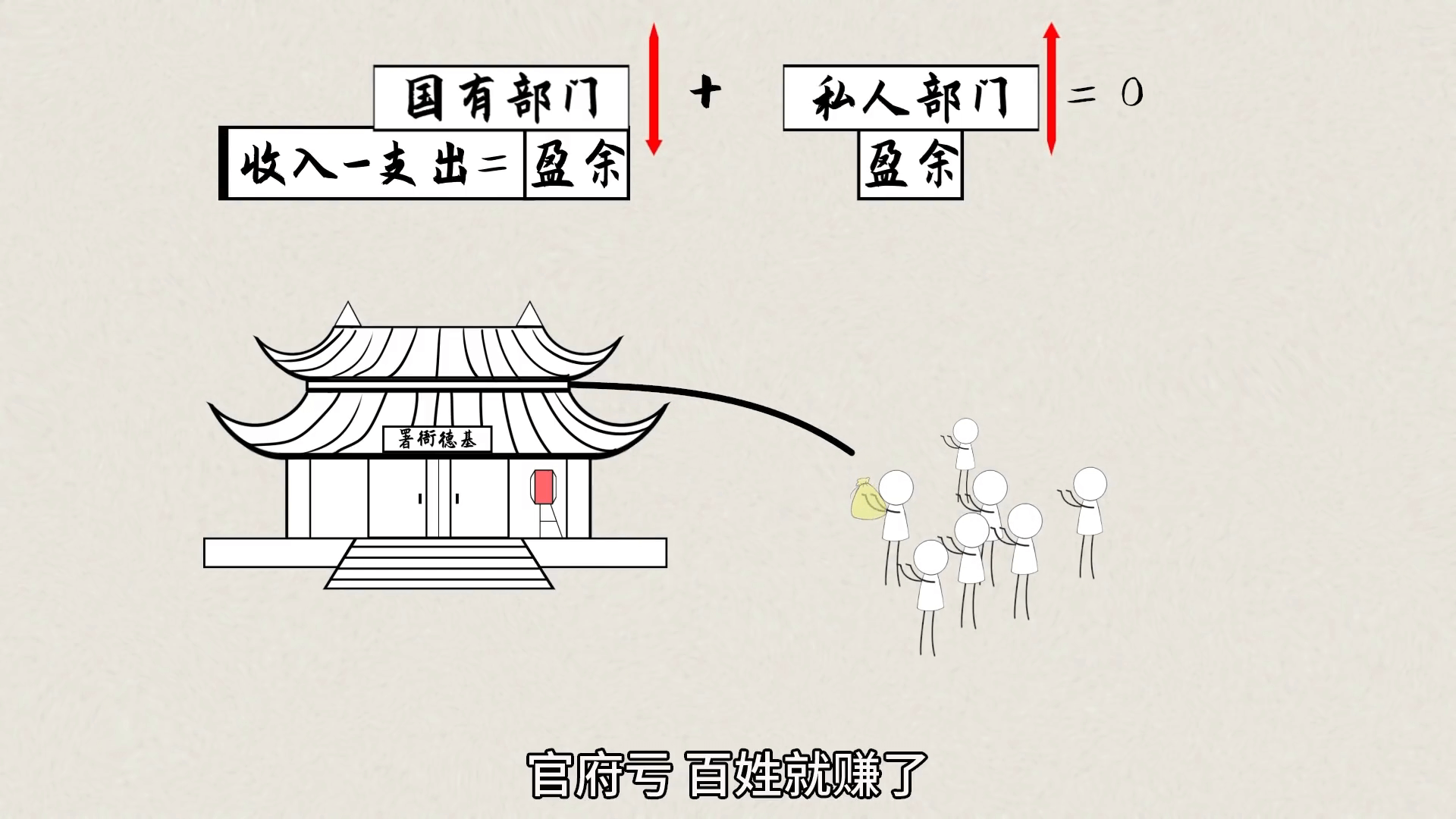

So since wealth will not disappear out of thin air, then the wealth surplus generated by the government’s income minus expenditure will offset the wealth surplus of the private sector composed of the people.

From this conclusion, we can draw a simple truth, that is, if the government earns, the people lose; if the government loses, the people earn.

Note that the surplus here does not mean that if the government casts a pile of copper coins and hides them at home, it counts as a surplus, because that has not circulated. Only when the government buys the people’s things and services and adds the newly cast copper coins to the trading system, causing the people to obtain more copper coins, do such copper coins count.

We know that copper coins are debt. When the government casts copper coins mindlessly, it is equivalent to accelerating the issuance of debt externally.

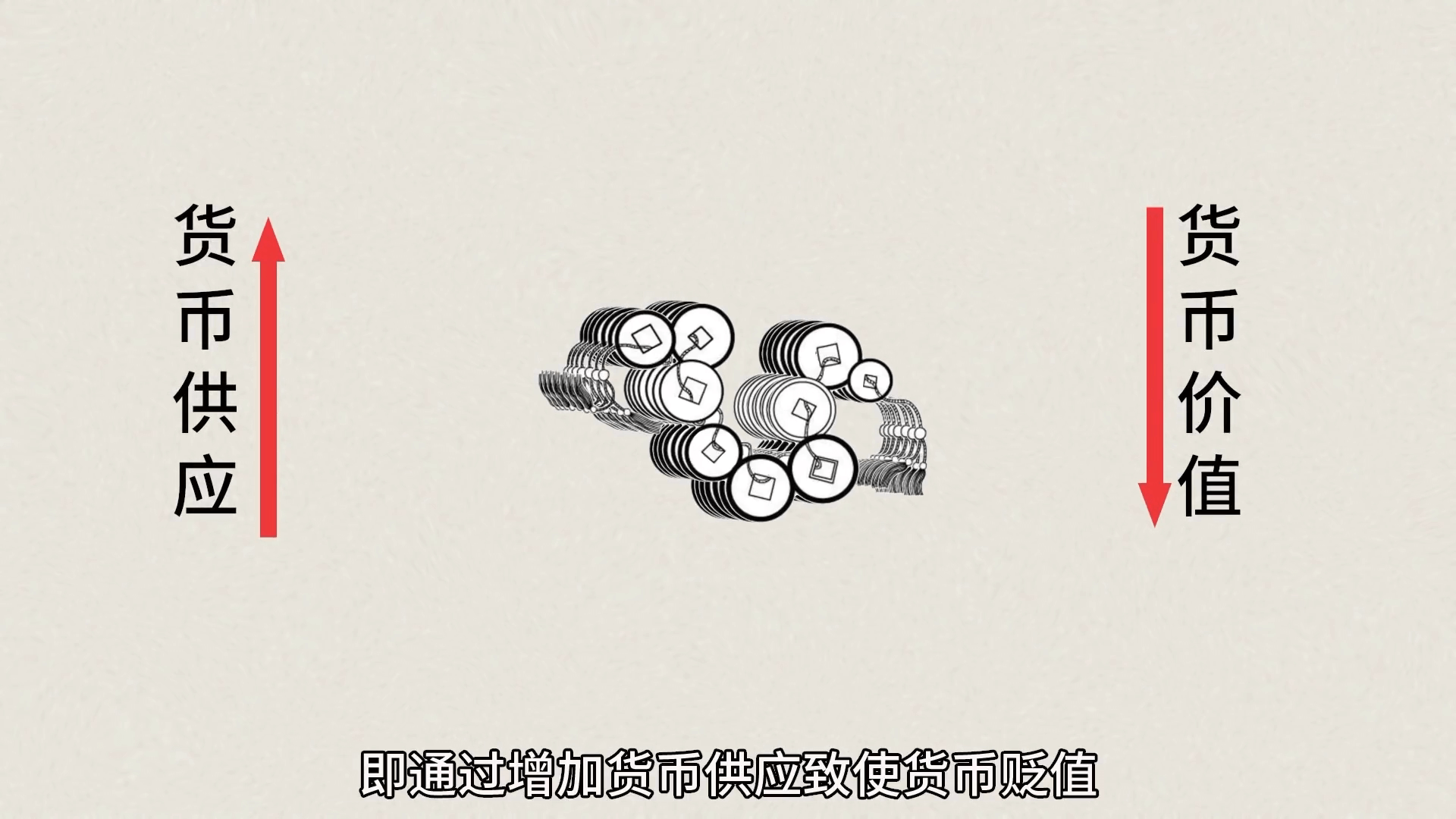

So this is the essence of government behavior. It is issuing a kind of debt that has no connection with actual economic resources, a kind of debt that cannot be cashed. This kind of debt is equivalent to levying seigniorage on the people, that is, causing currency devaluation by increasing money supply.

As the currency issuer, the government takes private resources as its own. Look at the formula again. In this case, the government plunders private wealth and generates a surplus. Naturally, the private sector composed of the people loses.

So when will the government lose? Looking back at history, although high-ranking officials and rich people were often filthy rich and fat, the emptiness of the national treasury was the norm. This is because copper coins come with a deflation attribute. When deflation occurs, it means that the speed of the government casting copper coins is not fast enough. This means that less debt is issued, and seigniorage cannot be levied on the common people.

At the same time, the government needs to support a large group of bureaucratic system and soldiers who do not participate in production, and the government’s normal income is only tax revenue, and tax revenue is an income that cannot be increased in the short term. So let me ask, when a natural disaster causing huge economic losses occurs, when the country needs to fight a war, what should the government do? At this time, the government can only deplete the national treasury and take out money and grain for disaster relief or conscription, thereby the government’s surplus turns into wealth, and the surplus of the private sector composed of the people rises.

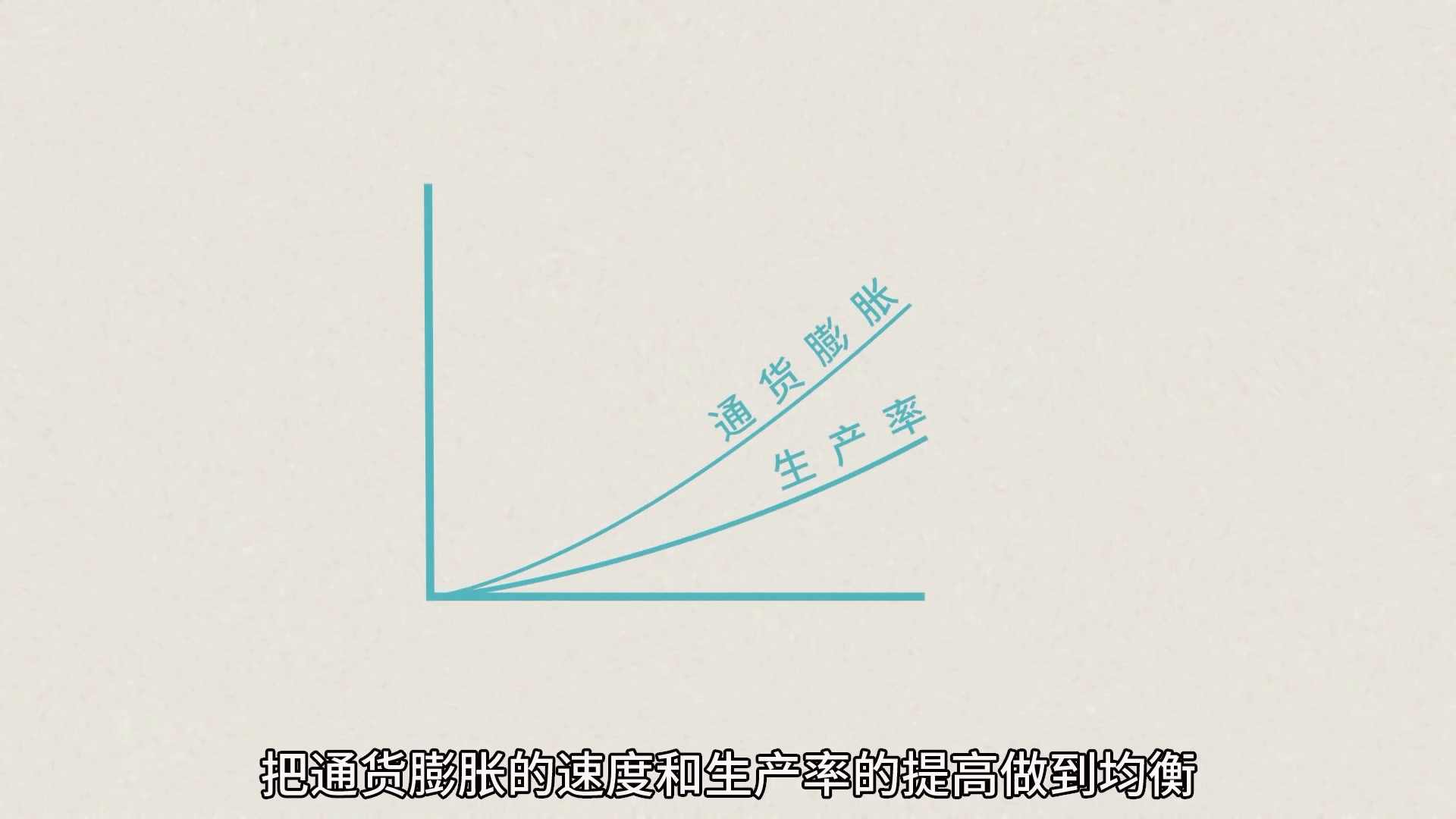

Some people might ask, are the government and the people natural enemies? Not necessarily. In theory, the government should stabilize market prices, not letting a fish be 4 yuan today and 8 yuan tomorrow, maintain a relatively low level of inflation, print money slowly, and balance the speed of inflation with the increase in productivity. Then even if the government’s fiscal deficit gets higher and higher, it doesn’t matter. As long as the government’s military strength is still there and the regime is stable.

It can print money to pay off debts itself. Besides, the government’s loss equals the people’s profit. As long as wealth distribution is done well, what reason do the people have to be unhappy?

Of course, what was said above is a model so simple that it cannot be realized. In reality, of course, there will be various problems. For example, currency like copper coins simply cannot maintain inflation.

For example, the government simply cannot perfectly monitor market prices. For another example, the economy will not develop stably either, because there will be natural disasters and wars. At the same time, when developed to a certain scale, the government will also encounter the real devil in economics, “stagflation”.

regarding more economic crisis issues, today’s video cannot go deep. Let’s return our attention to currency.

Since metal currency, the backwardness of its natural deflation attribute, dragged down human economic development, then naturally humans would make improvements in the system. Now after a series of foreshadowing, we have finally laid a good foundation on the road to understanding currency. Are you ready to enter the last part of the video?

Modern government participation in the market economy is actually divided into two departments, one is the government, and the other is the central bank. The government is responsible for collecting taxes and making plans for spending money for public affairs, while the central bank is responsible for creating currency.

We know that currency is bonds, and bonds are promises. Even the central bank cannot make promises out of thin air, because that will not gain the trust of the people. So we need to find the value behind the created currency.

The main value found by China’s central bank for RMB is the US dollar circulating in the international market. For example, Little Ji is Chinese. He sold toys to the United States through production and obtained 1,000 US dollars. But this US dollar cannot circulate in China, so Little Ji found a commercial bank on the street and exchanged his US dollars for 6,971 RMB according to the exchange rate, and spent it happily. The commercial bank got 1,000 US dollars and traded it to the central bank. Finally, the central bank got 1,000 US dollars that can circulate in the international market and printed 6,971 RMB circulating in China. Under this mechanism, as long as the power is stable, the value of this 6,971 RMB is equal to the value of 1,000 US dollars.

The credit chain is generated!

The currency generated in this way accounts for about 65% of the base currency created by the central bank.

At the same time, the central bank will also actively increase the amount of currency in the market and stimulate the economy by directly issuing loans to commercial banks. The currency created in this part accounts for about 36%.

In addition, the central bank can also give money to commercial banks and increase base currency by purchasing national debts sold by commercial banks in the secondary market. This part can also account for about 5%.

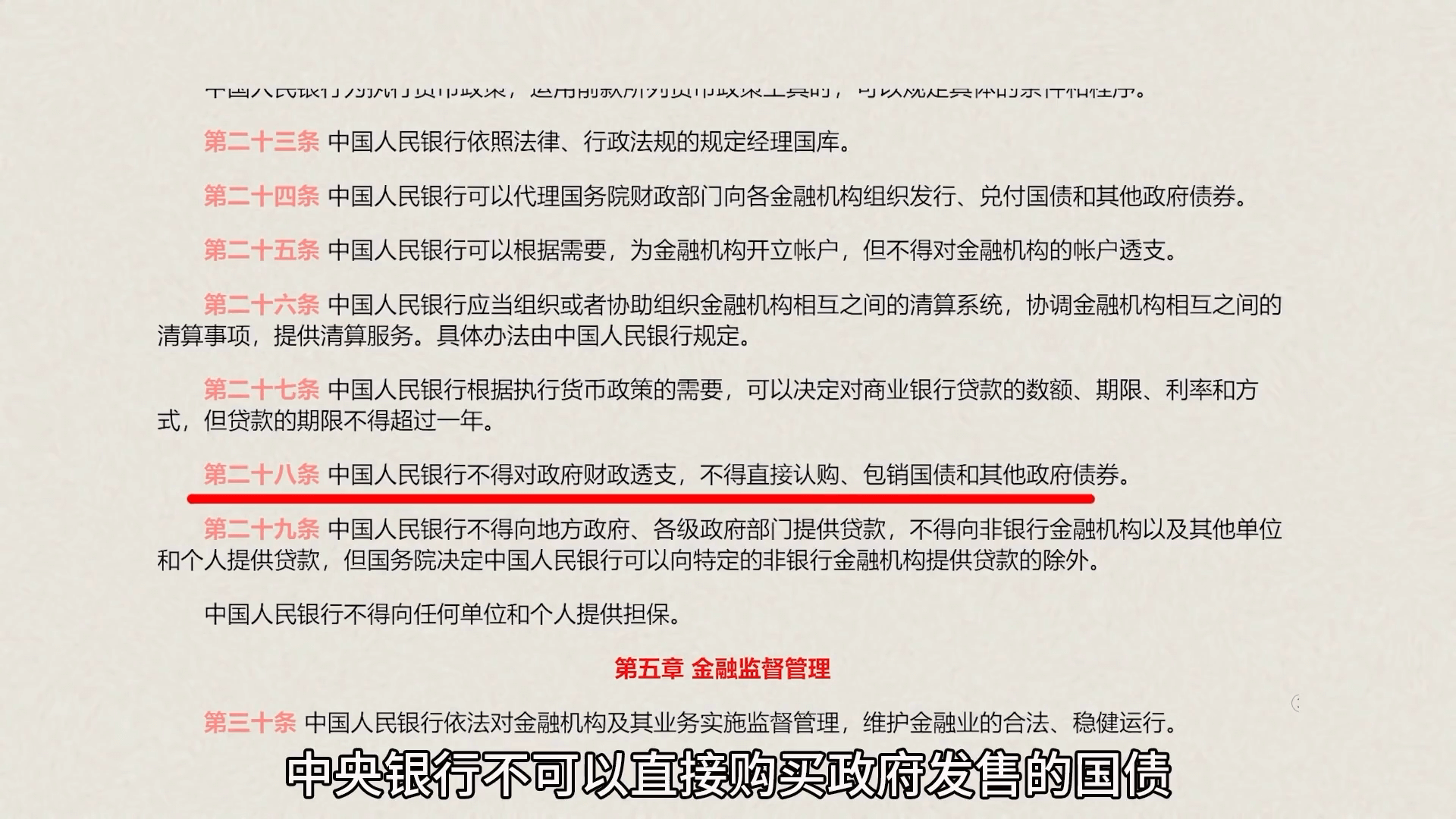

Please note here that the Banking Law stipulates that the central bank cannot directly purchase national debts issued by the government.

Because this is somewhat equivalent to what we mentioned before, the ancient government casting copper coins for its own use. This is absolutely not allowed.

But having said that, even if the central bank buys national debts in the secondary market, it is a bit weird, and it also has a bit of the flavor of printing money to pay off debts. But there is no way. Currently, central banks of various countries in the world indeed have to use this method to stuff money into commercial banks. There is only the difference between more and less, not the difference between having and not having.

Let’s take the United States during the epidemic as an example. In order to stimulate the economy, in March, the US central bank, the Federal Reserve, announced unlimited quantitative easing, just printing money.

Initially, they purchased 75 billion US dollars of national debts in the secondary market every day. Later, they gradually reduced it according to the actual situation. In April, they purchased an average of 30 billion per day. In May, an average of 7 billion per day. In June, an average of 4 billion per day. Of course, the Federal Reserve not only buys national debts but also buys other commercial papers. We won’t go deep here. Everyone just remember that the purpose is that the central bank is trying every means to stuff money into commercial banks.

Then some friends might ask now, the three main ways for the central bank to create base currency you mentioned earlier, 65% plus 36% plus 5% adds up to 106%. How is it more than 100%?

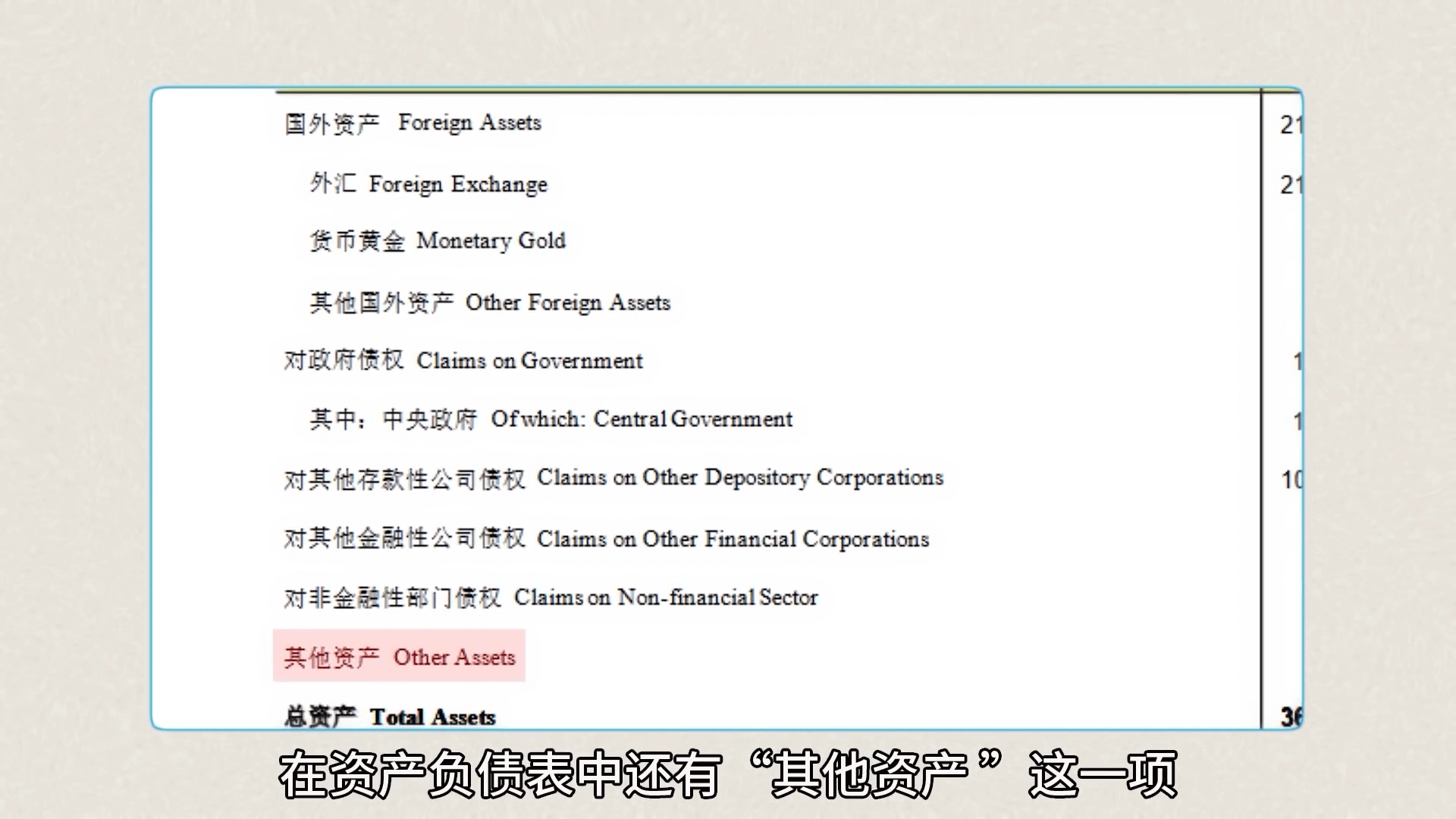

Here I need to explain the data in my video. For convenience, it comes from the balance sheet of the People’s Bank of China in December 2019. In fact, besides the three items I mentioned earlier that affect the central bank’s assets, there is also the item “other assets” in the balance sheet, so the total will be more than 106%.

This shows that base currency was cut in a certain link. Where? Fiscal revenue.

The taxes collected by the government will naturally become the government’s deposits, deposited in the central bank’s account. It was mentioned earlier that the money saved by the government cannot be counted as circulating money, so government deposits cannot be counted as base currency. We need to subtract this part from the currency created by the central bank. This part is about 10%. 106% minus 10% equals 96%, which is about right.

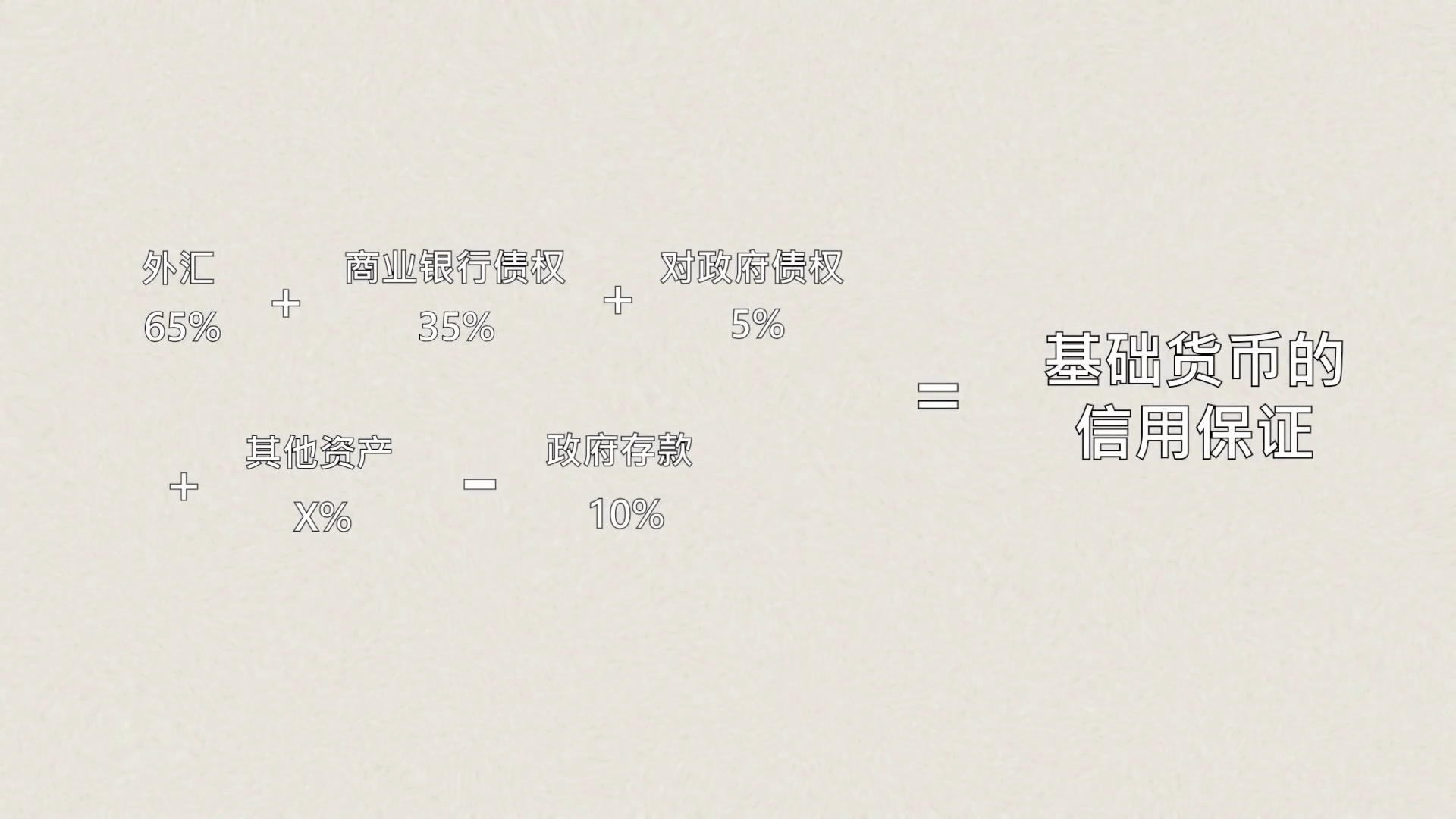

Now we list an equation: foreign exchange 65%, plus claims on commercial banks 35%, plus claims on government 5%, plus other assets x, minus government deposits 10%, equals the credit guarantee of base currency.

This equation is not difficult to understand. The left side of the equation represents the anchor behind the currency issued by the central bank. Why can we use RMB? How does the central bank print RMB from the money printing press and send it to commercial banks? All can be answered through this equation.

Friends interested in this part of the content can enter the official website of the People’s Bank of China, click on the public directory, click on statistical data in statistics and reports, then select the year and click on the monetary statistics overview, and download the balance sheet of monetary authorities for research.

Commercial Banks Distributing Currency, Deposit Currency and Credit Expansion

So next, how do commercial banks distribute currency to each of our hands? The biggest difference between modern economy and ancient economy, the last link of the current banking credit system, the live target of Bitcoin intellectuals, the favorite of conspiracy theorists, the climax part of this video, “deposit currency”.

If the ancient government credit system created currency from top to bottom, resulting in frequent creation of too little or too much, then the most magnificent transformation of the banking credit system of modern economy is creating currency from bottom to top.

Suppose you are a road repair worker named Little Ji. You paid physical labor for society to repair a road, and then you got a paper note with 100 yuan written on it as you wished. Now you will be like thousands of all normal modern people, habitually depositing this 100 yuan into the bank. But please note, the bank will not keep this 100 yuan for you for no reason, and even give you a few yuan more in interest. There is no free lunch in the world.

The essence of your saving money in the bank is that you have reached an agreement with the bank, that is, the bank can dispose of the 100 yuan you deposited at will without notifying you, such as lending it to others.

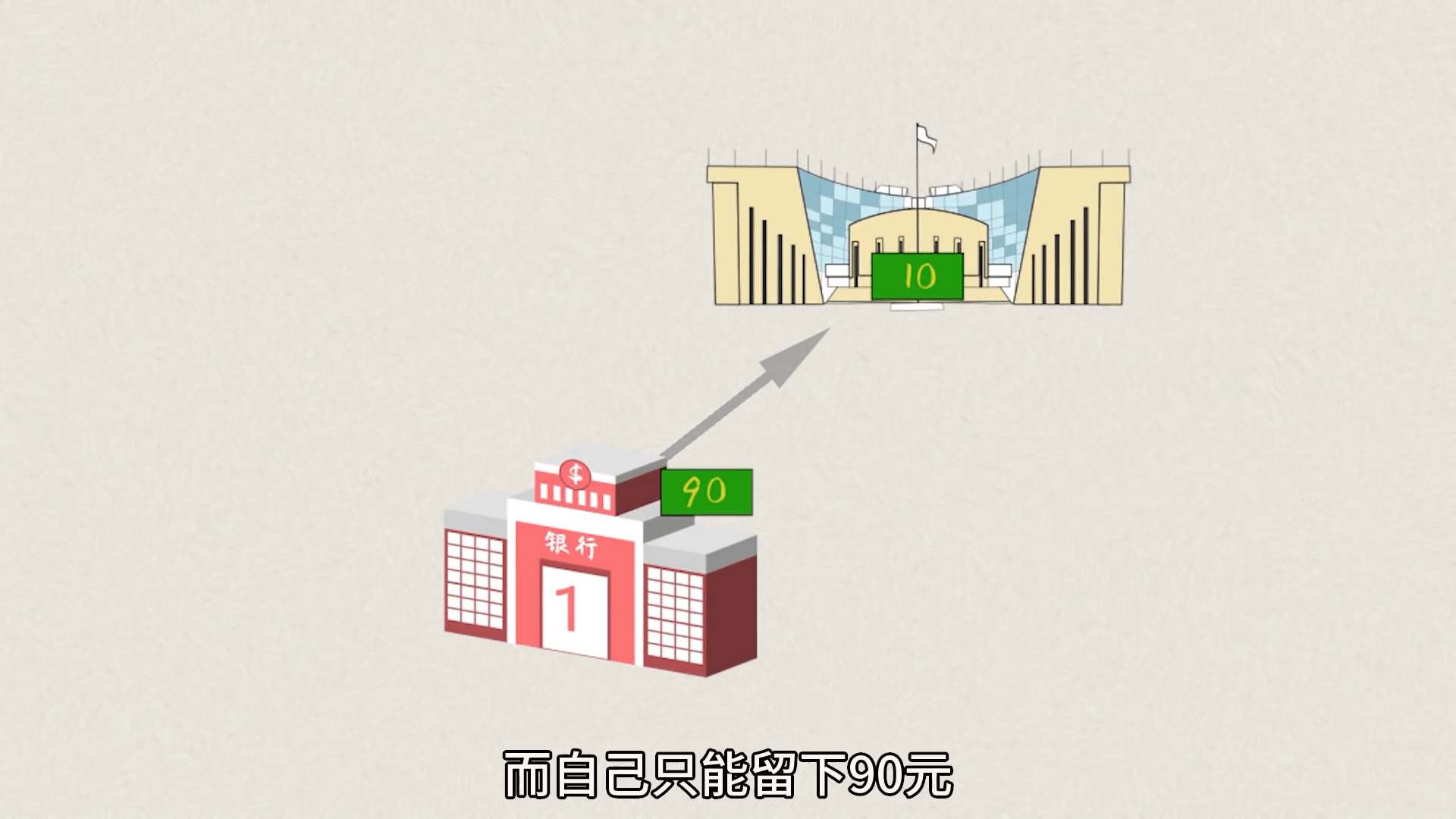

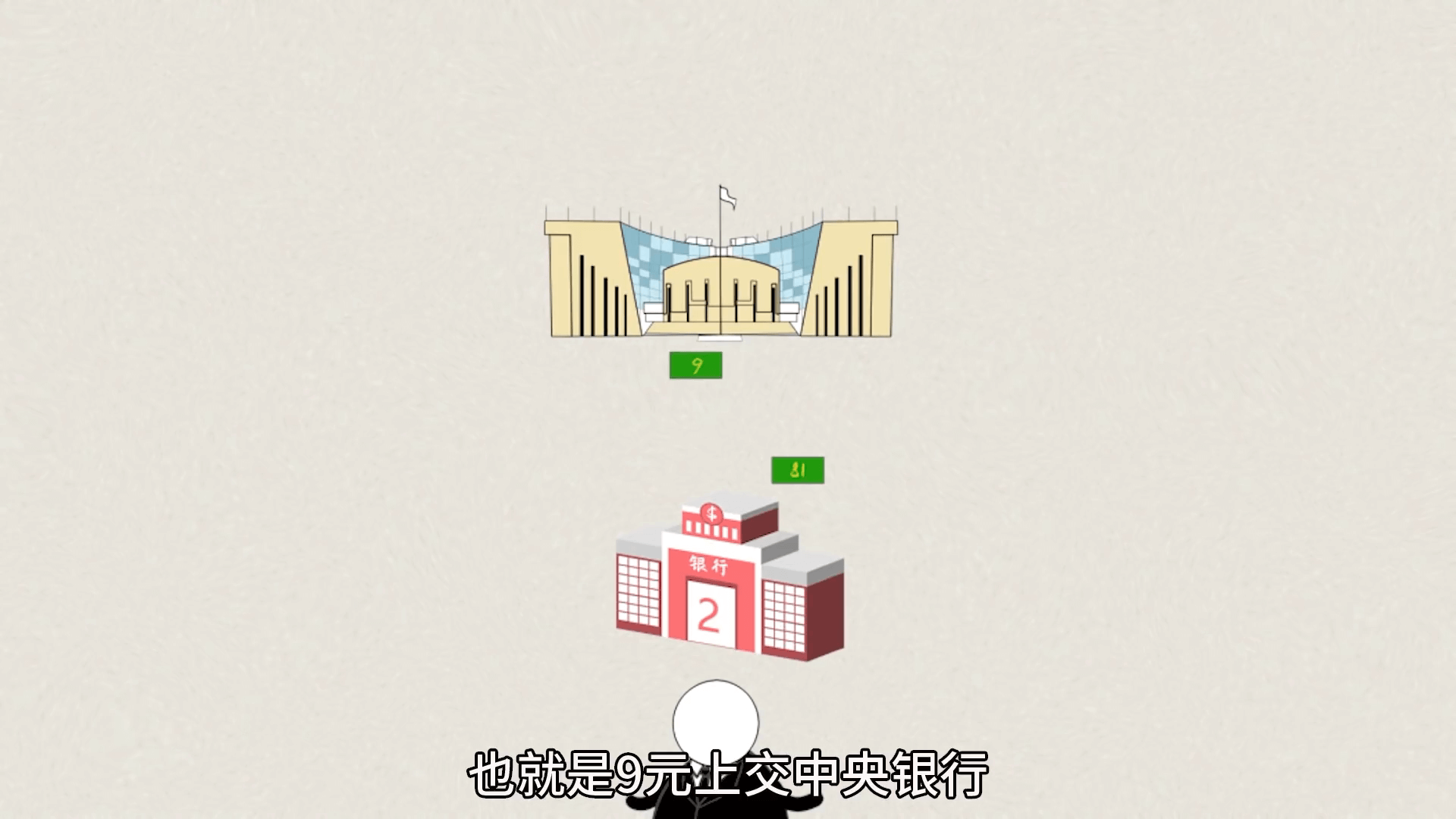

Of course, there is a premise, that is, the commercial bank needs to deduct 10 yuan from the 100 yuan and hand it over to the central bank for safekeeping according to the deposit reserve ratio of about 10%, and can only keep 90 yuan for itself.

Now our second worker Little De appears. Little De wants to buy a house, this is a rigid demand, just short of 90 yuan. What to do?

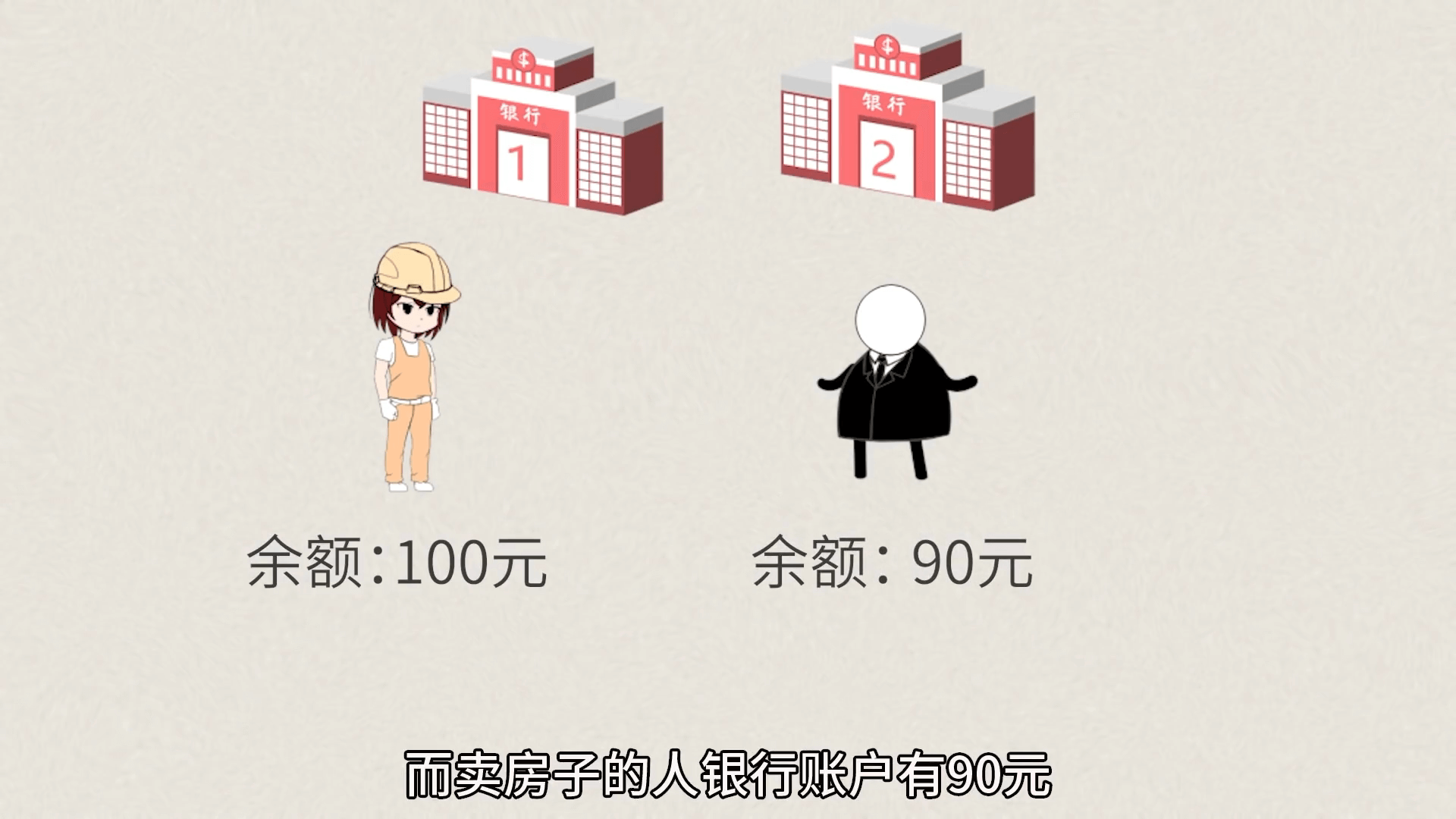

Because ordinary workers can generally only afford to support one house in their lifetime, they will work hard to repay the loan for this house and will not easily stop paying. So lending money to people who need to buy houses and earning interest from it is a way of making money that commercial banks are very willing to do. So the commercial bank lent your 90 yuan to Little De, and Little De took it to buy a house.

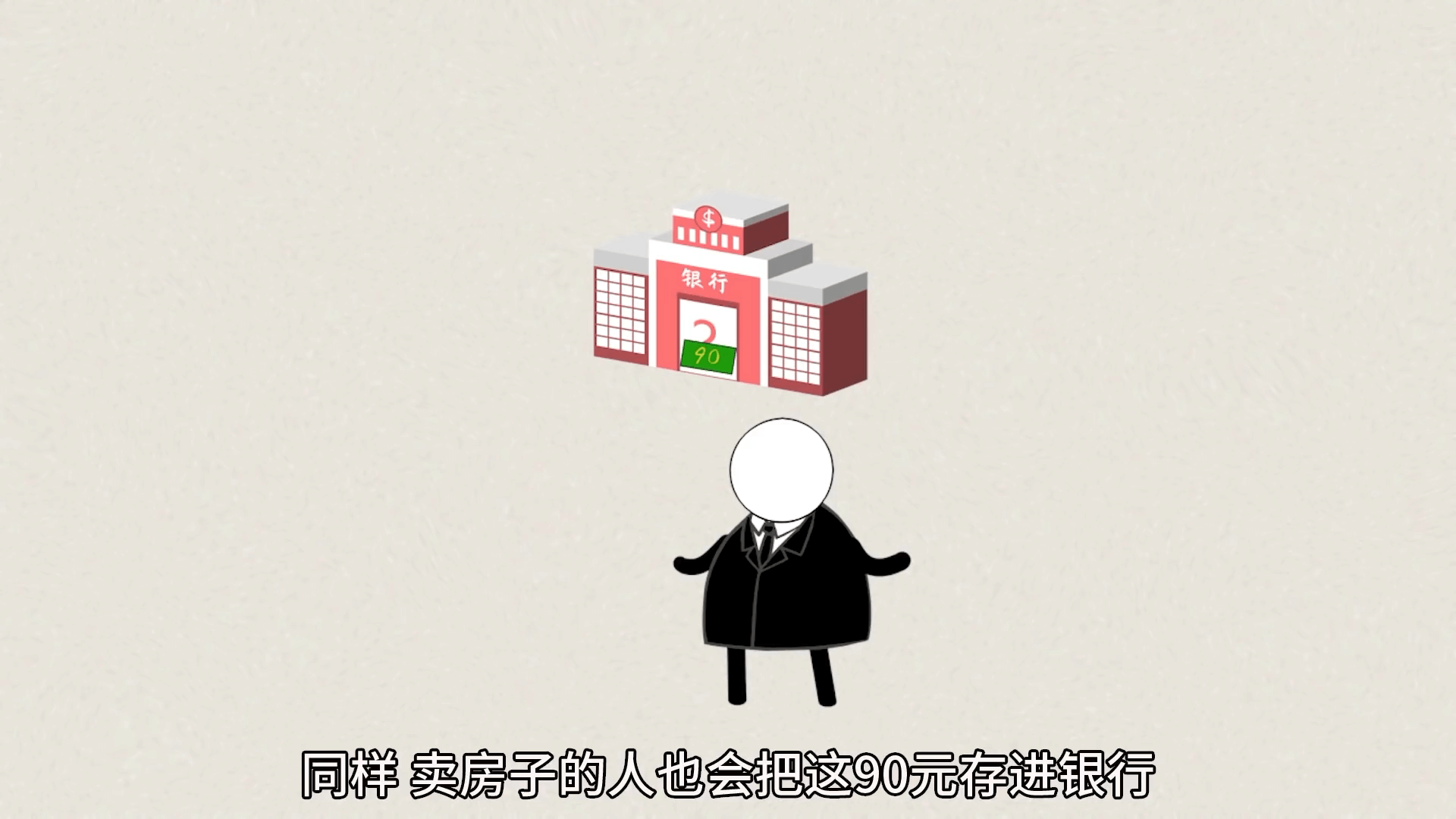

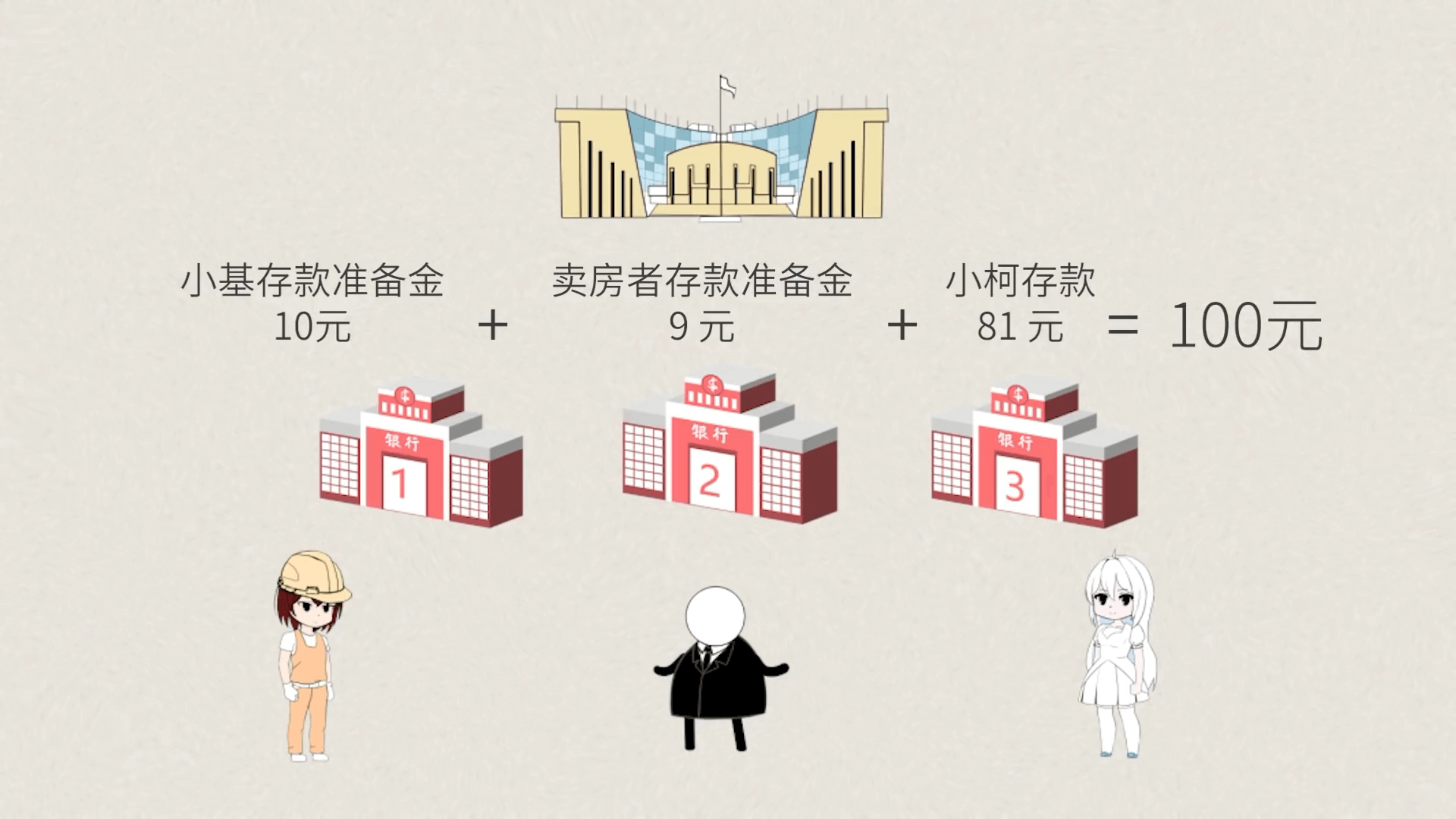

Similarly, the person selling the house will also deposit this 90 yuan into the bank. The bank again hands over 10% of the 90 yuan, which is 9 yuan, to the central bank, and detains the remaining 81 yuan.

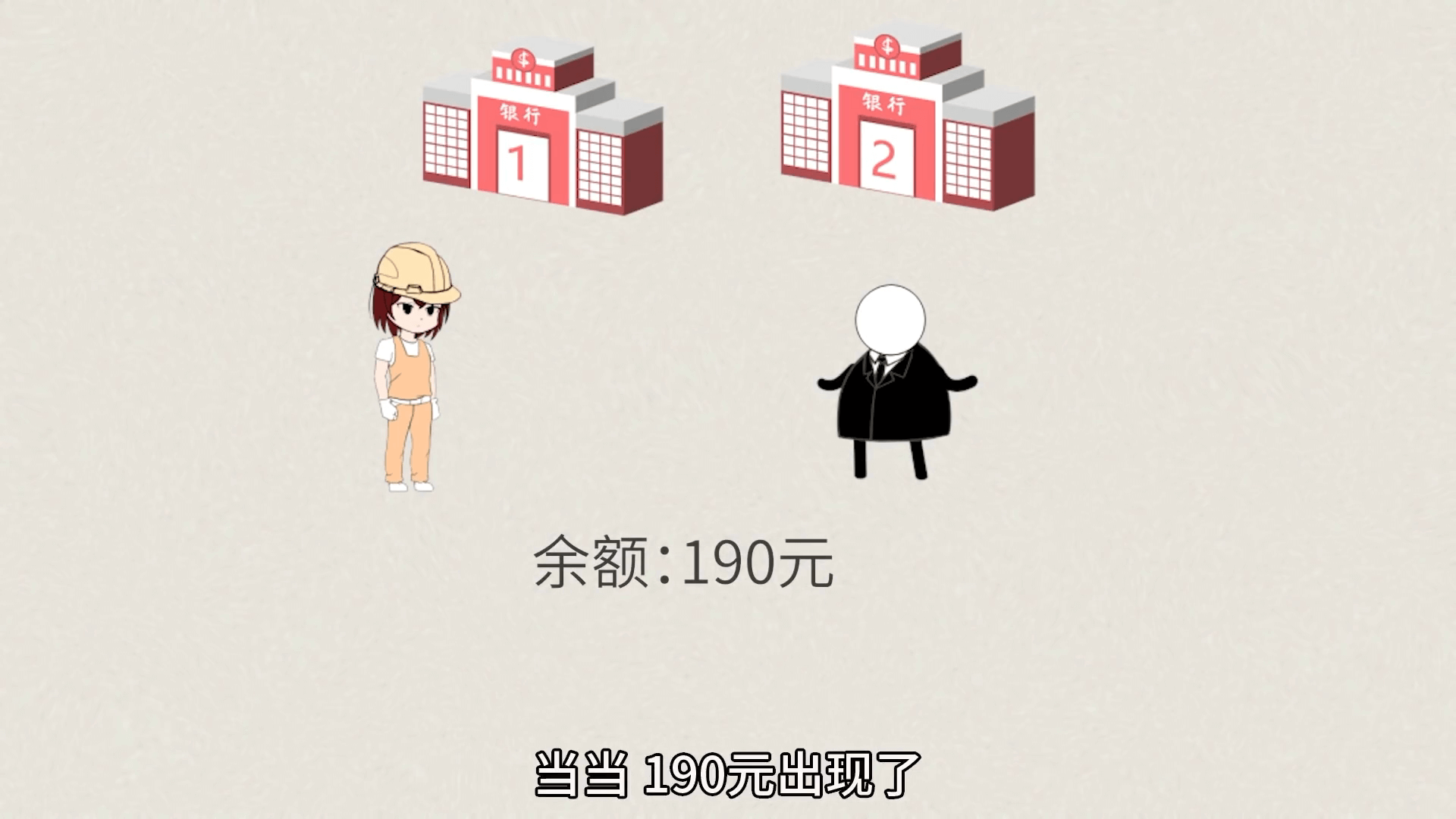

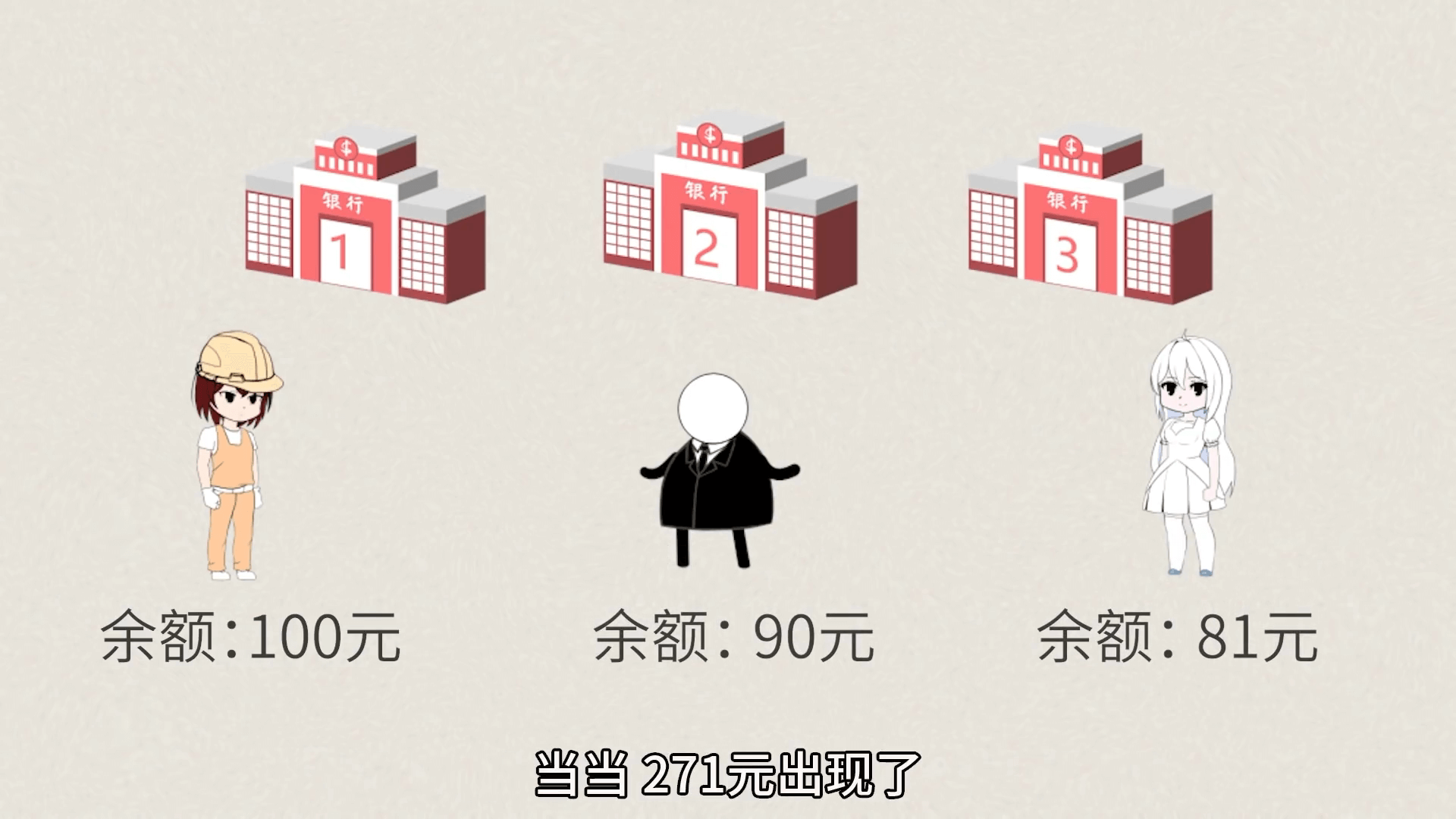

Now Little Ji’s bank account has 100 yuan, and the house seller’s bank account has 90 yuan. Ding ding, 190 yuan appeared.

Then the footsteps of commercial banks will certainly not stop here. The remaining 81 yuan bank account period continues to lend to Little Ke. Little Ke gets the money. We skip the step of him buying things and assume he directly deposits it into another bank. So now Little Ji’s bank account has 100 yuan, the house seller’s account has 90 yuan, and Little Ke’s account has 81 yuan. Ding ding, 271 yuan appeared.

The balance in our bank accounts has magically increased here. So let’s calculate how much money the banking system has now. Little Ji’s deposit reserve 10 yuan, plus the house seller’s deposit reserve 9 yuan, plus Little Ke’s account 81 yuan, 100 yuan. That is to say, the bank still only has 100 yuan.

But if Little Ji, the house seller, and Little Ke meet, they will find that the bank deposits add up to 271 yuan. At this time, if the three of them decide to go to withdraw money together, the commercial bank will go bankrupt.

But what if the base of this money is large enough?

As long as there is no phenomenon of many people running on the bank together, then this trick can continue to be played.

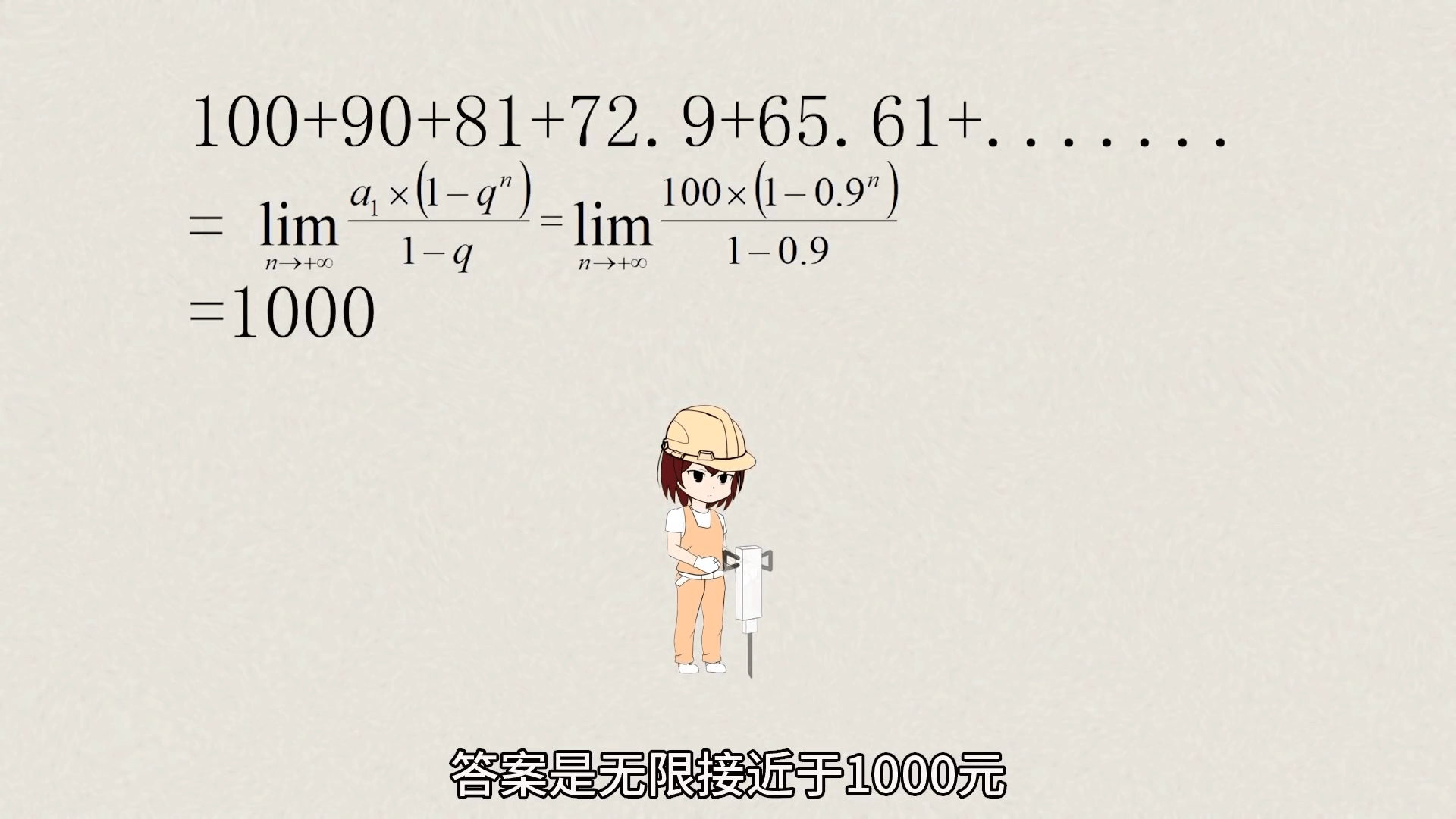

How much money will Little Ji’s 100 yuan eventually become? We can list a formula, 100 plus 90 plus 81, skipping the calculation part, the answer is infinitely close to 1,000 yuan.

In modern society, the money in our hands is expanded by credit in this way.

What does this mean? The concept of currency you understood before might be paper notes, or even a string of bank numbers, there should correspond to paper notes behind it, but in fact, it is not like this at all. In the current concept of currency, the amount of paper notes you understand is probably only this much.

And the vast majority of so-called currency is just a string of bank numbers, they are probably this much.

And the essence of these currencies is “credit”, we gave it a nice name “deposit currency”.

Speaking of this, some people may be worried. Since this money is all fake, will the money we deposit in the bank be in danger?

Rest assured, the reason why you ask such a question is entirely because the model I provided is simple enough, simple enough that we can directly get how modern commercial banks make money with money.

But at the same time, because it is too simple, some conspiracy theorists or virtual currency supporters will intentionally or unintentionally use this as an argument to try to negate and overthrow the modern currency system.

Everyone rest assured, the deposit currency mechanism relying on the commercial bank credit system at present is, in my opinion, the most reasonable and feasible currency mechanism that matches the current productivity level.

It is certainly far better than the metal currency cast by the ancient government credit system, and at the same time more realistic than the beautiful picture depicted by virtual currency supporters.

The scale of deposit currency certainly cannot be expanded at will. Simply put, it is the result of the game between the central bank, commercial banks, and the people. The central bank provides water, commercial banks provide faucets, and the behavior of thousands of people is responsible for turning the faucets.

Specifically, every loan issued by commercial banks is driven by the people, and at the same time has its corresponding meaning. Mortgage money goes to buy cement, feeding migrant workers and designers. Car loan money goes to feed workers on the automobile industry chain. Student loans cultivate talents and drive technological innovation.

So, is this perfect? Of course not.

This system of creating deposit currency by loans is very easy to lend too much, leverage too high, and finally crash the economy. Moreover, we mentioned at the beginning of the video that there is no absolutely correct economics for the government to refer to.

The economic life of us humans along the way is nothing more than “development of productivity”, encountering unexplainable “economic crises”, then “trying to explain” and “reforming economic systems”, productivity continues to develop, continues to encounter economic crises, continues to explain and continues to reform economic systems.

So our human economic state is actually always in a spiraling upward state. Fortunately, today, even the worst situation has finally improved.

In ancient times, people were forced to starve to death on the streets during economic crises, while today people can at least eat a bite of relief food and drink a bowl of hot soup during economic crises. These are the worst situations. The reality is that the living conditions of most people have become better due to economic development.

Of course, right now we are still facing new economic crises. Judging from the situation in the past few months, humans still seem helpless when dealing with economic problems. The hands of governments intervening in the market are forcibly increasing their efforts. This is a short-term problem.

Then facing long-term problems, we can see that humans still wielded that set of weapons from many years ago, tariffs, sanctions, trade wars. Can it be solved? If it cannot be solved, then moving the army. This is the content of the next issue, the basic logic of the Sino-US trade war, the three major contradictions, I can’t wait to write it for you to see, I won’t go deep here.

Then in the very last part of this video, let’s throw away the theory and talk about some issues closely related to everyone’s life. Why is work so tiring, why is life so annoying?

Compared with ancient times, the modern currency system has another biggest characteristic, which is stronger concentration.

Ancient currency was nothing more than concentrated in the hands of the emperor and high-ranking officials and rich people. Their means of making money were nothing more than corruption and bribery, while the vast majority of the people were farming or working for the government to earn money, earning about the same.

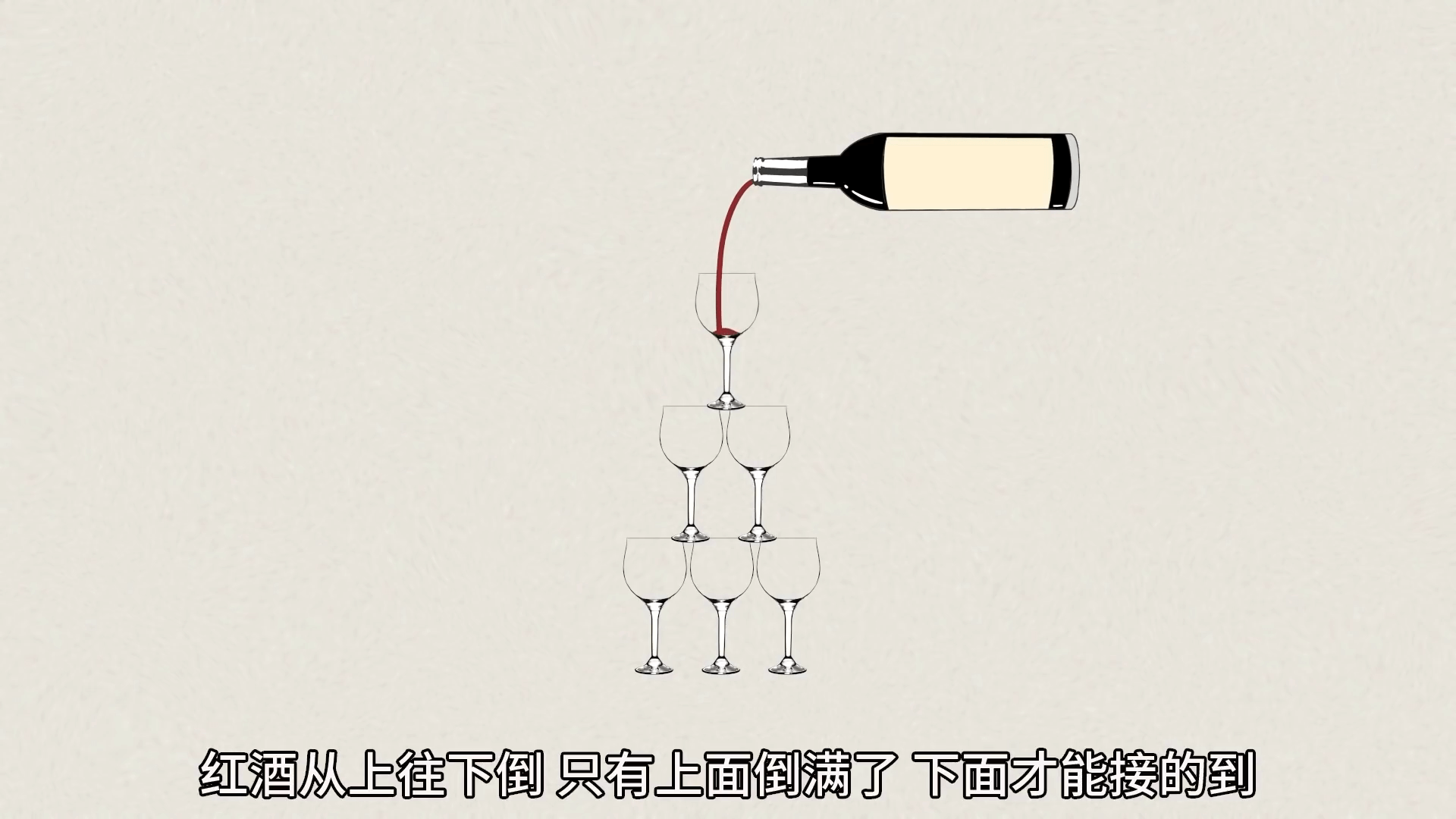

But modern times are different. You can imagine a pyramid structure of stacked red wine glasses. Red wine is poured from top to bottom. Only when the top is full can the bottom receive it.

And the most annoying thing is that the red wine glasses in the upper layers are huge. These huge red wine glasses are monopoly capital groups, businessmen who have eaten the dividends of longer and longer industrial chains and thus mastered the wealth code. The modern currency system can solve the problem of creation, but cannot solve the problem of distribution.

Accurately speaking, the set of free capital was not designed to solve the distribution problem. Its goal lies in expansion, and the improvement of most people’s living standards is essentially a by-product of expansion.

So here comes the problem. Can material abundance and unequal distribution bring happiness?

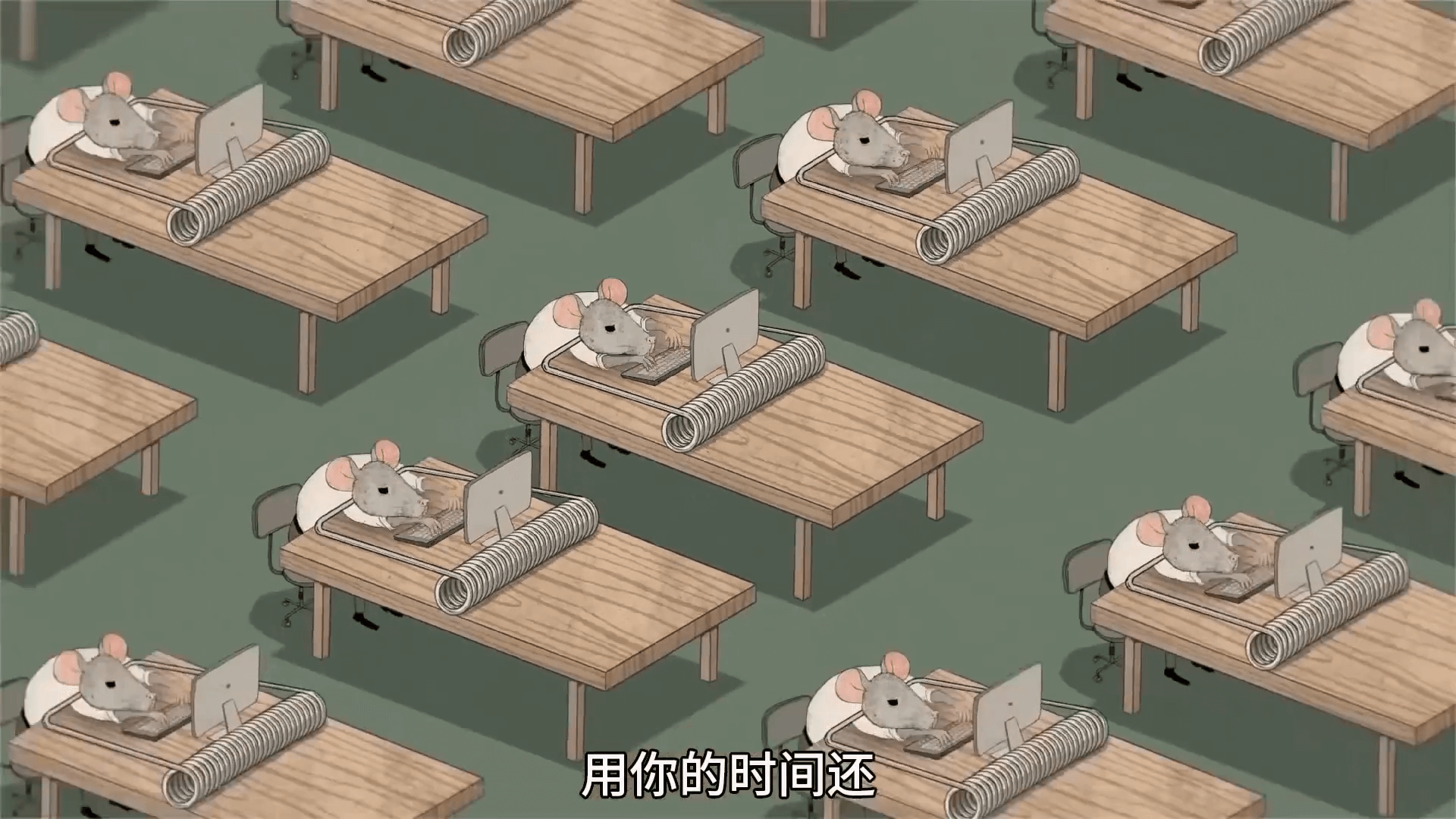

In his early years, Marx put forward the concept of capital’s alienation of people, that is, labor products were originally products condensed by people’s time and energy, but in the process of capital development and growth, these labor products gradually alienated into independent beings. What concept is this?

You can imagine a devil trading with you when your greed appears. In order to constantly buy products, you need to constantly obtain currency. And currency is debt. Getting debt means that you have paid the only wealth you possess as a life, “time”.

You spend time working in exchange for debt given to you by others. You use debt to trade products, and this product also means someone else’s debt. Everyone is compromised to participate in mass production, so the relationship between laborers and labor products is unbalanced, and gradually moves towards extremes with industrialization. Laborers are in turn distributed and enslaved by labor products.

The fundamental reason lies in that capital is unable to solve the distribution problem. Workers get little and cannot possess means of production, so workers can only heavily rely on the means of production in the hands of capitalists to participate in social production, otherwise they will be excluded from the modern economy.

The result caused by this is that the identity of workers has become a certain factor in economics, and is not primarily a person. How to understand?

Let me take a young brother I observed for a long time because the queue was too long when I went to the water park last time as an example. He is an employee of the park, specifically responsible for placing large lifebuoys on the platform at the top of the slide, and then giving instructions to tourists telling them they can slide. I watched for a long time that day. All his work content was to take the lifebuoy from the mechanical equipment, put the lifebuoy in place, press the button, and then give a thumbs up to the distance.

“Take down the lifebuoy, put down the lifebuoy, press the button, thumbs up”

“Take down the lifebuoy, put down the lifebuoy, press the button, thumbs up”

Looping all the time.

Actually, for the commodity of the park, for capital, this young brother, this person, is no different from the mechanical equipment that drags the lifebuoy up. Wait until one day, mechanical equipment can also take the lifebuoy from the mechanical equipment and put it on the slide at a low enough cost, the position of the person here will be directly replaced. And this young brother spent his whole life doing countless loops here, and in the end, he could only exchange it for a house, some industrial products plus some food.

And these loops themselves have no meaning. He is a link based on satisfying other human desires, but at this stage, a certain human has to be sacrificed to do repetitive manual labor year after year. If you ask any specific person about such a thing, no one would be willing, but in fact, everyone is already in it.

Then after satisfying other people’s desires? Who took the profits generated by these desires?

I don’t know, anyway, it’s definitely not this young brother, and this is the root cause of everyone’s pain in modern society.

Let me give another example. One of my uncles drove a truck with my aunt for a lifetime, belonging to the screw of industrial capital. The money saved bought a house, but they slept in the wind and ate in the dew all year round, no difference from having no home, and could not accompany their children through the most precious childhood. The problem of left-behind children is not an isolated case, right? So is this worth it or not?

According to my video style, I usually call this the price, here it is the price of economic development. Then, regarding the mainstream public opinion output that industrial development brings a beautiful world in the past, can it accommodate more angles to discuss?

Some people might say, if you study hard and don’t be at the bottom, won’t you get rid of it? And I admit, some white-collar jobs may indeed be easier and happier, but most white-collar workers still have their own pressures.

I will give an example of a classmate. He had very good grades and worked very hard, but his family had no connections. After graduation, he excitedly entered the bank. Don’t mention how happy he was at that time. Then he plunged into the bottom of the river and worked as a teller for a few years. Collecting money and calculating accounts, soliciting deposits, selling wealth management products, making sales calls, collecting money and calculating accounts, soliciting deposits, selling wealth management products, making sales calls every day. All his relatives specifically were persuaded by him to deposit money and apply for credit cards. If they didn’t know he worked in a bank, others would think he was engaging in fraud. These boring and repetitive jobs made him silly, and then he loved to complain to me, making me have to overcome psychological obstacles for half a day even clicking on his WeChat avatar now.

Let’s discuss the human problem here first. Finally, let’s talk about consumption. We know that expenditure is the driving force of the economy, and expenditure is demand. And they ultimately come from consumerism. Without consumerism, demand cannot be expanded. And expanding demand is one of the basic conditions for the capitalist economy to maintain operation. So what exactly is consumerism?

It is very simple. Economists have long discovered that in the process of modern commodity trading, the value brought by consumers’ desires accounts for an increasing proportion. Whether a thing sells well or not depends more and more on whether it can make consumers satisfied in comparison. A 2,000 yuan mobile phone is not good, an 8,000 yuan mobile phone is good. A 100,000 yuan car is not good, an 800,000 yuan car is good. An ordinary restaurant is not good, a restaurant that can be posted on Moments is good.

At the same time, unlike ancient times, in the industrialized modern economy, all desires will be alienated into commodities. As a person, from the moment you were born, except for your body, everything else has joined the melting pot of capital. You will start paying debts from birth, confinement centers, baby clothes, early education classes, preschool classes, interest classes.

You want to stop, no way, parents don’t allow you to fall behind.

Those so-called wealth freedom dreams of doing whatever you want when you earn enough money, you will never realize. As long as your desire is still there for one day, as long as the attribute of capital pricing according to scarcity is still there for one day, you will never feel enough.

So audience friends, if you come home from work one day and feel too tired, maybe you can think about whether the happiness humans get from industrial products is more, or the unhappiness brought by participating in forced labor, accepting comparison, and consumerism is more?

Ancient times had slavery. If modern times do not solve the distribution problem, you have to admit that free capital is an extremely clever system. The extremely strong maintained their status, guaranteed exploitation of the weak, and at the same time distributed a part of the benefits to the middle class in exchange for the stability they dreamed of. Then isn’t this another kind of…

Just kidding, just kidding. In short, what we have seen in recent years is the increasing hostility emanated by the so-called bottom people on social platforms. Can the upper-middle-class people really turn a blind eye and snort at this because human joys and sorrows are not connected?

Why do the vast majority of young people escape into games as soon as they get off work, play until 2 am, and race against time to try to grab back their own time?

Admittedly, I think the current currency system is the set of methods that best fits the current actual situation, but this does not contradict my belief that it has many, many problems at the same time.

The so-called company law working 8 hours a day, overtime must be paid overtime pay, is just superficial, not an effective way to solve this problem. Its essence is that developing countries simply cannot achieve effective supervision, and companies driven by capital cannot effectively implement it either. The reason why developed countries can do it is that they have accumulated first-mover advantages and an economic structure dominated by financial capital. The apparent ease of the bottom people is harvested by the government taxing the rich and distributing it to them, as well as from developing countries. It is not that the situation will improve immediately after the country formulates a set of policies. How can there be such a simple thing?

In the current economic system, only a part of people on earth can always enjoy such resource preferential treatment.

The weak can only support the strong unless you surpass him. You want to use the promotion of values in European and American countries to promote your 8-hour working day. The premise is that you surpass them in cutting-edge technology and surpass them in finance. Then do you want to ask them if they agree first?

Everything has a price. The modern banking credit system of creating currency by loans has given us a majestic new world, but it has also created unprecedented desires and demands from the bottom up. Once these demands start, they cannot be easily stopped. And every time it stops, it brings a devastating economic crisis. Will you restrain your desires? Maybe, but others won’t. Every time a new desire is generated, a new deposit currency is created. The essence of currency is debt. Debt must be repaid, repaid with your time.

This video ends here. It’s very long. Thank you very much for watching. If it is helpful to you, you can follow me. Okay, love you guys, bye.